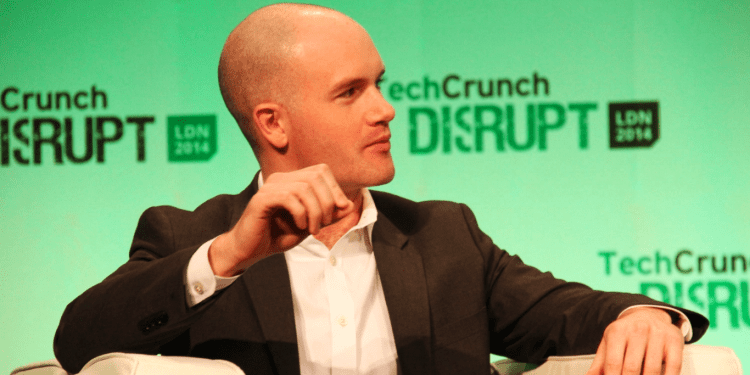

- Coinbase CEO, Brian Armstrong, is asking regulators to target centralized crypto entities when it comes to ecosystem regulation.

- Armstrong argues that centralized exchanges and custodians have the most risk of causing consumer harm.

- Brian Armstrong affirms that Coinbase is working hard to get crypto legislation passed in 2023.

Brian Armstrong, the Coinbase Chief Officer, has suggested stricter regulations on centralized crypto actors but says decentralized protocols should be allowed to grow given that open-source code and smart contracts are the ultimate forms of disclosure.

In a series of Tweets, Armstrong shared a realistic blueprint for regulating cryptocurrencies and restoring trust in the crypto realm following the shocks and surprises caused by FTX’s downfall. The executive cited that custodians, stablecoin issuers, and crypto exchanges need further regulatory clarity, adding that these operators carry the most risk for consumer harm. He further said that legislation with centralized actors” is something everyone can agree should be done for “it’s the low-hanging fruit.”

Regulating stablecoin will be an excellent place to start, according to the CEO, a sector that has acquired a lot of attention from D.C. and can get quick momentum with a quick win. Armstrong believes that the stablecoin market in the U.S. can be regulated under standard financial services law.

A good stablecoin regulation would require the issuers to register as state trust or OCC national trust charter and undergo various annual audits to provide the transparency that the user’s funds are held in appropriate reserve assets and separated from corporate cash. Additionally, the issuers should ensure reasonable controls and board governance, meet basic cybersecurity regulations, including SOC standards, and have the capability to meet the sanctions requirements.

According to Armstrong, traditional financial services can serve as an inspiration, which could entail implementing know-your-customer (KYC) and anti-money laundering (AML) schemes, enabling a federal licensing and registration protocol.

The Coinbase exchange only lists assets that it classifies as commodities through its own self-developed detailed legal analysis of purchases, according to the CEO. He further stipulated that it was developed due to a need for more clarity provided by the U.S. securities and commodities regulators. However, the Coinbase founder believes that the U.S.

Congress should require the Commodities Futures Trading Commission (CFTC) and the Securities Exchange Commission (SEC) to categorize the top 100 cryptocurrencies by market cap and declare them as either commodities or securities.

”The industry is primarily focused on trading crypto commodities today, but a ”robust market” to register and issue crypto securities should also exist in the U.S., and could be a real improvement over how traditional securities are issued.”

Decentralized crypto

Nonetheless, financial regulators should refrain from playing a role here for decentralized crypto products such as decentralized finance (DeFi), decentralized Autonomous Organizations (DAO), and self-custodial wallets, as transparency is built in by default in decentralized crypto products.

Armstrong stated,

” Lastly, decentralized crypto presents an opportunity to create even stronger consumer protection by increasing transparency and removing the middlemen via custodial wallets, public and open smart contracts, and on-chain accounting.”

The Coinbase CEO notably called upon Congress to step in and pass legislation for categorizing cryptos with a new version he termed as Howey Test. “I’m optimistic that we can significantly progress on the above in 2023,” Armstrong affirmed that Coinbase would make it happen and requested all interested policymakers who would like to see more clarity of crypto regulation to keep in touch.