- Gold’s 5–6% drop reopens risk appetite, fueling Bitcoin’s rebound.

- Coinbase acquires Echo for $375M, pushing into token issuance.

- Coinbase buys Cobie’s $25M UpOnly NFT, hinting at a podcast comeback.

Crypto traded with a spring in its step over the last 24 hours. A violent reversal in gold eased the “flee-to-metals” trade, spot-ETF flows steadied after a choppy start to the week, and one headline stole the culture cycle: Coinbase just spent $25 million on Cobie’s UpOnly NFT—setting up a likely return of the podcast that defined the last bull. Here are the three biggest stories driving timelines today.

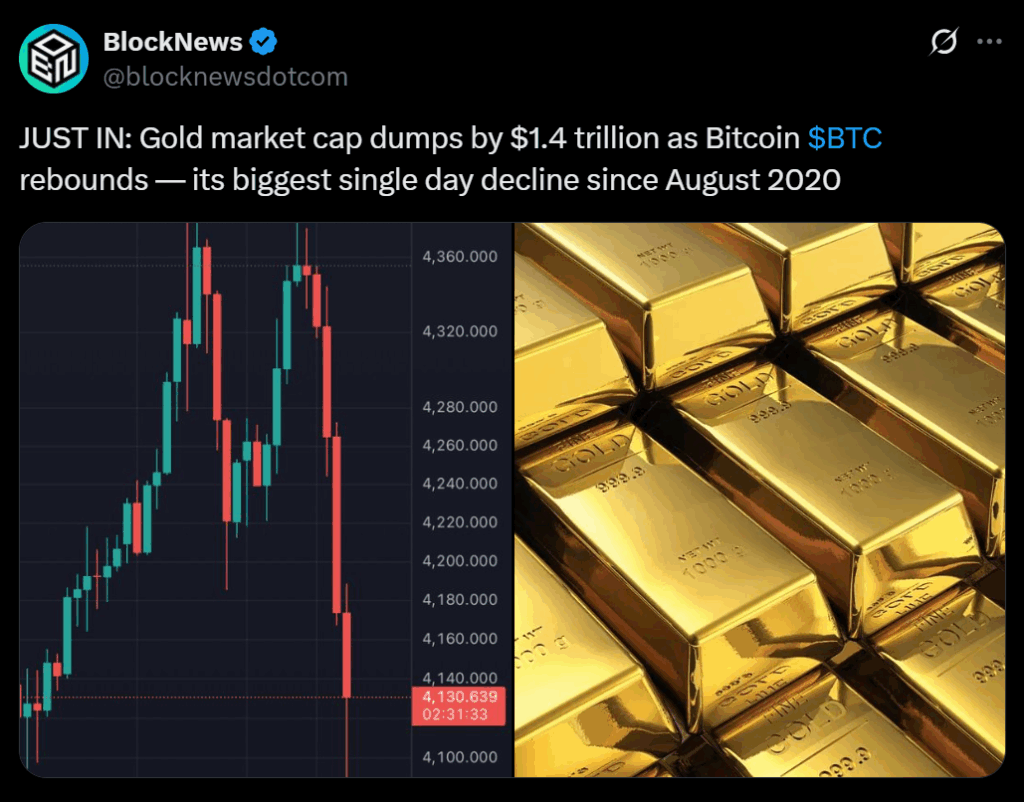

1) Gold’s biggest drop in years takes pressure off crypto risk

After racing to fresh records early in the week, gold snapped hard—falling roughly 5%–6% intraday in its steepest single-day decline since 2020. The move unwound a two-month melt-up that had pushed bullion above $4,380/oz, before sellers yanked it back toward the low $4,100s by U.S. afternoon trade. Profit-taking, a firmer dollar, and slightly calmer U.S.–China headlines all showed up in the tape, flipping some cross-asset flows back toward risk.

Why it matters for crypto: the “metals over everything” consensus that’s been draining attention (and some capital) from digital assets just blinked. When gold is screaming higher, crypto often struggles to capture the hedge bid; when that trade cools, the liquidity hunt rotates. Today’s bullion washout coincided with firmer crypto breadth and faster dip-buying across large caps—exactly what you’d expect when the safe-haven magnet weakens.

