- Texas House advances Bitcoin reserve bill with strong bipartisan support and a key amendment.

- New rule requires crypto assets to maintain market cap status for 24 months to qualify.

- If finalized, Texas could become the second state to legally manage a Bitcoin reserve.

In a big move this week, the Texas House of Representatives gave the green light to Senate Bill 21—better known as the Bitcoin reserve bill. It wasn’t just a squeaker of a vote either; lawmakers came together across party lines and passed it 105 to 23. One amendment, in particular, stirred attention, pushing the bill further along the path to creating a state-managed Bitcoin reserve that could set Texas apart in the crypto world.

House Amendment Tweaks Crypto Market Listing Rules

Representative Linda Garcia introduced a notable change before the vote: firms listed on the crypto market—like those on Binance—must now stay in the market cap rankings for 24 months instead of just 12. That’s quite the shift. The idea? Make sure Texas’s reserve isn’t holding assets that fizzle out too fast. They want longevity, stability… y’know, something solid. Lawmakers on both sides seemed pretty aligned on that—transparency and planning came up a lot during the debate.

But here’s the catch: since the House made this change, their version no longer matches the Senate’s. That means someone’s gonna have to sit down and hash out the differences, probably in one of those conference committee things. Still, that hasn’t stopped the momentum.

How Texas Plans to Hold Bitcoin—Officially

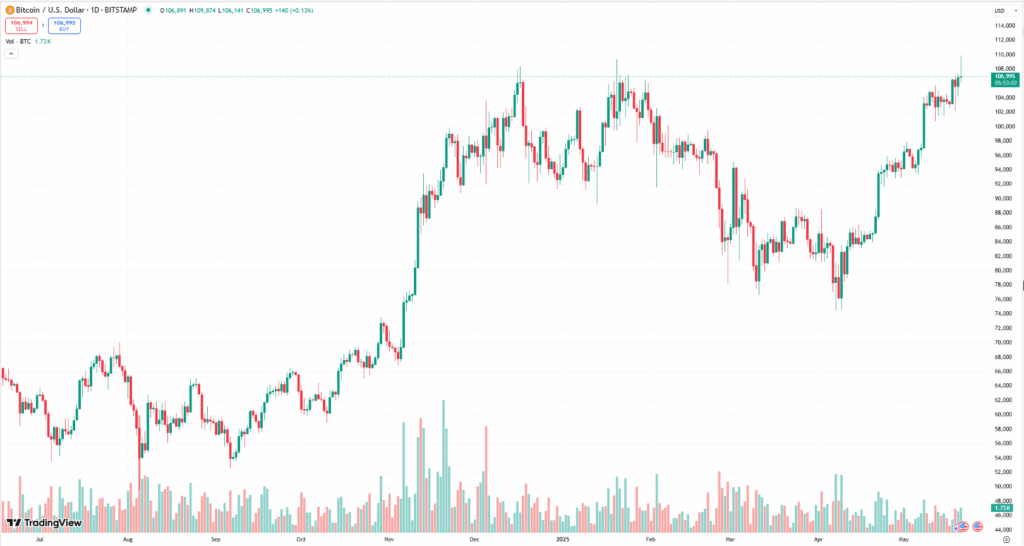

The new legislation sets up a dedicated Bitcoin reserve fund, which would be overseen by the state comptroller. This isn’t just tossing some BTC into a wallet and calling it a day—the whole thing would live on the blockchain, which brings a layer of security and visibility that traditional ledgers can’t touch. The goal? Hedge against inflation, global money shakeups, and maybe even modernize how the state thinks about assets.

It’s a pretty bold strategy, considering not many states have even dipped a toe into crypto waters like this. But hey, it’s Texas.

Clear Rules, Real Oversight

Senate Bill 21 doesn’t just throw Bitcoin into the state books and walk away. It spells out how the comptroller should buy, store, and report on these assets. Biennial reports will be mandatory, breaking down the value, movement, and size of the reserve—so nothing slips through the cracks.

Also, a special advisory committee’s in the mix to help steer things. These folks won’t be random bureaucrats; they’ll be people who’ve actually worked with crypto and blockchain. Which is a relief, honestly. You don’t want someone learning what a private key is after they’ve already signed off on the fund.

Almost There—Just a Few Steps Left

The House gave it the nod on its second read, but one more vote is needed before it’s officially theirs. Once both chambers settle on a final version, it’ll head to the governor’s desk. If it gets signed, Texas will be the second state (after New Hampshire) to lock in a Bitcoin reserve by law. Arizona tried something similar, but yeah—their governor shot it down.

Given Texas’s big footprint in crypto mining and regulation, this move would only cement its reputation as a digital finance trailblazer.