- Senator Cynthia Lummis plans to introduce the “Bitcoin Act” to establish a strategic Bitcoin reserve for the United States, aiming to purchase around 5% of the total Bitcoin supply over 5 years.

- The proposed reserve would operate similarly to the U.S. gold reserves, serving as a hedge against economic uncertainty, and the Bitcoin would be required to be held for at least 20 years.

- While some support the idea of a strategic Bitcoin reserve, others raise concerns about centralization and government control over an asset designed to be decentralized.

Donald Trump is set to become the next president of the United States, renewing talk of a strategic Bitcoin reserve. Senator Cynthia Lummis has been a vocal proponent of the idea. She claims that under Trump’s leadership, the US could build a reserve to “supercharge the US dollar’s position as the world reserve currency.”

The Bitcoin Act

Lummis introduced the Bitcoin Act earlier this year to establish a decentralized network of Bitcoin vaults operated by the Treasury Department. The act would implement a $1 million Bitcoin purchase program over five years to acquire around 5% of the total Bitcoin supply.

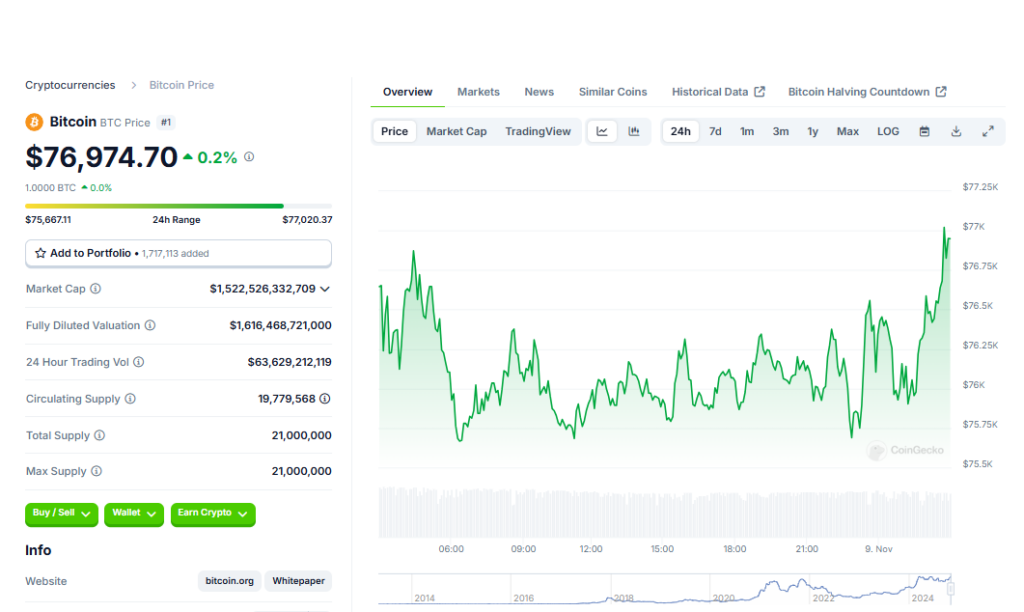

At Bitcoin’s current price, this would cost over $76 billion. However, spreading out the purchases over five years and Bitcoin’s volatile price could impact the final cost. The act would use existing Federal Reserve funds rather than taking on new debt.

Current Government Bitcoin Reserves

The government already holds billions in seized Bitcoin. It’s unclear if these would become part of the strategic reserve. Earlier this year, the government began moving seized funds as Trump vowed not to sell them.

The Bitcoin Act and Selling Reserves

The act establishes a 20-year minimum holding period before selling any purchased Bitcoin. After 20 years, the government would reevaluate its position on selling reserves, which could significantly impact the market if done in size.

Concerns Over Centralization

Some crypto enthusiasts are concerned the plan would overly centralize Bitcoin within the government, going against its ethos. There are also concerns over convincing skeptical legislators to approve the act.

Conclusion

While Lummis is excited about the potential for a strategic Bitcoin reserve under Trump, passage of the required act faces challenges. Some in crypto also worry about the implications of the government holding such a large portion of Bitcoin. The plan’s future remains uncertain.