- Dormant whales reawakened, moving 3,500 ETH into Kraken — hinting at possible profit-taking as ETH consolidates near $2,800.

- Spot and derivatives data show mixed signals: inflows rising, but market sentiment remains cautious; 64% of traders are long, raising liquidation risk.

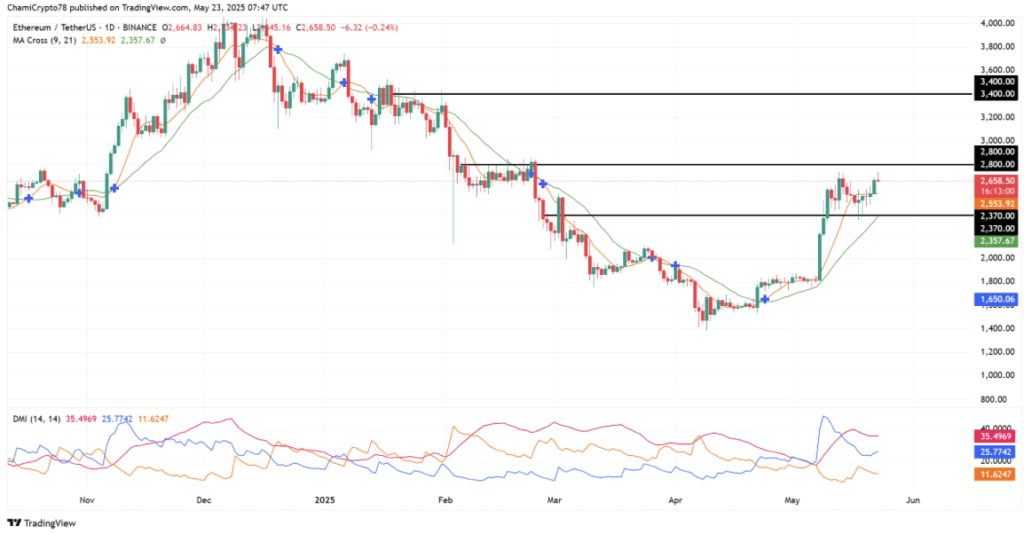

- Technical setup favors bulls if ETH holds above EMAs; a breakout past $2,800 could open the door to $3,400 — but more whale selling could stall momentum.

Two long-silent Ethereum (ETH) whales just popped back onto the radar, stirring up some buzz after dropping 3,500 ETH — worth over $9.3 million — into Kraken. One of the wallets hadn’t moved in four years. The other? Quiet for about ten months.

Old Coins, New Moves

These transfers are raising eyebrows because when old wallets wake up, it often means they’re cashing out or moving to distribute. Combined, the whales still control 13,600+ ETH, so this may just be the start. And the timing? Kinda spicy — ETH is currently consolidating just under some major resistance.

Whales Are Active Again

Over the past week, inflows from large holders jumped 50.89%, while outflows surged 80.46%. Still, on a monthly basis, outflows are down slightly (-5.74%) and down even more over 90 days (-17.45%). Basically, more ETH is heading toward exchanges than leaving, hinting that some whales may be prepping to sell.

Spot Flow Says… Not Much

Looking at spot exchange flow, we’re seeing a bit of a tug-of-war. On May 23, about $832 million flowed in, and around $840 million flowed out. That kind of balance doesn’t tell us much — just that the market’s still figuring itself out.

Even with all this whale activity, traders seem split. Buyers and sellers are circling each other, waiting for something to tip the scale.

Derivatives Lean Bullish — But Risky

On Binance, 64.32% of ETH/USDT traders are long. The long-to-short ratio’s sitting at 1.80, showing optimism — but maybe too much. If momentum fades, those longs could get wiped fast.

Can ETH Crack $2,800?

Right now, ETH is floating around $2,658. It’s still above the 9-day EMA ($2,553) and the 21-day EMA ($2,357), which is a good short-term sign. Resistance is firm at $2,800. Support’s down near $2,370.

If it breaks above $2,800 cleanly, we could see a run to $3,400. The DMI agrees — the ADX is 35.49 (which means the trend is strong), and the +DI is well above the -DI, favoring bulls.

But here’s the catch: more whale deposits could freak the market out, boost volatility, and kill the rally.

Final Thought

ETH’s at a crossroads. Technicals look good, but whale behavior is unpredictable. A breakout or a breakdown? That’s still up in the air — and it might all come down to whether these big wallets keep moving coins into exchanges.