- SUI is consolidating between $0.90 and $0.95, with $0.87 as the key support level.

- RSI is near oversold while MACD remains bearish, signaling sellers still control momentum.

- Open interest and derivatives volume are declining, but funding has turned slightly positive.

SUI is still under pressure, and the chart isn’t pretending otherwise.

As of Friday, February 13, SUI is trading around $0.9250, down roughly 1.09% over the past 24 hours, based on CoinMarketCap data. Volume has cooled off too, dropping about 17.64% to $523.19 million. Market cap slipped by around 1.01% to $3.55 billion, which lines up with the general tone right now: sellers are still controlling the pace.

It’s not a collapse, but it’s also not strength. It’s that slow bleed that makes traders impatient.

SUI Consolidates Near $0.90 While the Trend Stays Bearish

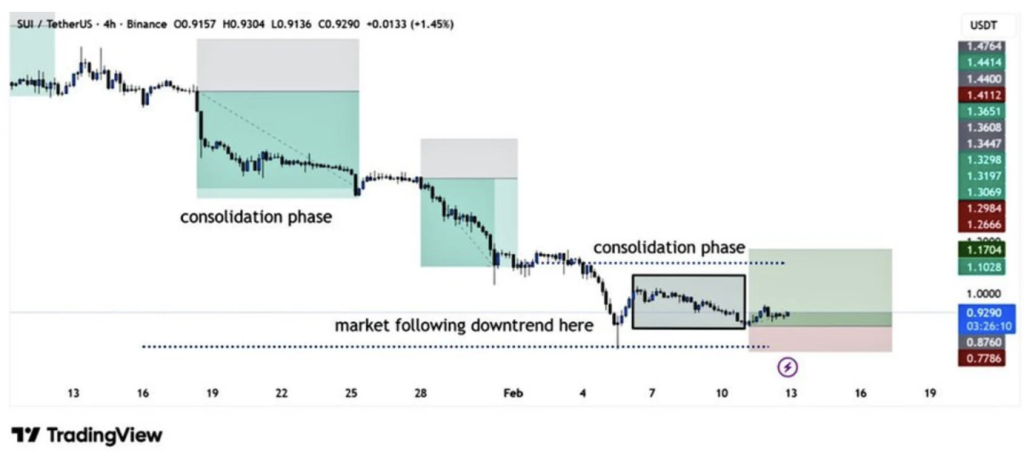

Crypto analyst BitGuru pointed out on X that SUI remains locked in a downtrend, moving from one consolidation zone to the next… but at lower levels each time. That’s usually what a weakening market looks like: price pauses, breaks down, pauses again, repeats.

Right now, BitGuru highlighted the $0.90 to $0.95 range as the active zone, with $0.87 acting as the key support level traders are watching closely. If SUI loses that $0.87 area cleanly, the structure could get uglier fast.

On the flip side, if SUI can hold the range and defend $0.87, BitGuru suggested there’s a decent chance of a short-term push higher. Targets mentioned include $1.10 and $1.17, which would basically represent a relief rally back into prior supply zones.

Another analyst, Move Insider, shared a more aggressive upside projection, noting that if the structure stays intact longer-term, a move toward the $1.56 to $2.33 range could be in play. That’s obviously a much bigger jump, and it would likely require a broader market recovery, not just SUI doing its own thing.

For now, momentum is slowly building, but it’s still capped. Traders are watching for volatility shifts because right now SUI is stuck in “quiet bearish” mode.

RSI Is Near Oversold, and MACD Still Favors Bears

The indicators are giving mixed signals, but the bearish pressure is still the loudest.

SUI’s Relative Strength Index (RSI) is sitting around 29.80, which is right near oversold territory. The RSI average is around 26.59, showing momentum is still weak and buyers haven’t truly taken control. Oversold conditions can lead to bounces, sure, but they can also stay oversold for longer than people expect. That’s the annoying part.

Meanwhile, the MACD is still flashing bearish. The MACD value is around -0.0046, with the MACD line at -0.1623 and the signal line at -0.1576. In plain English: sellers still have the advantage, and the trend hasn’t flipped yet.

So even if a bounce happens, the technicals suggest it may still be corrective rather than the start of a new uptrend.

Derivatives Activity Drops, but Funding Turns Slightly Positive

CoinGlass data shows derivatives volume is falling too, down about 14.97% to $712.79 million. Open interest has declined by around 2.72%, now sitting near $506.39 million.

That decline in OI is worth noting. It often signals traders are stepping back, closing positions, or simply not willing to commit heavy leverage while price action stays uncertain.

But here’s the twist: OI-weighted funding is slightly positive at 0.0040%. That suggests sentiment among remaining derivatives traders is leaning bullish, or at least less bearish than before. It’s not an aggressive signal, but it hints that shorts aren’t totally dominating anymore.

Liquidations over the last 24 hours totaled around $710.83K, with $493.66K coming from longs and $217.17K from shorts. So yes, long positions are still getting punished more, which matches the overall downtrend vibe.

Final Thoughts: $0.87 Is the Line That Matters

SUI is still trading under a downward structure, and the market is basically waiting for the next decision point. That decision is $0.87.

If price holds above it, SUI could stabilize and attempt a short-term recovery toward $1.10–$1.17. But if $0.87 breaks, the token risks slipping into a deeper leg down, especially with volume cooling and open interest fading.

Right now, SUI isn’t “dead,” but it is in a fragile zone. And in crypto, fragile zones don’t last long — they either bounce hard, or they snap.