- Bankrupt crypto lender sues Roger Ver for failing to settle crypto options which expired on December 30.

- The “Bitcoin Jesus” has a track history of being sued by crypto firms, as CoinFlex accuses him of defaulting on debt.

- Roger Ver is given 20 days to respond to the court summons or is obliged to pay.

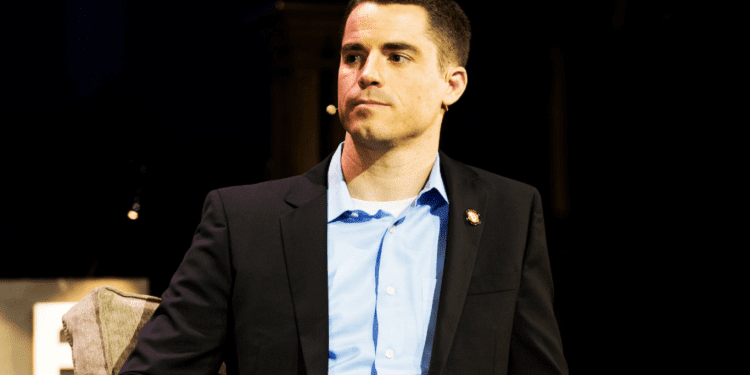

Roger Ver, popularly known as “Bitcoin Jesus” because of his early Bitcoin evangelism, has been summoned to court by the bankrupt crypto lender Genesis over unsettled crypto options worth $20 million.

On January 23, GGC International (GGCI) filed a suit against the Bitcoin Cash (BCH) proponent, Roger Ver, in the New York State Supreme Court, alleging that the BTC evangelist failed to fulfill his end of the bargain by settling the crypto options transactions which expired on December 30.

The plaintiff, GGC International, is a company located in the British Virgin Islands and owned by Genesis Bermuda Holdco Ltd., which executes spot trading activities and enters into derivatives sourcing virtual assets as a principal.

Roger Ver, identified as the “Defendant” in the court filing, was given 20 days to respond to the court summons. If he failed to respond within the decided time frame, he would be obligated to pay the total amount by default.

“In the case of your failure to appear or answer in this action, judgment will be taken against you by default for the relief demanded herein and the costs of this action,” the court file reads.

What are Crypto Options?

Crypto options contracts empower the contract holder with the right but not the commitment to purchase or sell an asset at a specified date and time. Crypto options are derivatives and only assist traders in avoiding possible liquidation related to futures contracts and minimizing the risks of loss. For the crypto options, the buyer is required to pay an upfront fee to the option writer.

Roger Ver vs. crypto firms

This was not the first time the Bitcoin cash proponent would be summoned to court for failing to keep his end of the bargain with crypto firms which is why it was no surprise that GGCI filed a suit against the “Bitcoin Jesus.”

In June 2022, Mark Lamb, the CEO of CoinFlex, accused Roger Ver of owing the company $47 million USDC. Mark stated that the company had a written contract with the early Bitcoin (BTC) investor, which required him to “personally guarantee any negative equity on his CoinFlex account.” In the tweet, Mark mentioned that he had served Roger Ver with a notice of default since he refused to pay his sent to the company.

The crypto exchange, CoinFlex, announced earlier on June 23 that it froze its withdrawals and would resume them on June 30. The crypto exchange stated that it needed to sell tokens about a debt owed by a particular high-net-worth individual. CoinFlex did not mention the name of Ver in this announcement.

In response to the claims made by the CEO of CoinFlex on Twitter, Roger Ver also made his announcement, craftily countering the accusations without mentioning CoinFlex in his tweet. Roger denied the allegations against him by calling them “false.” The Bitcoin Cash (BCH) proponent explained his narrative by claiming that not only were the accusations made by the counterparty false but he was also being owed a “substantial sum of money” by the counterparty.

Crypto community teases Roger Ver.

Since GGCI filed a suit against Roger Ver, the crypto community has made jokes about the situation, saying that Roger was unlikely to pay his debts because he had become a crypto degen.

“Margin came calling, and Roger didn’t pick up. Genesis issued a summons to Roger Ver for failing to settle $20 million of crypto options,” tier10k commented.

Genesis goes bankrupt

On January 20, Genesis, the cryptocurrency lender, became the latest crypto firm to fold due to the bear market and file for Chapter 11 bankruptcy in the Southern District of New York. The company, which was once estimated to have been worth between $1 billion to $10 billion in the court filing, announced that it was throwing in the towel.

The crypto community had long foreseen the collapse of Genesis as the crypto firm suspended withdrawals back in November 2022 due to the unexpected failure of FTX. The recent filing for bankruptcy has affected a few companies with exposure to the lending firm. Companies like Bybit and Gemini both have exposure, with the latter currently being at loggerheads with Genesis.

Conclusion

The controversy around Roger Ver, a Bitcoin Cash (BCH) proponent, grows as the now-bankrupt crypto lending firm Genesis filed a suit against him for failing to settle the crypto options, which expired on December 30.