- Key Resistance Ahead: Ethereum is facing strong resistance between $2,295–$2,350, where over 6 million ETH is held. This area could trigger heavy selling as many wallets are still underwater.

- Weak On-Chain Support: Network activity and whale accumulation are both down sharply, with fees and large-holder netflows dropping—signaling reduced confidence from institutional players.

- Recovery Possible, But Cautious: ETH has bounced recently and is testing resistance at $1,703. A breakout could lead to a run toward $2,330, but without stronger on-chain support, momentum might stall.

Ethereum (ETH) is currently grappling with a pretty stubborn resistance wall right near the $2,330 mark—a level that could end up shaping where things go next, at least in the short term. But here’s where it gets a bit tricky: more than 106 million ETH addresses are still sitting underwater, which means a huge chunk of holders are waiting for breakeven prices before they even think about holding longer.

Now, zooming in a little, data shows that about 6.28 million ETH is parked between $2,295 and $2,350 across roughly 2.6 million wallets. That’s not a small number. This cluster is one of the biggest resistance zones on Ethereum’s network right now, and any move toward it might trigger sell pressure from holders itching to cut their losses.

If ETH does manage to slice through this zone, though, it could flip a major resistance into support—and more importantly, boost market confidence.

Whale Activity Drops as Network Slows

Things aren’t looking too lively on-chain, either. Ethereum network fees have dropped—like, a lot. We’re talking a 56% drop in the last week and nearly 89% over the past three months. That kind of slide usually points to weaker demand and lighter activity across the board.

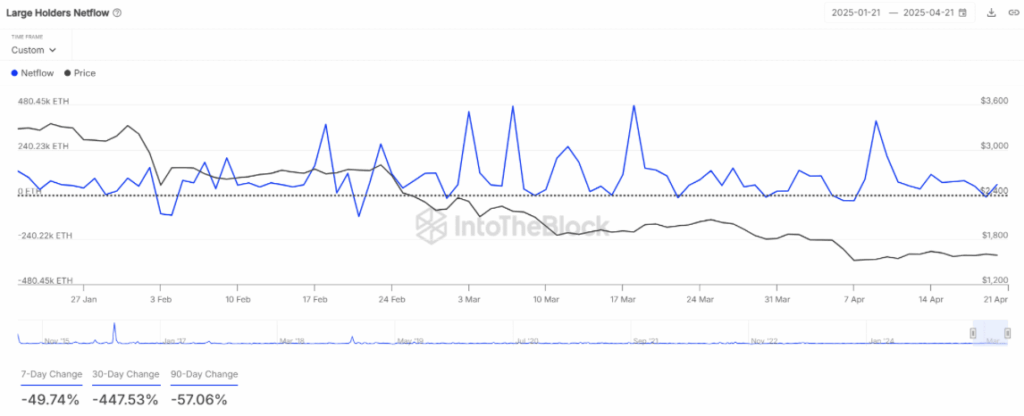

At the same time, whales seem to be chilling on the sidelines. Large holder netflows tanked by almost 50% this past week—and over 447% (!) in the last month. It’s a clear sign that big-money players are holding back, which doesn’t do any favors for Ethereum’s short-term breakout hopes.

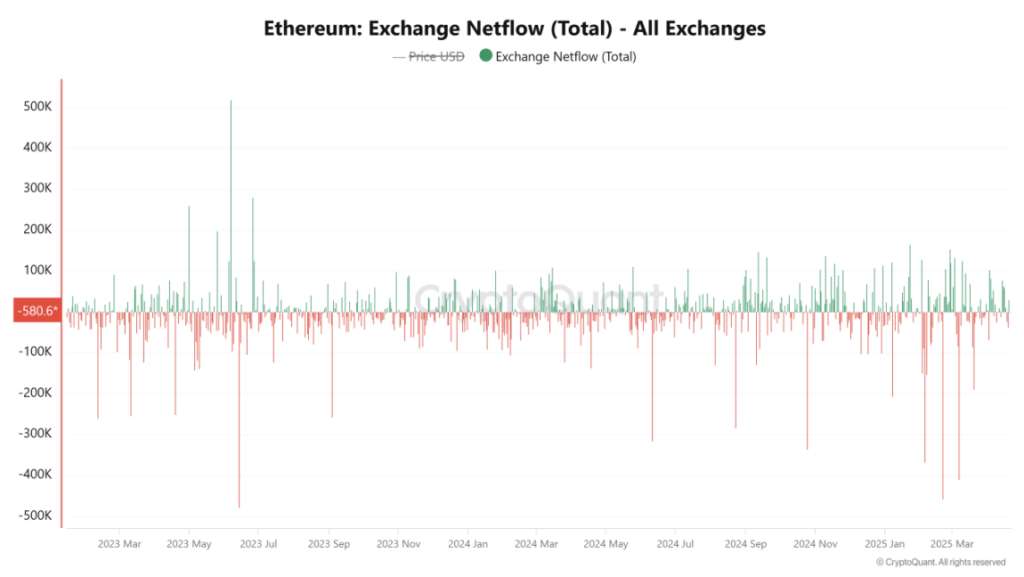

Even though some ETH has been moving off exchanges (which is usually a good thing), the lack of serious whale accumulation means the buy-side momentum just isn’t strong enough—at least not yet.

Price Tries to Bounce, But Downtrend Isn’t Broken

ETH has shown a bit of life lately. It bounced 3.6% in the last 24 hours, trading around $1,647 at the time of writing. That’s after a solid rebound from the $1,385 zone, now testing resistance between $1,650 and $1,703.

But—yeah, there’s always a “but”—Ethereum’s still moving within a descending parallel channel. That pattern has smacked down multiple recovery attempts in recent weeks. The $1,703 level also happens to align with the top of that channel, forming a double whammy of resistance.

If ETH can actually break out above that, it’d invalidate the bearish trend and maybe set the stage for a push to $2,330. Until then though, the downtrend is still technically intact.

Retail’s Hanging On, Institutions? Not So Much

Even with all this back and forth, retail traders don’t seem too fazed. Exchange netflows show that about 29,948 ETH left trading platforms last week—a nearly 2% drop in balances. That’s usually a bullish signal, suggesting folks are prepping for long-term holds rather than quick flips.

Still, optimism isn’t universal. The divide between retail hope and institutional hesitation is still very real. Network activity is quiet. Whale interest is lacking. And unless something shifts soon—whether it’s price, sentiment, or usage—Ethereum may not have enough gas in the tank to push past $2,330.

Bottom Line?

Ethereum’s stuck at a crossroads. The recent bounce is encouraging, and traders are cautiously optimistic. But the lack of on-chain excitement and big-money backing means any rally attempt could fizzle out unless ETH reclaims $1,703 and stirs up fresh demand. For now, the $2,330 barrier isn’t going anywhere.