2) Coinbase’s $375M Echo Buy Signals a Primary-Markets Push

Coinbase agreed to acquire Echo—an on-chain capital-formation platform—for about $375 million in cash and stock. Echo (founded by Jordan “Cobie” Fish) runs private and public token raises and recently shipped Sonar for open sales; it’s facilitated $200M+ in project funding since launch. For Coinbase, it’s acquisition #8 in 2025, extending a strategy to own more of the lifecycle—from fundraising to listing to derivatives—just months after its Deribit deal. Reuters+2Wall Street Journal+2

Traders read the move as both product and distribution: fold Echo’s rails into Coinbase’s user base, then route liquidity across spot, perps, and Base-native apps. Even with shares little changed intraday, the message is clear—primary issuance is coming on-chain at scale, and Coinbase wants to be the front door for retail and institutions alike. Expect tighter integration of token launches and potential RWA issuance once the deal closes.

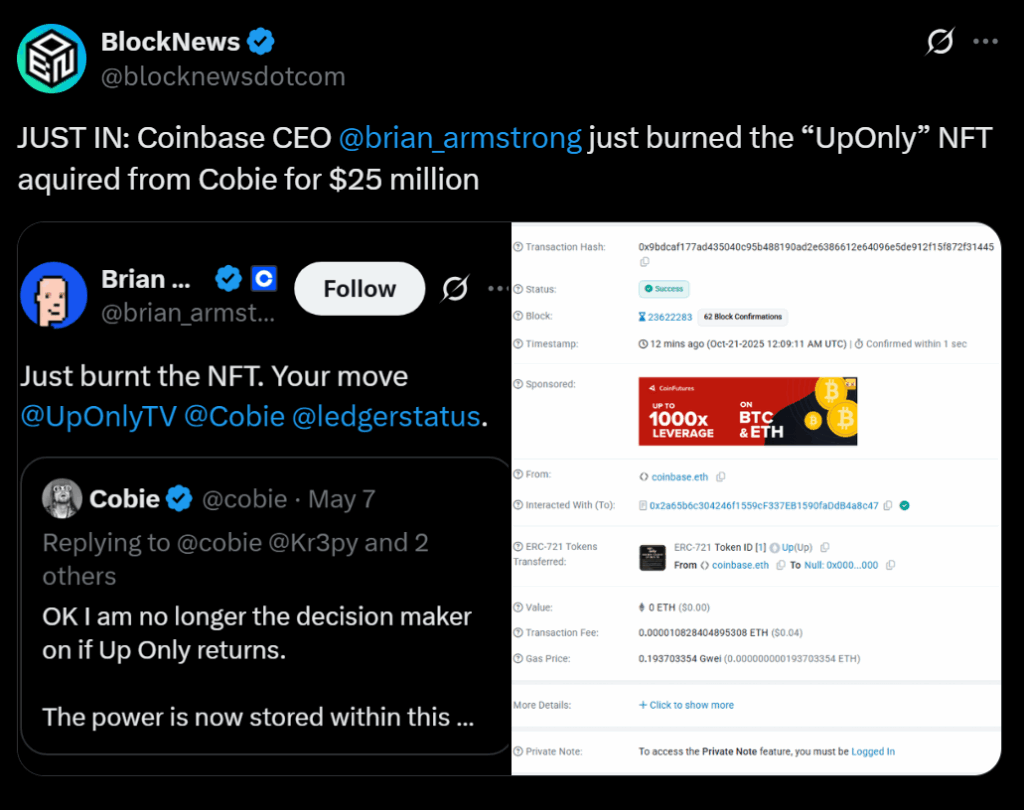

3) Coinbase buys Cobie’s UpOnly NFT for $25M USDC—podcast revival inbound

Culture bomb: Coinbase purchased the UpOnly NFT from Cobie (Jordan Fish) for $25,000,000 in USDC—a token whose metadata includes a burn clause compelling production of a new UpOnlyTV season. On-chain trackers flagged the 25M USDC transfer from a Coinbase-linked wallet, and Brian Armstrong amplified the news, signaling the show’s comeback after a multi-year pause. The deal instantly dominated crypto Twitter and pushed “UpOnly” to the top of social mentions.

Why it matters: beyond nostalgia, it’s a statement about programmable media rights. An NFT used as a binding content lever—funded by a top U.S. exchange—blurs commercial IP, community governance, and on-chain enforcement. Expect a fresh season timeline (the burn condition points to a ~3-month window post-trigger), brand tie-ins, and a halo effect for creator-centric NFTs. It’s also a shot of oxygen for crypto’s culture loop right as prices try to re-gather momentum.