- Nansen, a blockchain analytics company, reveals data on PYUSD, Paypal’s stablecoin’s adoption rate.

- The stablecoin issuer, Paxos Trust, holds 90% of Paypal’s stablecoin.

- Coinbase’s plan to support PYUSD may be a significant boost for the stablecoin.

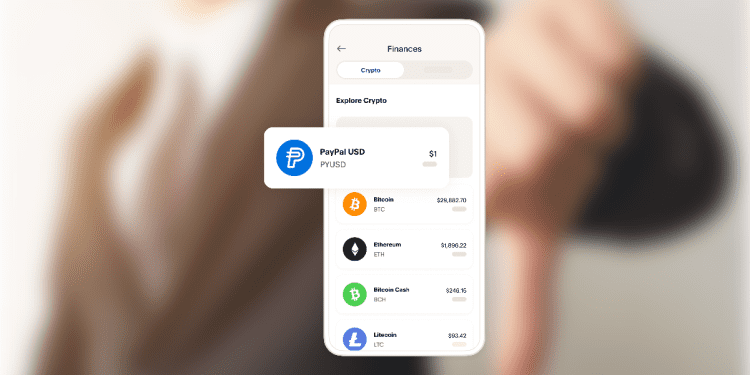

PayPal’s Stablecoin Faces Low Interest Among Crypto Users

Three weeks after its sudden release, PYUSD, Paypal’s stablecoin, faces a low adoption rate. The level of interest amongst cryptocurrency users is shallow. On-chain analytics reveals that over 90% of the stablecoin is in its issuer’s wallet, Paxos. Further research shows less than ten stablecoin holders possess $1000 in their wallets.

The prominent question in the mind of every crypto enthusiast is,

How is the fintech giant with over 350 million users worldwide unable to garner sufficient interest in its newly released stablecoin?

The stablecoin market situation takes its fair share of the blame. The recent crypto winter that coursed through seasons in the cryptocurrency industry also affected the stablecoin market. At the start of the year, the stablecoin market was worth $167 billion. Eight months later, the stablecoin market worth currently rests at $124 billion. While prominent stablecoins like USDT and USDC stay on top of the market, not without suffering random losses, other stablecoins are bravely attempting to fit in.

Paypal’s PYUSD was released to join USDC and USDT, the top two stablecoin players. However, weeks after its release, the fintech-backed stablecoin is nowhere close to its competitors.

In a bid to assess the reasons for the failure of PYUSD, some critics attributed its failure to its centralized nature. They argued that the collaboration between PYUSD and Ethereum has the markings of becoming a poorly designed central bank digital currency.

While the crypto community viewed the launch of PayPal’s stablecoin with little interest, smart contract auditors also shared their concerns over the security of the stablecoin’s smart contract.

According to smart contract auditors, PayPal’s stablecoin smart contract contains “freeze funds and wipe frozen funds”, an indication of centralized attack vectors in solidity contracts.

Several smart contract auditors believe that PayPal’s stablecoin smart contract may threaten decentralization and control of users’ assets.

Nansen’s Analytics Reports Show The Low Adoption Rate of PYUSD

Nansen, a blockchain analytics company, recently published a comprehensive analysis of PYUSD usage data. The report highlights a shallow adoption rate.

Despite having over 350 million users worldwide, PayPal’s stablecoin has hardly gathered 250 holders, a deficient number for the status of a fintech giant.

Nansen’s report further showed that Paxos Trust, the stablecoin issuer, holds over 90% of the stablecoin.

The decentralized exchange pools holding PYUSD are only in possession of 50,000 tokens. According to Etherscan, there are only 233 holders of the PYUSD token.

In addition to the underwhelming data volume from PYUSD,

“The research claims that Kraken, Gate.io, and Crypto.com wallets have a combined total of approximately 7% of the entire supply.”

While the underwhelming statistics from PYUSD are unexpected, given the status of the fintech giant, it is quite too early to predict the future of the stablecoin.

On the bright side, Coinbase has announced its plan to support PayPal’s stablecoin. This may be the much-needed boost for the stablecoin.