- Bitcoin is surging past $88K amid concerns over U.S. dollar strength and speculation that President Trump may remove Fed Chair Jerome Powell, pushing investors toward non-sovereign assets like BTC.

- On-chain and ETF data show strong conviction from long-term holders and institutions, with over 63% of BTC supply untouched for a year and record inflows into U.S. spot Bitcoin ETFs.

- Despite headwinds in mining, including all-time low hashprice and upcoming tariffs on ASIC rigs, macro uncertainty is driving capital into Bitcoin as a “sovereign-free macro hedge.”

Bitcoin’s been on a tear lately, and Bitwise Asset Management just dropped a weekly market report that kinda sums it all up in one punchy line: “With political pressure mounting on Powell and the dollar falling, Bitcoin’s outperformance reflects growing structural divergence from risk assets.” Whew. Basically? It’s not just another crypto pump—there’s real macro tension driving this thing.

What’s Fueling Bitcoin’s Climb?

The backdrop’s messy. The U.S. Dollar Index slid under 98.5 as rumors swirl about President Trump possibly firing Fed Chair Jerome Powell. The White House is “actively exploring” it, per National Economic Council Director Kevin Hassett. Bitwise calls this an “assault on monetary independence”—and it’s making people look harder at non-sovereign assets like BTC.

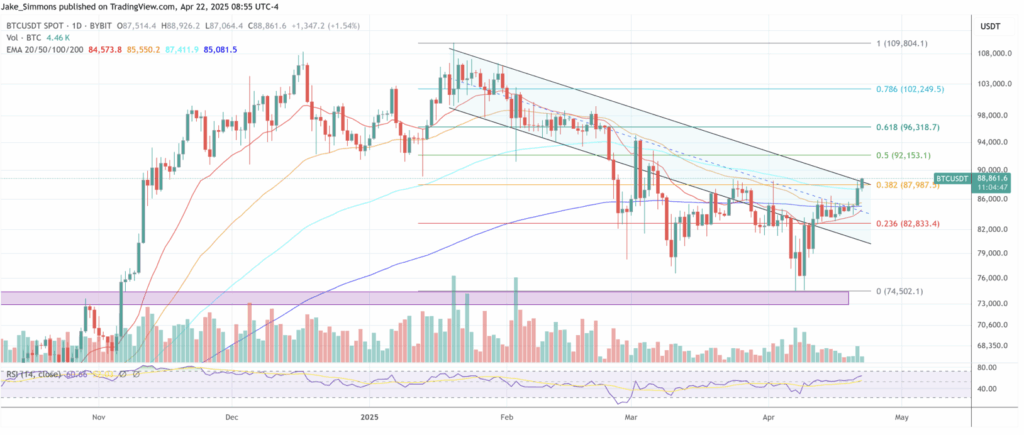

While stocks—like the Nasdaq 100 and S&P 500—are both down around 7–9% this month, Bitcoin’s doing its own thing. Up over 7% month-to-date, BTC’s chart is peeling away from the pack. That’s what Bitwise calls “early-stage decoupling.”

Long-Term Holders Are Holding Tight

On-chain data backs this up too. Over 63.5% of all BTC hasn’t moved in a year. Long-term holder supply is at a yearly high of 69%. Plus, exchange balances are shrinking—down to 2.6 million BTC—after another 260K coins got yanked off platforms. Bitwise says that’s a clear signal of conviction from the big holders.

Derivatives & ETPs Say Bulls Are Still in Control

In futures, BTC open interest is climbing. Funding rates on perpetual swaps remain positive, which means traders are paying to stay long. Implied volatility is chill, sitting near 49%—low by historical standards. That tells us the market’s not in frothy territory… yet.

Even though global crypto ETPs saw $30 million in outflows, U.S. spot Bitcoin ETFs actually took in $15.8M last week. Bitwise’s own ETF grabbed $23.8M. BlackRock’s IBIT pulled in a whopping $186.5M. And just yesterday? A record $381 million poured into U.S. Bitcoin ETFs—biggest day since February.

Corporates Are Buying, Too

Japanese firm Metaplanet added 330 BTC to its stash, averaging $85,605 per coin. Strategy Inc. grabbed 6,556 BTC worth about $556M. That’s not retail—you don’t drop half a billion on a meme. This is real capital betting big on Bitcoin.

But Mining Faces a Squeeze

Not everything’s rosy though. Hashprice—what miners earn per terahash—is at all-time lows. On top of that, the U.S. is slapping up to 46% tariffs on mining gear from Southeast Asia. With nearly 40% of mining power in the U.S., that’s a problem. Some miners are bouncing to countries like Ethiopia, Norway, or Bhutan to cut costs. Meanwhile, public companies holding BTC are soaking up investor dollars without the mining headaches.

So, What’s the Big Takeaway?

Bitwise says the same macro conditions that launched Bitcoin off its March lows are still very much alive. Their Crypto Sentiment Index just flipped positive for the first time in two months, even though most altcoins are still lagging behind BTC. In their words, the market is favoring “sovereign-free macro hedges”—code for Bitcoin, basically.

Their conclusion wraps it all up: As the world gets shakier about the dollar and central banks, portfolios are diversifying. And more and more capital is quietly sliding into the one asset that doesn’t come with a central bank at all: Bitcoin.

At the time of writing, BTC was cruising at $88,861.