- Ethereum is trading near $2,087 after reclaiming $2,000 but lacks sustained upside momentum.

- Whales sold 1.3M ETH, then quickly bought back 1.25M ETH, creating churn without direction.

- Long-term holders have shifted from steady accumulation to modest distribution, signaling uncertainty.

Ethereum is trying to stabilize, but it doesn’t look fully convinced.

ETH is trading around $2,087 after reclaiming the $2,000 level, which on paper sounds constructive. But the follow-through just isn’t there. Every attempt to build upside momentum seems to stall before it really gets going, and that hesitation isn’t just about resistance levels. It’s about who’s buying — and who isn’t.

Whales Sell Big… Then Reverse Just as Fast

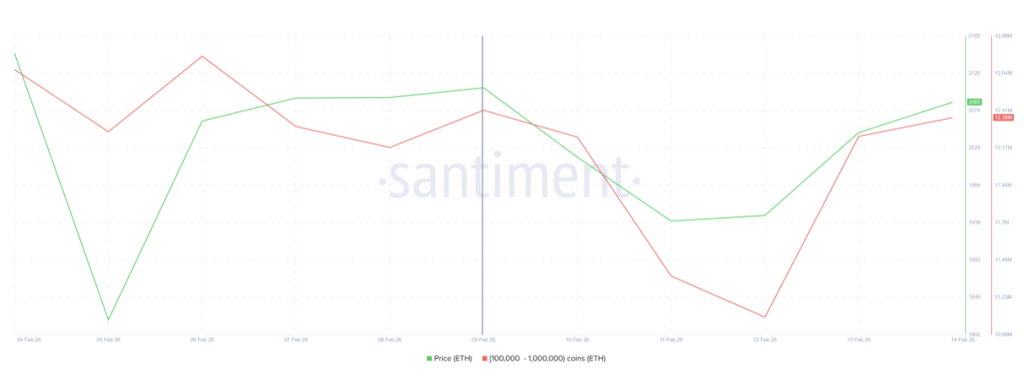

Whales, especially those holding between 100,000 and 1 million ETH, tend to shape the tone of the market. And recently, they’ve been anything but consistent.

Between February 9 and February 12, this cohort offloaded roughly 1.3 million ETH, which translates to around $2.7 billion in value. That’s not small. Moves of that size shift liquidity and sentiment almost instantly.

But then, within the next 48 hours, the same group reportedly bought back about 1.25 million ETH. Nearly $2.6 billion in fresh buying. So the net effect? A massive churn of capital, but without a clear direction.

That kind of back-and-forth creates liquidity. It creates volatility. What it doesn’t create is trend.

And that’s exactly where Ethereum is stuck — moving, but not progressing.

Long-Term Holders Are Losing Conviction

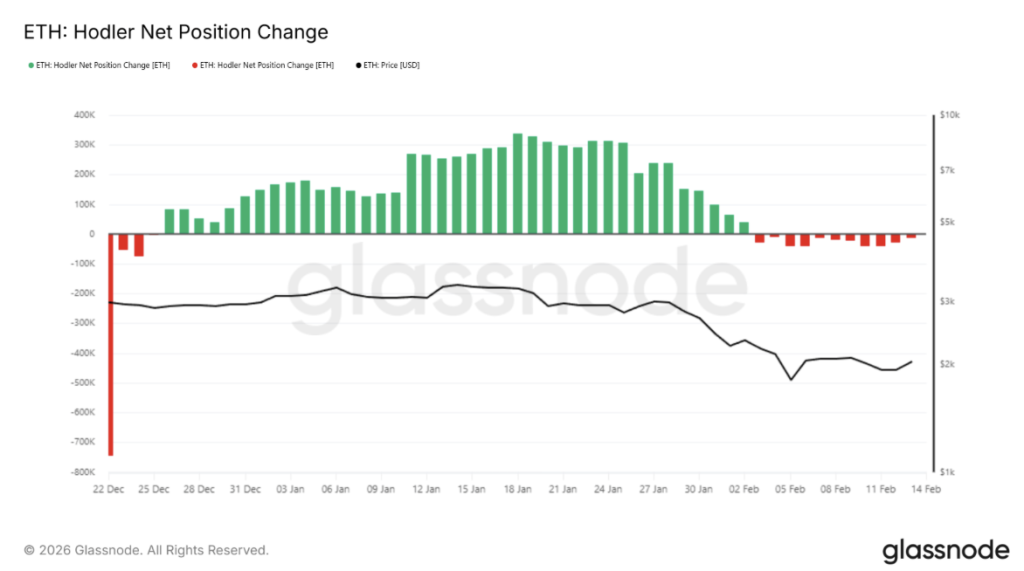

If whale activity looks indecisive, the long-term holders aren’t exactly offering clarity either.

The HODLer net position change metric shows that since late December 2025, long-term holders had been steadily accumulating ETH. That steady accumulation usually acts like a quiet floor under price. It’s not flashy, but it’s stabilizing.

Then February hit, and something shifted.

Accumulation slowed. Then modest distribution began. Not aggressive dumping — nothing dramatic — but enough to suggest conviction is softening. When long-term holders start trimming instead of stacking, it sends a subtle signal: uncertainty is creeping in.

And markets don’t rally cleanly when conviction fades.

Ethereum Is Holding $2,000… Barely

Technically, reclaiming $2,000 matters. It’s a psychological and structural level, and Ethereum is currently holding above it.

But the next key resistance sits around $2,241. To push through that zone convincingly, ETH would need clear, sustained accumulation from whales and long-term holders. Right now, that alignment just isn’t there.

So consolidation becomes the default scenario.

Ethereum may continue hovering around $2,000, defending support near $1,902 while failing to decisively break upward. Sideways action can last longer than most traders expect, especially when both buyers and sellers seem unsure.

It’s not bearish collapse. It’s indecision. And indecision can be exhausting.

What Would Flip the Script?

For Ethereum to break out meaningfully, the dominant cohorts need to lean in the same direction.

If whales return to steady accumulation and long-term holders resume net positive positioning, ETH could push through $2,241 and aim for $2,395. Beyond that, $2,500 becomes the real inflection point. Clearing $2,500 with strength would invalidate the current bearish hesitation and confirm a stronger recovery trend.

Until then, Ethereum remains stuck in a liquidity churn zone.

It’s not breaking down. But it’s not breaking out either. And when the biggest players can’t decide, price usually drifts… right in the middle.