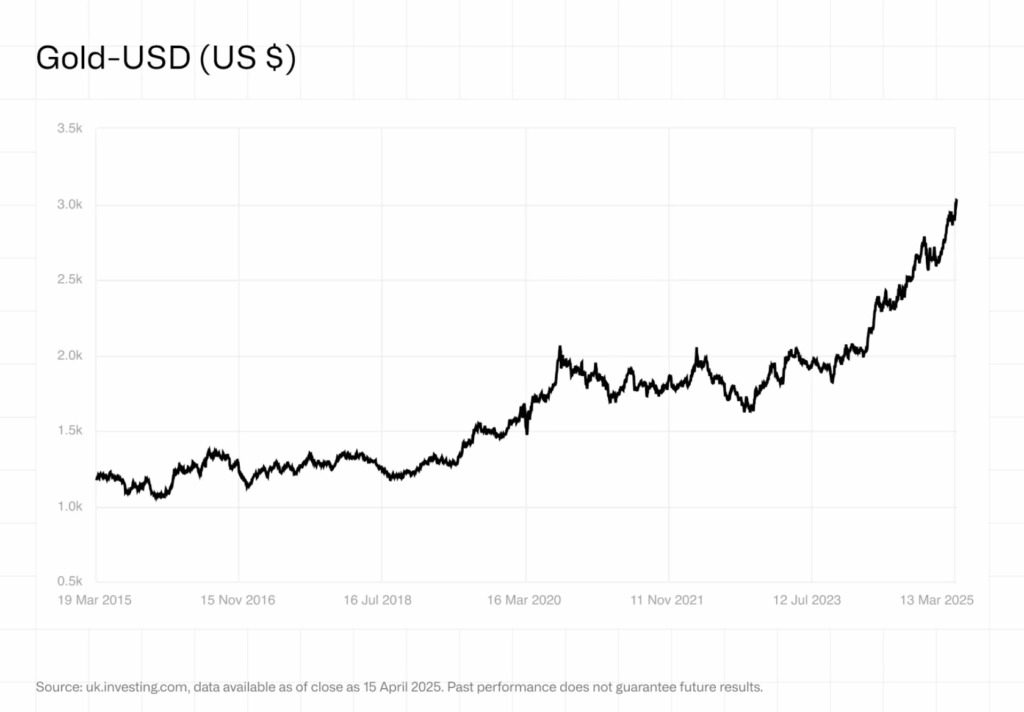

- Gold and Bitcoin as Safe Havens: Amid economic uncertainties like inflation and trade tensions, both gold and Bitcoin have emerged as preferred assets for preserving value. Gold reached a record high of $3,500 per ounce, with forecasts suggesting it could surpass $4,000 by 2026. Bitcoin, trading around $93,500, has seen increased institutional investment, notably through BlackRock’s IBIT ETF.

- China’s Strategic Gold Accumulation: The People’s Bank of China has been consistently increasing its gold reserves, now holding over 2,292 tonnes. This move reflects a broader trend of de-dollarization and a shift towards assets perceived as more stable.

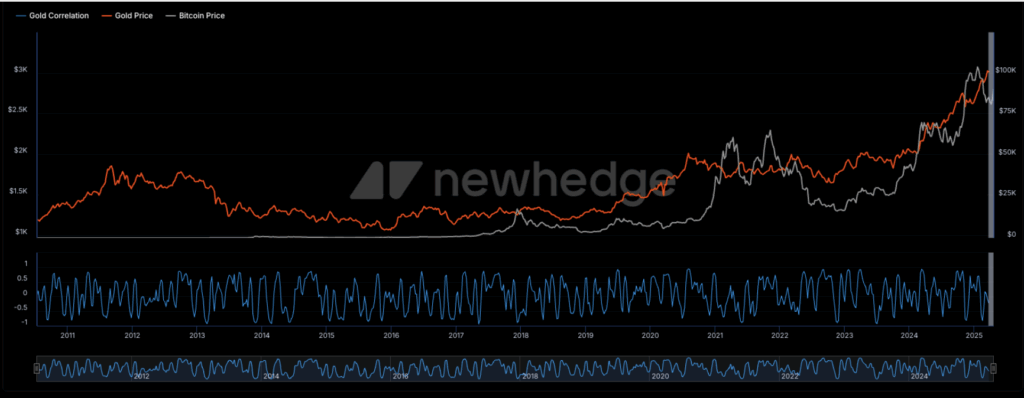

- Diversification Benefits: While Bitcoin offers higher returns, it comes with greater volatility compared to gold.Combining both assets in an investment portfolio can enhance risk-adjusted returns, balancing gold’s stability with Bitcoin’s growth potential.

Amid rising inflation, a weakening U.S. dollar, and escalating trade tensions, investors are increasingly turning to gold and Bitcoin as hedges against economic uncertainty.

Gold and Bitcoin Surge Amid Economic Uncertainty

Gold prices have reached a record high of $3,500 per ounce, driven by concerns over U.S. monetary policy and global economic instability. JPMorgan forecasts gold could average $3,675 per ounce by late 2025, potentially surpassing $4,000 by mid-2026 if current trends persist. China’s central bank has significantly increased its gold reserves, now holding over 2,285 tonnes, reflecting a strategic move towards de-dollarization.

Bitcoin has also seen substantial gains, trading around $93,500, up over 20% year-to-date. Institutional interest is growing, with BlackRock’s spot Bitcoin ETF (IBIT) attracting significant investments, contributing to Bitcoin’s mainstream adoption.

When Cash Is No Longer Attractive

The U.S. government’s establishment of a Strategic Bitcoin Reserve marks a significant policy shift, recognizing Bitcoin as a strategic asset. Both gold and Bitcoin are increasingly viewed as effective hedges against inflation and currency devaluation, offering alternatives to traditional fiat currencies

Gold and Bitcoin: Which One Is Better?

Bitcoin’s volatility has decreased, with its 30-day volatility at its lowest in two years, while gold’s volatility has increased amid market uncertainties. Long-term, Bitcoin has outperformed gold in terms of purchasing power growth.However, due to its higher volatility, Bitcoin may be more suitable for investors with a higher risk tolerance, whereas gold remains a preferred choice for conservative investors.

Notably, the correlation between Bitcoin and gold is weak or negative, especially during periods of market stress, suggesting that combining both assets could enhance portfolio diversification.

Conclusion

Gold offers stability and a long-standing reputation as a store of value, while Bitcoin provides adaptability and growth potential in the digital age. A balanced investment approach that includes both assets may offer the best opportunity for wealth preservation and growth in the current economic climate.