The crypto market continues the downtrend after a short-lived recovery on Wednesday, losing 1.85% of its overall market value to $1.1 trillion. Some market analysts believe that the recent SEC filings could strengthen proof-of-work (PoW) coins like Bitcoin (BTC), Litecoin (LTC), and Dogecoin (DOGE) because they were not mentioned as securities.

Bitcoin and Dogecoin led the recovery among top-cap cryptos on Wednesday, rising 4.18% and 4.62%, respectively. Litecoin (LTC) jumped as much as 4%, while the total crypto market capitalization rose 3.3% to $1.12 trillion.

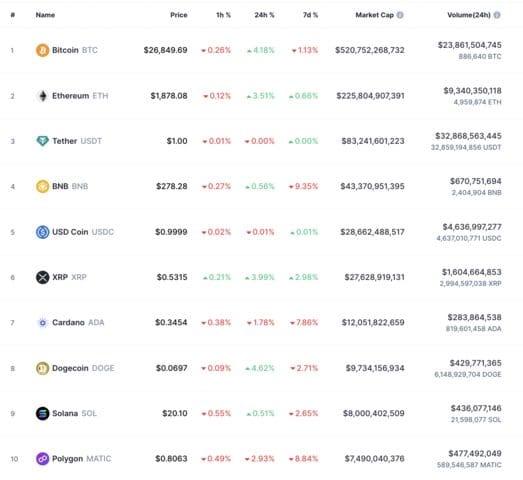

Top 10 Cryptos

The bounce appeared to recoup all the losses incurred by traders who were nursing wounds from record liquidations on Monday. The Monday crypto bloodbath triggered by the news that the SEC was suing the largest crypto exchange in the world, Binance, led to the liquidation of token-tracked futures with over $293 million.

Liquidations usually occur when a trading platform forcibly closes a trader’s leveraged position due to a partial or a total loss of the margin initially set. This happens when a trader does not have sufficient funds to keep the trade open.

Note that large liquidations usually signal that a local bottom or top is in. In this case, the recent liquidations may be a sign of a base after the Monday sell-off, pointing to a steep upward price move and allowing market participants to position themselves appropriately.

The SEC Focuses on Proof-of-stake Tokens in its Securities List

Bitcoin and Dogecoin may continue leading the recovery as traders shake off the possible implications of the regulatory troubles of the two largest crypto exchanges in the world, Binance and Coinbase in the United States, with some tokens termed security.

Security is a negotiable financial instrument representing monetary value, usually in the form of a stock, bond, or option.

Even though the SEC has yet to give any official legal definition of crypto security and is yet to respond to a petition from Coinbase seeking clear rulemaking explanations, it referred to some tokens termed as securities in recent lawsuits.

According to the lawsuits, the SEC considers the following to be securities: Binance Coin (BNB), Solana (SOL), Cardano (ADA), Polygon (MATIC), Filecoin (FIL), and Sandbox (SAND), among others.

Notice that all these are proof-of-stake (PoS) coins, which refer to blockchains that require block validators to lock-up tokens to validate transactions on the network.

It is now evident that the SEC stayed clear from mentioning PoW tokens in any of the lawsuits. These include Bitcoin (BTC), Litecoin (LTC), Monero (XMR), Ethereum Classic (ETC), and Dogecoin (DOGE), among others.

It needs to be clarified from the lawsuits why the Gensler-led team is mainly focusing on PoS cryptocurrencies, failure to mention PoW tokens reassures holders of these coins that US regulators consider them commodities, not securities.

As such, some market observers suggested that PoW crypto majors may recover while those termed as securities in the SEC filings could experience turbulence in the near term.

In an email to Coindesk, Jeff Mei, COO of crypto exchange BTSE, said:

“We’ve seen somewhat of a bloodbath for altcoins. Most likely, this is because the SEC’s lawsuits name a basket of altcoins as securities while not categorizing Bitcoin and Ether in the same class.”

Mei observed that traders appear to be fleeing the “ relative safety of the top cryptos by market cap,” adding that it is possible to see a constitution in price drops “with the blue-chip Bitcoin and Ether holding ground, but with continued uncertainty for the majority of altcoins.”

It is believed that the SEC filings strengthened the value proposition of the big crypto as BTC and DOGE were not explicitly termed as security by the SEC.