- ADA is bouncing off key support between $0.55–$0.60, with bullish divergence hinting at a potential breakout.

- Technical targets point to $1.20 if resistance between $0.80–$1.00 is broken, though short-term sentiment stays mixed.

- Cardano’s earlier supply cap (2100 vs. Bitcoin’s 2140) could mean smoother tokenomics in the decades to come.

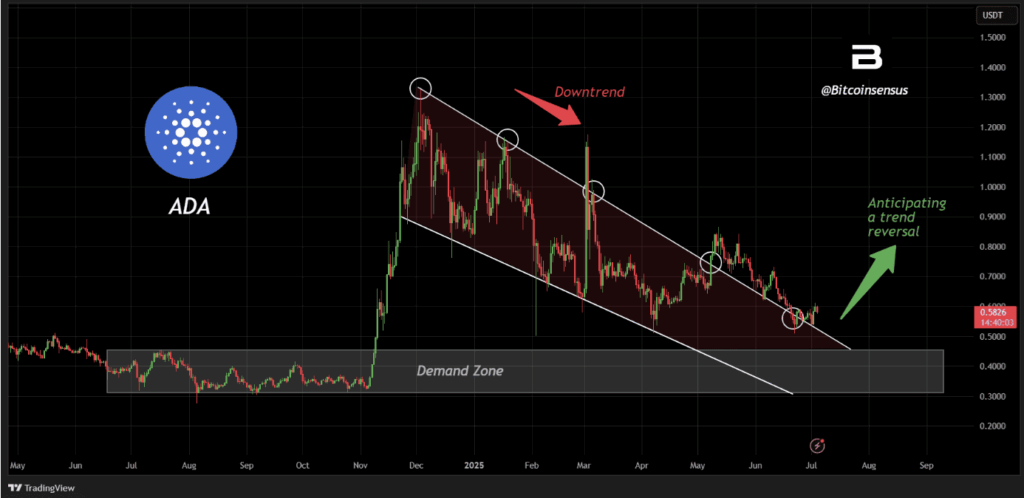

Cardano (ADA) is kinda at that tipping point again. The weekly chart’s been showing something interesting—price is bouncing inside this clean, almost too-perfect descending channel that’s been holding since early 2024. Now, it’s dancing around a pretty critical demand zone, between $0.55 and $0.60. Feels like we’re seeing a bit of a base form here, which might just be what ADA needs to finally push up.

From what Bitcoinsensus shows, the latest candles bounced right off support—and here’s the kicker—there’s a bullish divergence forming. That usually signals a trend reversal is lurking around the corner. RSI and maybe even MACD are likely flashing higher lows while price action dips lower. Classic divergence stuff.

Now, that descending resistance line? It’s floating up near $0.80 to $1.00. That’s the big test. If ADA breaks above that ceiling, then yeah, we could be looking at the end of this long slog downward. But it’s gotta clear that line clean. No fake-outs.

Bullish Patterns, But the Move Isn’t Guaranteed

Zooming out, ADA’s been respecting its parallel channel like a well-behaved altcoin. Upper line, lower line—it’s all very symmetrical. Bitcoinsensus marked up their chart with the usual: red arrow for “downtrend,” green for “reversal,” and boxes pointing out the demand zone and where a breakout might launch.

As of early July 2025, ADA’s sitting around $0.57. It’s gained about 3% this week, not bad. TradingView shows slightly higher numbers—4.5% for the week and a hefty 46% on the year. That kind of growth keeps the optimism alive.

If it breaks that resistance band with force, we could be talking about a jump to $1.20. That’s a previous rejection zone—where things got heavy last time. Still, despite the setup, the broader technical mood feels neutral. CentralCharts has ADA leaning long-term bullish, but the short-term vibe? More on the bearish side.

Supply Curve: A Quiet Advantage?

Here’s something not a lot of people are talking about—Cardano’s supply cap timeline. The DApp Analyst posted that ADA will hit its full supply limit by 2100. That’s forty years before Bitcoin reaches its max in 2140.

By the year 2040, Cardano will have about 91–93% of its total supply (roughly 41–42 billion ADA) out in circulation. Bitcoin, by comparison, will have released almost all of its 21 million coins—about 99%. So, what does that mean? ADA might reach a supply plateau earlier, smoothing out its tokenomics over time.

No more dramatic halvings like BTC. Just steady release, a capped supply, and less issuance volatility. That could make ADA more predictable long-term… and maybe even more attractive for the patient investor.