- ETH struggles to hold above key psychological levels as selling pressure builds.

- Short-lived rebounds suggest weak bullish commitment, keeping the downtrend intact.

- If the current structure breaks, a deeper correction could be on the horizon.

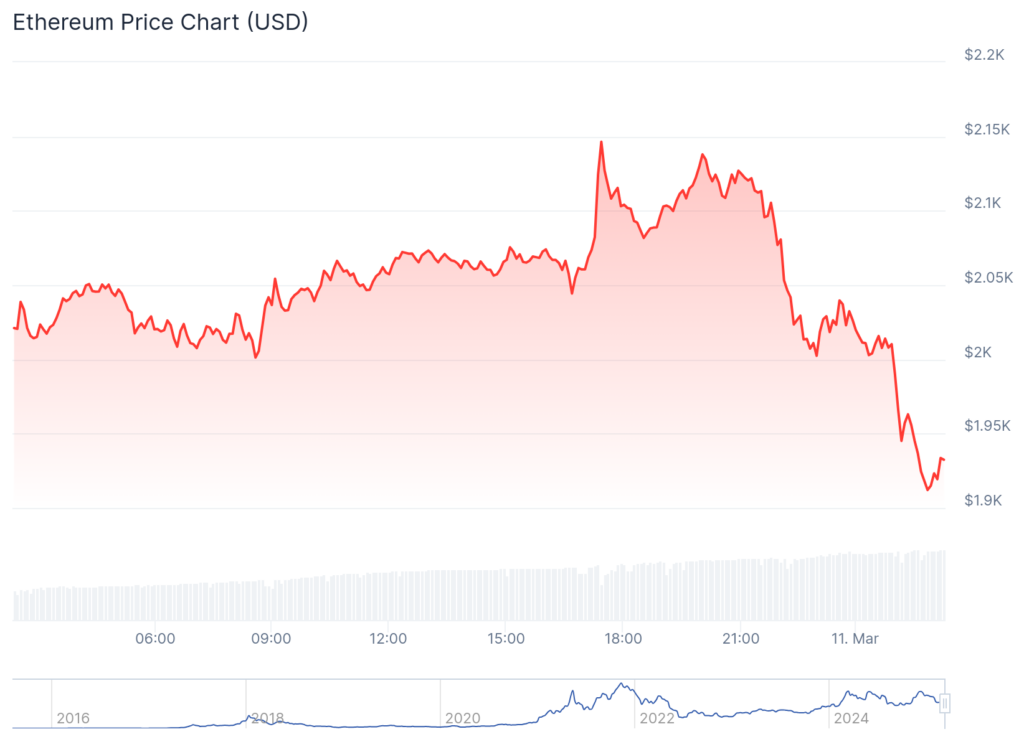

Ethereum has been showing signs of exhaustion as it fails to maintain upward momentum. The CoinGecko chart reveals a steady decline, with each bounce being met by renewed selling pressure. This kind of price action typically suggests that buyers are hesitant to step in, while sellers continue to dominate.

A sharp drop in price has brought ETH closer to a significant support level. Historically, this zone has acted as a turning point, but with current momentum, it remains uncertain if it will hold. If the price continues to struggle, the risk of a deeper correction increases.

Failed Rebounds Highlight Bearish Control

Despite a few attempts at recovery, Ethereum has been unable to sustain any meaningful rallies. Quick price spikes have been followed by strong rejections, further reinforcing the bearish outlook. This suggests that short-term buyers are taking profits quickly rather than holding for a prolonged move upward.

At this point, ETH needs to reclaim lost ground before any talk of a reversal can be considered. If it continues to struggle at current levels, it could lead to another leg down. On the other hand, if bulls manage to push the price above a key level, it might provide some relief—at least temporarily.

Market Structure Suggests Further Uncertainty

ETH’s market structure is showing weakness, with lower highs forming in recent sessions. The broader trend is still leaning downward, and unless bulls step in with strong momentum, the outlook remains fragile. Price action will need to show some form of stability before any real confidence returns to the market.

If Ethereum finds support at its current level, a short-term bounce could be expected. However, without confirmation of strength, any rally might be short-lived. A break below support would open the door for further downside, making this an important level to watch in the coming days.

Ethereum was introduced in 2015 as a decentralized platform that enables smart contracts and decentralized applications (dApps). It has grown into one of the most widely used blockchain networks, supporting a wide range of industries. Despite its strong fundamentals, ETH remains subject to market fluctuations, and its current downtrend reflects broader uncertainty in the crypto space.

As ETH trades near key levels, the next move will be crucial. Will bulls defend this support, or is more downside ahead? The market is at a tipping point, and the coming sessions will likely provide more clarity.