- Technical Structure and Resistance: Dogecoin (DOGE) has broken out of a descending channel and retested it as support, confirming a bullish structure. It’s currently trading around $0.2238, with the $0.25 level acting as immediate resistance. A decisive break above this level could set the stage for a rally toward $0.35, but failure to reclaim it may lead to a pullback.

- Bullish Momentum Driven by Short Liquidations: On May 18th, short liquidations amounted to $387K, while long liquidations were just $65K, indicating a market-wide short squeeze that could push prices higher.

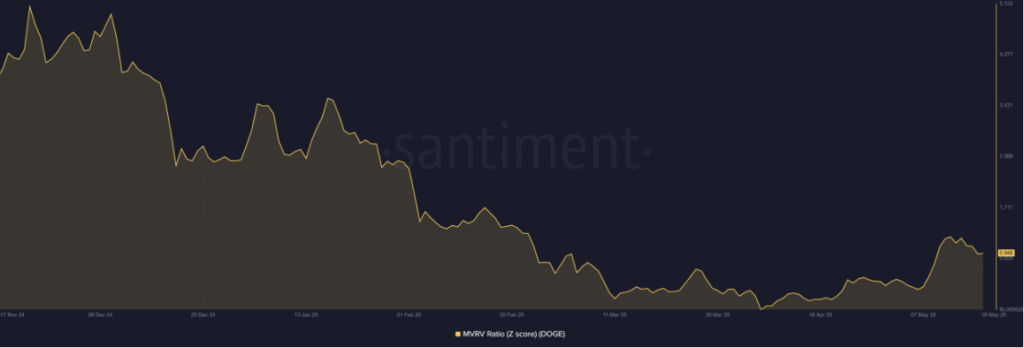

- MVRV Z-Score and Volatility Concerns: The MVRV Z-score sits at 0.94, suggesting room for further gains as most holders aren’t sitting on substantial unrealized profits. However, a sharp spike in DOGE’s Stock-to-Flow Ratio to 99.53 raises potential volatility concerns, as similar spikes have historically led to both rallies and corrections.

Dogecoin (DOGE) has managed to reclaim some key technical ground after breaking out of a descending channel and retesting it as support — a sign of bullish structure holding steady. At the moment, the price hovers around $0.2238, marking a 3.37% gain in the past 24 hours. The $0.25 zone looms as immediate resistance, a level that once served as support but has since flipped to a supply zone.

Potential Rally or Retracement?

A convincing break above $0.25 could set the stage for a rally toward $0.35. But if DOGE fails to decisively reclaim this level, a short-term pullback might be on the cards.

Short Liquidations Fuel Bullish Momentum

On-chain liquidation data reveals a notable shift in favor of bulls. On May 18th, short liquidations amounted to $387K, whereas long liquidations were a mere $65K. This disparity points to a market-wide short squeeze, with bears exiting underwater positions. Such imbalances often accelerate price movement, creating upward pressure on the asset.

MVRV Z-Score Points to More Upside

The MVRV Z-score for Dogecoin stands at 0.94 — well below the 2.5 threshold commonly linked to overvaluation. This metric compares market cap to realized cap, providing a snapshot of average holder profitability. A low score indicates that most holders are not sitting on significant unrealized profits, minimizing the incentive to sell.

Thus, the current reading suggests room for further price gains.

Volatility Concerns Arise

DOGE’s Stock-to-Flow Ratio has surged to an unprecedented 99.53, signaling a significant slowdown or even a halt in circulating supply growth. While perceived scarcity is rising, such spikes in the Stock-to-Flow Ratio have historically preceded both major rallies and corrections. Traders should keep an eye on potential volatility.

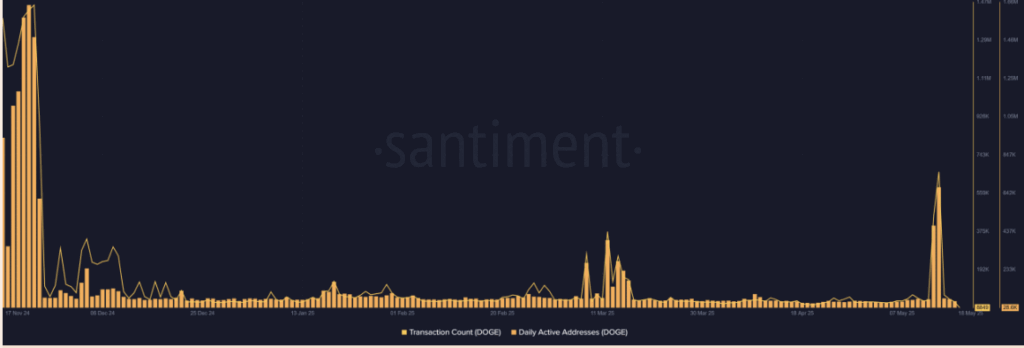

Network Activity Spikes, Then Drops

Earlier in May, daily active addresses surged to over 500K but have since plummeted to just 28.6K. Similarly, transaction counts dropped from their monthly highs to a mere 8.8K. This abrupt decline raises concerns that the earlier rally was driven more by speculative interest than by sustained network utility.

Mixed Signals in Derivatives Data

DOGE derivatives data presents a mixed outlook. Total volume dropped 22.05% to $3.46B, hinting at waning speculative interest. Yet, Open Interest (OI) rose 2.7% to $2.64B, suggesting that traders are holding their positions. Options OI also jumped 10.61% to $378.98K, indicating growing demand for volatility exposure or hedging, while Options Volume sank 85.89%, pointing to reduced intraday speculation.

Can DOGE Hold Above $0.25?

Dogecoin has a shot at reclaiming $0.25 and sustaining the breakout, bolstered by significant short liquidation pressure, a low MVRV ratio, and steady OI. Still, inconsistent on-chain activity and the sudden spike in Stock-to-Flow Ratio pose risks of increased volatility. Confirmation of a move above $0.25 with solid volume would be crucial for validating the next leg up toward $0.35.