- SEC Chairman Paul Atkins’ remarks have reignited confidence in XRP’s regulatory outlook.

- Support for clearer SEC–CFTC jurisdiction signals a move away from enforcement-first policy.

- Legislative momentum could unlock institutional access and end years of legal uncertainty.

Crypto markets are buzzing again after recent remarks from SEC Chairman Paul Atkins reignited confidence around XRP’s regulatory future. After years of lawsuits, uncertainty, and what many investors saw as enforcement-first policymaking, Atkins’ comments about congressional action landed differently. For a growing number of market watchers, the message was clear: regulatory clarity for XRP may finally be within reach, and from a policy standpoint, the long fight could be nearing its end.

What Paul Atkins Actually Said

Atkins didn’t mention XRP directly, but his words carried weight. In a public post, he said this week could be a turning point for crypto as Congress moves to modernize financial markets for the 21st century. He also stated he is fully supportive of Congress clarifying how regulatory authority should be split between the SEC and the CFTC. That alone marks a noticeable shift away from years of ambiguity and toward legislation-led oversight, which the industry has been asking for.

Why Some Analysts Say XRP Is “Done”

Crypto analyst JackTheRippler was quick to label XRP a done deal after Atkins’ remarks. His reasoning rests on the idea that regulators and lawmakers now appear aligned on ending prolonged legal gray areas. When senior officials publicly encourage clearer legislation, markets tend to assume follow-through is coming. That expectation alone can move sentiment fast, especially for an asset like XRP that has spent years stuck in regulatory limbo.

The Jurisdictional Shift That Changes the Equation

At the center of this renewed optimism is the proposed Digital Asset Market Clarity Act. The legislation aims to clearly define categories of digital assets and assign oversight between agencies, directly addressing the confusion that has surrounded XRP since the SEC lawsuit began in 2020. If passed, it would replace courtroom battles with rule-based clarity and create a repeatable framework for future crypto regulation, not just for XRP.

What This Means for XRP’s Legal and Market Outlook

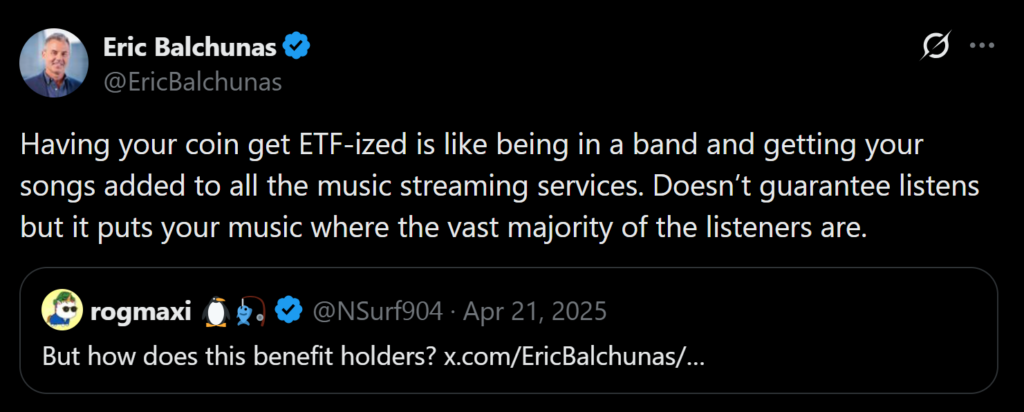

Bloomberg Intelligence ETF analyst Eric Balchunas has previously compared regulatory approval to getting music added to major streaming platforms. It doesn’t guarantee success, but it puts the asset where institutions can finally access it. For XRP, that matters. Clear legal status is a prerequisite for products like spot ETFs, and Atkins’ support for legislative action has meaningfully improved those odds. As a result, many investors are already repositioning, betting that access and legitimacy come next.

Why Timing Matters Now

Atkins has argued that a durable regulatory framework is necessary if the US wants to compete with Europe and Asia on digital asset innovation. His comments arrived alongside the Senate Banking Committee releasing a massive draft crypto market structure proposal, suggesting both lawmakers and regulators are moving in sync. The tone has shifted from adversarial to collaborative, and that alone is a major change.

For XRP holders who endured years of uncertainty, the signal feels different this time. The regulatory conversation appears to be moving out of courtrooms and into legislation. Whether prices react immediately is still an open question, but from a policy perspective, many believe the direction is now set. For XRP, that may be what people mean when they say it’s a done deal.