- U.S. spot Bitcoin and Ethereum ETFs saw heavy outflows, with BlackRock’s IBIT and ETHA leading single-day withdrawals.

- Offshore whale concentration in IBIT adds structural risk and increases short-term volatility.

- Oversold technicals hint at a possible bounce, but without a new bullish catalyst, institutional demand remains weak.

Institutional mood turned sharply negative this week, and the crypto market didn’t take it lightly. Capital rotated out of major digital asset products at speed, dragging sentiment down with it. Bitcoin and Ethereum spot ETFs, once seen as steady pillars of demand, are now reporting sizable outflows — and BlackRock’s flagship funds are right at the center of the storm.

Bitcoin ETFs Face Heavy Withdrawals

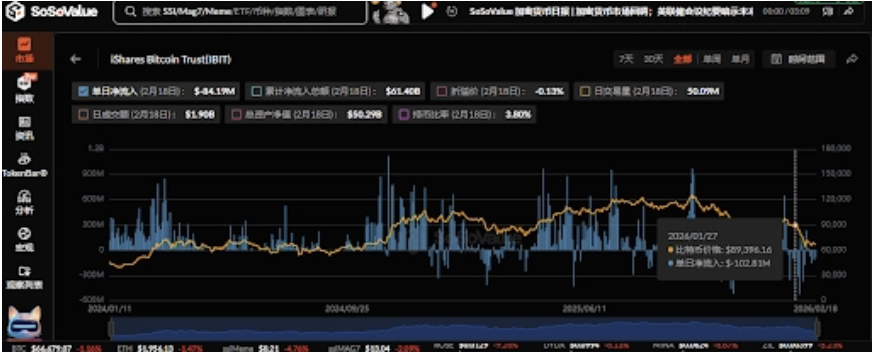

U.S. spot Bitcoin ETFs recorded a combined net outflow of $133 million, a number that landed harder than many expected. BlackRock’s IBIT alone saw $84.19 million walk out the door in a single session, marking the largest daily withdrawal among peers. That kind of move doesn’t happen quietly, it shifts tone across the entire market.

Trading volume has also cooled. On Tuesday alone, U.S. spot Bitcoin ETFs saw $104.9 million in net outflows, while total activity slipped to just above $3 billion — noticeably softer than recent averages. Analysts point out there’s no fresh bullish catalyst in sight, and without a new narrative to grab onto, institutional capital appears content to sit on the sidelines… or simply exit.

Offshore Whales Add a New Layer of Risk

Recent 13F filings added an unexpected twist. Laurore Ltd, a relatively low-profile Hong Kong-based entity, emerged as a major holder of BlackRock’s IBIT, becoming a significant player within the fund’s internal liquidity structure. That kind of ownership concentration can introduce fragility, especially when large holders shift positions quickly.

While BlackRock remains the dominant issuer, it’s these concentrated private players who can influence short-term price action more aggressively. Offshore whales don’t typically operate with retail conviction; they manage entries and exits strategically, often focusing on liquidity windows rather than long-term narratives. The result is a market that feels more unstable, where price swings aren’t just emotional — they’re structural.

BlackRock Caught Between Redemptions and Dip Buyers

BlackRock now finds itself in a delicate balancing act. On one side, large-scale redemptions pressure the ETF structure. On the other, on-chain data shows whales accumulating Bitcoin at lower levels, buying into weakness with quiet confidence.

This push and pull creates a strange kind of price discovery environment. IBIT’s technicals reflect the strain — the fund dropped 2.21% in its latest session, and its Relative Strength Index has fallen to 32.03, deep in oversold territory. Normally, that might hint at a bounce. But when outflows remain heavy, oversold conditions can stretch longer than traders expect, which makes things… tricky.

Ethereum ETFs Struggle Without Yield Incentives

Ethereum isn’t escaping the pressure either. Spot Ethereum ETFs recorded $41.83 million in net outflows, with BlackRock’s ETHA seeing $29.93 million withdrawn in a single day. That’s a notable drain, especially for products still trying to solidify institutional loyalty.

One underlying issue is structural: these ETFs do not offer staking rewards. In a market where yield matters, yield-free exposure looks less attractive compared to decentralized alternatives that generate returns. Capital has started drifting toward more productive DeFi avenues, leaving ETH price action relatively flat and technically vulnerable.

Daily indicators now show a bearish crossover for Ethereum, reinforcing the cautious tone. Sell-side pressure from ETF redemptions spills into perpetual markets, triggering liquidations and adding to downside momentum. It becomes a feedback loop — outflows pressure price, falling price triggers more caution, and the cycle continues.

For now, both Bitcoin and Ethereum sit in a phase that feels less like panic and more like institutional recalibration. Whether this is just a pause before the next leg higher, or the start of a deeper cooling period, depends on one thing the market currently lacks: a compelling new reason to buy.