- Ripple has applied for a U.S. national banking license and Fed master account, signaling a major leap toward traditional financial integration.

- XRP price predictions now range as high as $50, fueled by institutional demand, ETF speculation, and expanding real-world use cases.

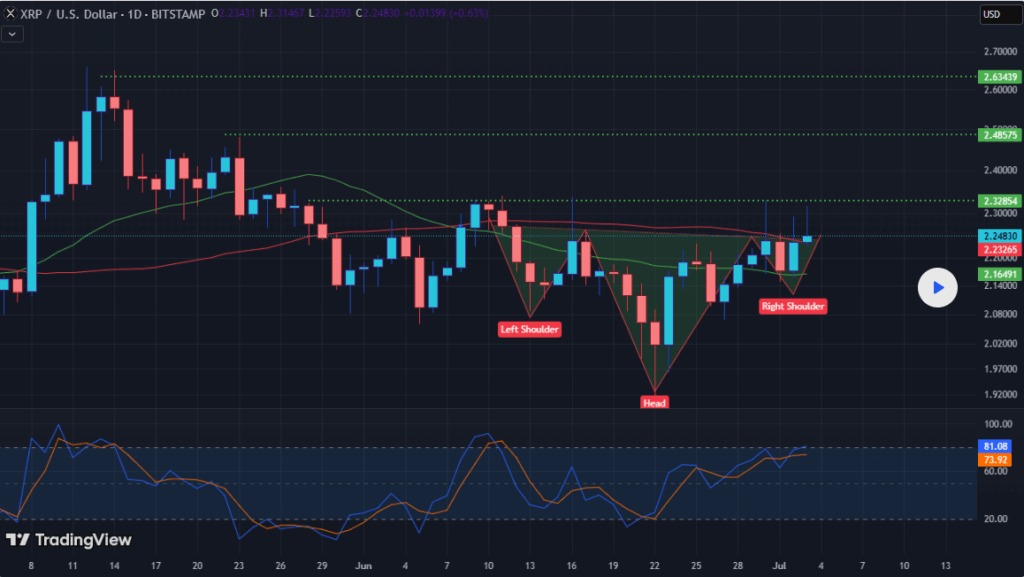

- Technical and on-chain indicators remain bullish, with analysts eyeing a breakout above $2.38 and institutional investors increasingly taking notice.

Ripple has shaken up the crypto world with a high-stakes bid to secure a U.S. national banking license—marking one of the boldest moves by a crypto firm to date. Coupled with an application for a Federal Reserve master account, this play signals Ripple’s push to become a true hybrid between digital assets and traditional banking. The announcement has injected new life into XRP, with analysts and advocates pointing to institutional demand, ETF speculation, and real-world adoption as fuel for a potential price run.

From Crypto Firm to Full-Fledged Bank?

On July 2, Ripple confirmed its formal application for a national bank charter. If approved, Ripple would be allowed to offer FDIC-insured accounts and direct access to U.S. payment rails like Fedwire and FedNow. Longtime XRP supporter Vincent Van Code described the move as a “watershed moment,” forecasting a long-term XRP price target between $30 and $50. His case hinges on growing use of RippleNet, potential ETF approvals, and XRP’s expanding role in cross-border settlements and CBDC infrastructure.

Technical and Institutional Signals Align

XRP is currently holding above a key ascending trendline, trading near $2.27 with bullish technical indicators flashing. A golden cross has formed, and open interest is climbing—hinting at growing confidence among leveraged traders. Analysts are eyeing a breakout above $2.38, which could set the stage for short-term targets around $2.50, and possibly $3.50 by year-end. Meanwhile, institutions are beginning to take notice. Grayscale’s inclusion of XRP in its large-cap ETF portfolio—even amid temporary SEC delays—suggests that Wall Street is warming up to the asset.

A $50 XRP: Dream or Data-Driven?

Critics say a $50 XRP would create an unsustainable market cap, but supporters argue the comparison to traditional equities is flawed. In a world where XRP is embedded in global payments, digital asset custody, and sovereign financial systems, the price ceiling becomes more flexible. Van Code notes that with ETF momentum, banking access, and strategic government partnerships (like Ripple’s work with Saudi Arabia), such projections are no longer fantasy.