- Coinbase Struggles as Regulatory Pressure Mounts: Market Share in Ether Staking Drops.

- Demand for ETH Staking Soars Amidst Coinbase’s Decline: Regulatory Risk a Concern.

- Intensifying Competition and Net Outflows Challenge Coinbase’s Staking Service.

Coinbase, a prominent cryptocurrency exchange, is experiencing a decline in its market share within the growing ether (ETH) staking industry. This decrease in market share can be attributed to mounting regulatory pressure faced by the exchange from U.S. authorities.

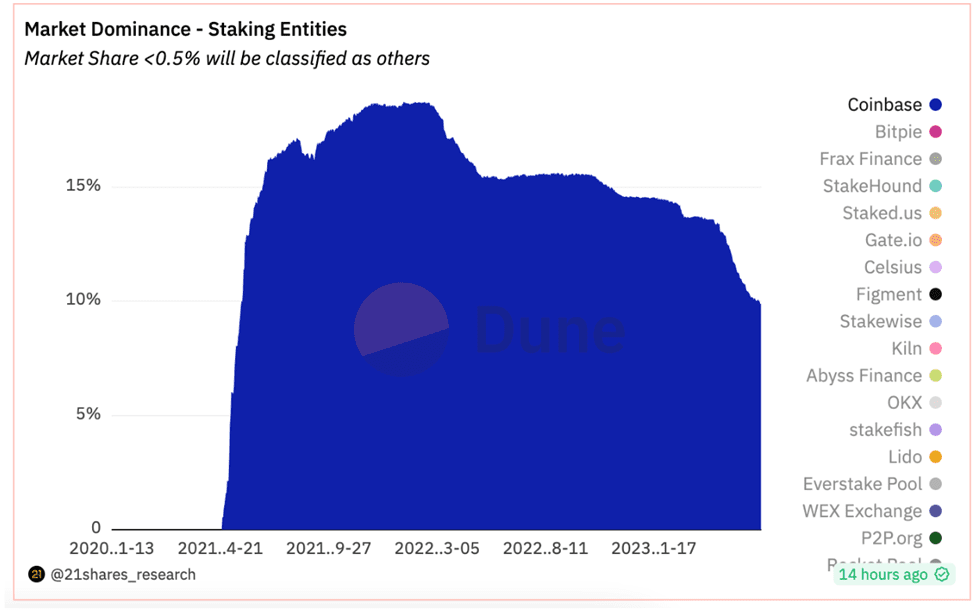

According to data from 21Shares, Coinbase’s share in ETH staking has dropped to 9.7%, marking its lowest level since May 2021. This decline is significant compared to the 13.6% share recorded on April 12, following the implementation of Ethereum’s Shanghai upgrade, which allowed users to withdraw funds for the first time.

High Demand for ETH Staking Amidst Regulatory Uncertainty

Interestingly, this drop in Coinbase’s market share comes at a time when the demand for ETH staking is surging. ETH staking involves locking up tokens to secure the blockchain and earn passive income on holdings. The implementation of the Shanghai upgrade resulted in a wave of deposits into the staking sector, with inflows surpassing withdrawals by approximately 3.5 million ETH, equivalent to around $7.3 billion at current prices.

However, Coinbase experienced a net outflow of $517 million (approximately 272,315 ETH) during the same period, making it the second-largest outflow after its rival exchange, Kraken. Analysts suggest that investors may be reluctant to use Coinbase’s staking services due to concerns about regulatory risks associated with the platform.

Coinbase market share in ETH staking

Earlier this year, Kraken faced a lawsuit from the U.S. Securities and Exchange Commission (SEC) and consequently decided to discontinue its staking service for U.S. customers as part of a settlement with the regulatory agency. In a similar vein, Coinbase was sued by the SEC on June 6 for allegedly violating federal securities laws, including offering unregistered securities through its staking service. Despite the lawsuit, Coinbase has expressed its commitment to maintaining the staking service.

Coinbase Faces Net Outflow and Increased Competition

Data compiled by 21Shares indicates that since the lawsuit, Coinbase has withdrawn around 149,300 ETH from Ethereum’s proof-of-stake network while depositing only 52,992 tokens. This net outflow of $183 million suggests that users have been unstaking their tokens and migrating away from the exchange.

While Coinbase still holds its position as the second-largest staking service provider, it faces tough competition from rapidly growing rivals like Figment, RocketPool, and Kiln, as illustrated by Dune’s chart.

Coinbase generates revenue from staking by charging a 25% commission on user rewards. Consequently, a decrease in the number of staked tokens directly impacts the exchange’s earnings.

The regulatory pressure faced by Coinbase and other cryptocurrency exchanges highlights the increasing scrutiny from U.S. authorities seeking to enforce compliance with securities laws. Consequently, some investors are exploring alternative platforms for their staking needs, potentially impacting Coinbase’s market share.

As the staking industry continues to evolve and regulators refine their stance on cryptocurrency-related activities, Coinbase and other exchanges face the challenge of navigating regulatory hurdles while striving to maintain their market positions. Adapting to the changing landscape and addressing regulatory concerns will be crucial for exchanges to secure their foothold in the staking market.