USDD is the next algorithmic stablecoin in the top 10 ranking by market cap in our stablecoin series. Launched in May 2022, it is one of the youngest stablecoins out there, and already, its existence is fraught with controversy.

Justin Sun, who describes himself as “His Excellency Mr. Justin Sun, Ambassador, Permanent Representative of Grenada to the WTO | Founder of TRON, a supporter of BitTorrent,” founded the Tron Foundation, which launched the Tron blockchain in 2017 and developed USDD.

The Tron blockchain supports smart contracts, dApps, and various kinds of blockchain systems; from the start, it was accused of plagiarism for allegedly copying the code from other crypto projects.

At the time of launch, UST was a rapidly growing stablecoin whose success was gaining a lot of traction, such that many felt Tron mostly wanted to jump on the algorithmic bandwagon. Accusations along the same vein have also emerged with the launch of USDD, comparing it to USD.

It all started last April with an open letter about the establishment of the TRON DAO Reserve and another one about the issuance of USDD by Sun himself, in which he introduced the stablecoin to the world.

USDD is compatible with the Tron, Ethereum, and BNB chain via the cross-chain protocol BitTorrent Chain.

It is decentralized, over-collateralized with a minimum collateral ratio of 130%, and chain agnostic. A comparison to other notable stablecoins can be seen below.

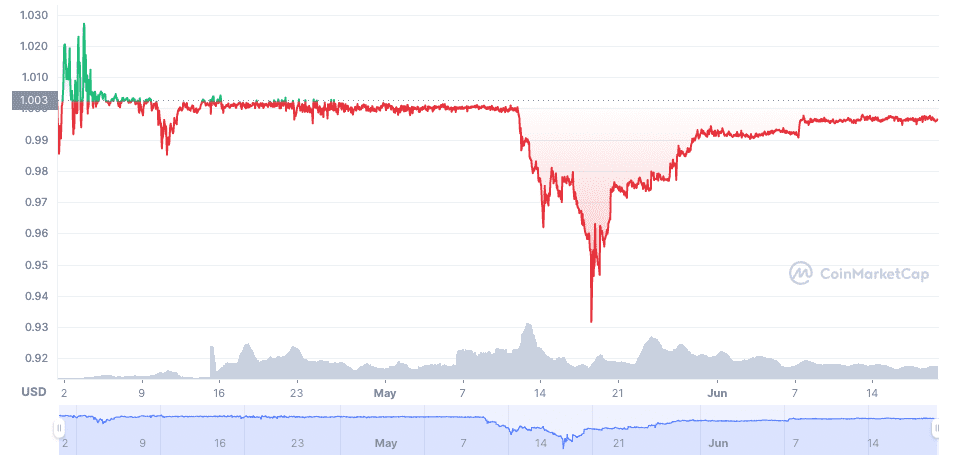

With a market cap of around $700 million, the algorithmic stablecoin is designed to remain pegged 1:1 to the US dollar. Over its short life span, it depegged to a minimum of $0.92 last June and a maximum of $1.03 on the now infamous May 12th, 2022. The TRON DAO Reserve oversees the management of USDD, its price stability, and reserves held in BTC, USDT, USDC, and TRX.

USDD functions via a dual-token model, whereby USDD is the stablecoin and Tron (TRX) is the token that expands or retracts depending on the stability of USDD. The team describes it as a supply and demand mechanism.

When USDD is below the peg, users are incentivized to buy USDD at a ‘discount,’ to be swapped via the protocol, allowing the user to make a profit. The incoming USDD is burned, which reduces supply and, by default, increases the price.

The opposite happens when the price of USDD is higher than $1. Users can swap $1 TRX for 1 USDD, then sell on the market at the ‘higher’ price. These arbitrage opportunities help protocol keep price stability.

Additionally, the protocol is programmed to maintain its safety and stability by the Super Representatives (SR) via the Delegated Proof of Stake mechanism. SRs are responsible for producing blocks and packing transactions, and in turn, they receive rewards from fee income made from swaps and TRX-stablecoin swaps. Any holder of TRX can become an SR, and TRX holders can vote for SR candidates.

All was well until UST’s dramatic failure occurred only a couple of days after USDD’s launch.

Due to its mechanism being similar to UST’s, many have questioned the stablecoin’s future. Sun remains optimistic and believes that algorithmic stablecoins are still worth pursuing if handled with care. In another open letter, he outlined the lessons from UST’s failures and provided reasons why USDD shouldn’t suffer the same fate.

He argues one of the Luna Foundation Guard’s (LFG) mistakes was an overreliance on Luna as collateral due to its volatility and that of only owning 15% of collateral in BTC.

He also blames UST’s fall on an overly rapid growth it could not handle. According to him, USDD is safer because of its overcollateralized basket of USDT, USDC, BTC, and TRX, and the flows of capital into the reserve in millions, which he claims will support the project and the peg.

Not everyone is convinced! The stablecoin wobbles, and investor confidence in algorithmic stablecoins is at an epic low. The stablecoin still seems to hang on, and the Tron team is going for an over-collateralization strategy to prevent future depegs. Can this last, and can confidence be restored?