- Bitcoin Stalls Below ATH as Sell Wall Looms: Despite trading above $100,000 for over a week, Bitcoin is struggling to reclaim its all-time high due to a massive sell wall of 174,380 BTC worth $18.34 billion held by investors seeking to break even around the $105K level.

- Market Sentiment Dampened by Profit-Taking: With 94.88% of BTC holders currently in profit, many are offloading their positions, creating a heavy resistance zone and discouraging new buyers, keeping BTC stuck around $103,689.

- Next Steps – Breakout or Breakdown?: If BTC can push through the $105K resistance, a new ATH becomes possible. However, as long as those out-of-the-money holders keep selling, Bitcoin’s path forward could remain choppy.

Bitcoin’s hit a wall – and it’s a big one. After pushing past the psychological $100,000 mark, the flagship crypto is now stuck, struggling to reclaim its all-time high (ATH). Despite spending more than a week trading above $100K, BTC just can’t seem to break through. And the reason? A massive sell wall.

The Sell Wall – $18.34 Billion Worth of Bitcoin

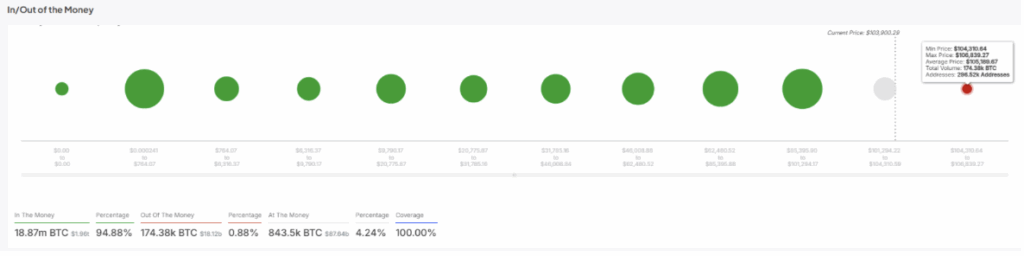

Data from IntoTheBlock shows that 174,380 BTC, worth around $18.34 billion, are sitting in the hands of investors who bought in at higher prices. These coins are currently classified as “Out Of The Money,” meaning the holders are underwater – and they’re waiting to sell.

According to the data, 296,520 addresses bought Bitcoin between $104,310 and $106,839, with the average purchase price landing at $105,169. These traders are now hoping for a price push to break even or snag a profit. Until then, they’re creating a heavy resistance zone, preventing BTC from pushing to new highs.

Profit-Taking Dampens Sentiment

With a sell wall this size, the market’s got a problem. Potential buyers are skittish, seeing that $105K level as a ceiling rather than a floor. Trading volume is up 13.37% to $49.87 billion in the last 24 hours, suggesting some investors are still moving BTC – but the overall vibe is cautious.

Right now, Bitcoin is trading at $103,689.18, up 1.62% over the same time frame. But the sell wall is still there, and it’s not budging. According to IntoTheBlock, about 94.88% of BTC holders are “In The Money,” representing 18.87 million BTC valued at $1.96 trillion. Meanwhile, 4.24% – holding 843,500 BTC worth $87.4 billion – are “At The Money,” neither making a profit nor a loss.

What’s Next for BTC?

If Bitcoin can push through the $105K resistance, the road to a new ATH opens up. But as long as those out-of-the-money holders keep unloading, the path forward looks bumpy. For now, it’s a waiting game – and BTC isn’t known for being patient.