- LINK surged 12% this week, powered by bullish fundamentals and a massive partnership with Mastercard.

- Nearly 3.86M LINK tokens have left exchanges, tightening supply and boosting long-term sentiment.

- Price targets range from $14 to $30—unless it loses $13, in which case bears might push toward $10 or even $5.

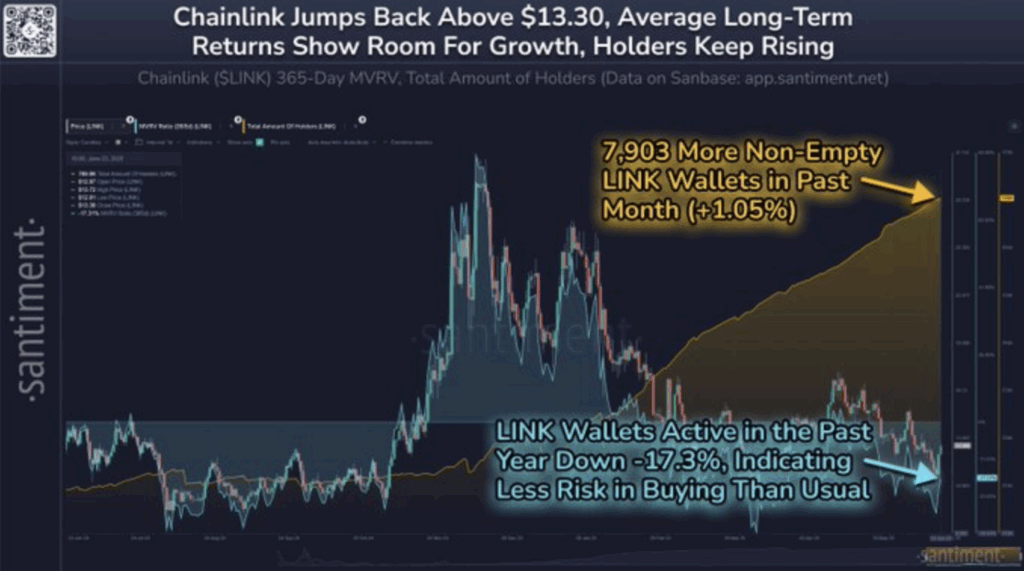

Chainlink (LINK) is back in the spotlight—up 12% this past week—and it’s not just hype this time. A real-world partnership with Mastercard lit the fuse, and strong fundamentals are doing the rest. Add to that a steady wave of tokens leaving exchanges, and you’ve got a classic recipe for bullish momentum.

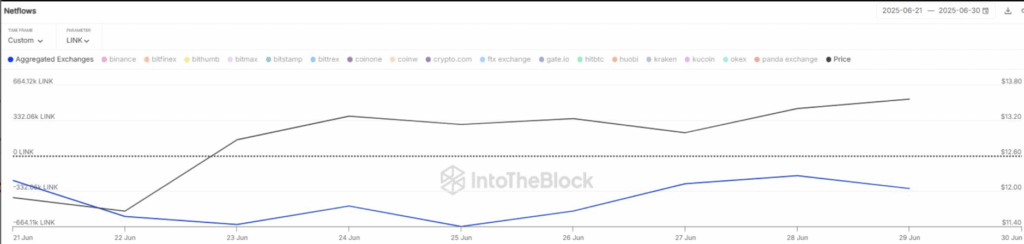

Since June 20, nearly 3.86 million LINK—worth over $51 million—have flowed out of centralized exchanges, according to Sentora (yep, the platform formerly known as IntoTheBlock). That kind of exodus usually means one thing: investors are locking tokens into self-custody, and that usually points to longer-term conviction. Plus, fewer tokens floating around on exchanges means less sell pressure. Translation? Price squeezes get a lot easier.

Mastercard Partnership Puts $30 LINK Back on the Table

LINK’s latest surge wasn’t random. It followed the official announcement—dropped on June 24—that Chainlink is teaming up with Mastercard. The two are working together on Swapper Finance, using Chainlink’s cross-chain interoperability protocol to connect Mastercard’s 3 billion+ users to crypto assets. That’s not just a foot in the TradFi door—that’s booting it wide open.

The move’s being hailed as a pretty big step toward blending traditional finance with DeFi, and it strengthens Chainlink’s case as the go-to infrastructure layer for the future of on-chain data and communication.

At the moment, LINK’s trading around $13.31, with a 24-hour volume sitting at $660.7 million and a market cap of about $9.02 billion. It’s dipped slightly in the last day—down 0.57%—but it’s still holding above that critical $13 mark. In this choppy market, that’s no small feat.

Derivatives Heat Up as Traders Eye Key Resistance

Open interest in LINK has nudged up 0.4% to $547M, while derivatives volume spiked 51% to $607M. That’s a clear signal—traders are getting more confident, and some are probably positioning for the next big leg up.

If LINK manages to punch through the $14 resistance level, there’s room to run. Analysts say the next targets could be anywhere between $25 and $30. And if things really get rolling? The 2021 high near $52 starts looking a lot less like fantasy.

But let’s not get ahead of ourselves. If LINK slips below $13, bears could drag it back down to $10. And if that fails too? $5 becomes the next major support—the same zone where accumulation happened during past market crashes.