- XRP surged 11.75% following Ripple’s stablecoin custody deal with BNY Mellon and expansion of RLUSD on Ethereum and XRPL.

- Technical patterns point to bullish breakouts, with targets at $2.87 and $3.72 in the short-to-mid term.

- Future utility for XRP hinges on RLUSD gaining traction on XRPL, where faster, cheaper transactions could challenge Ethereum’s stablecoin dominance.

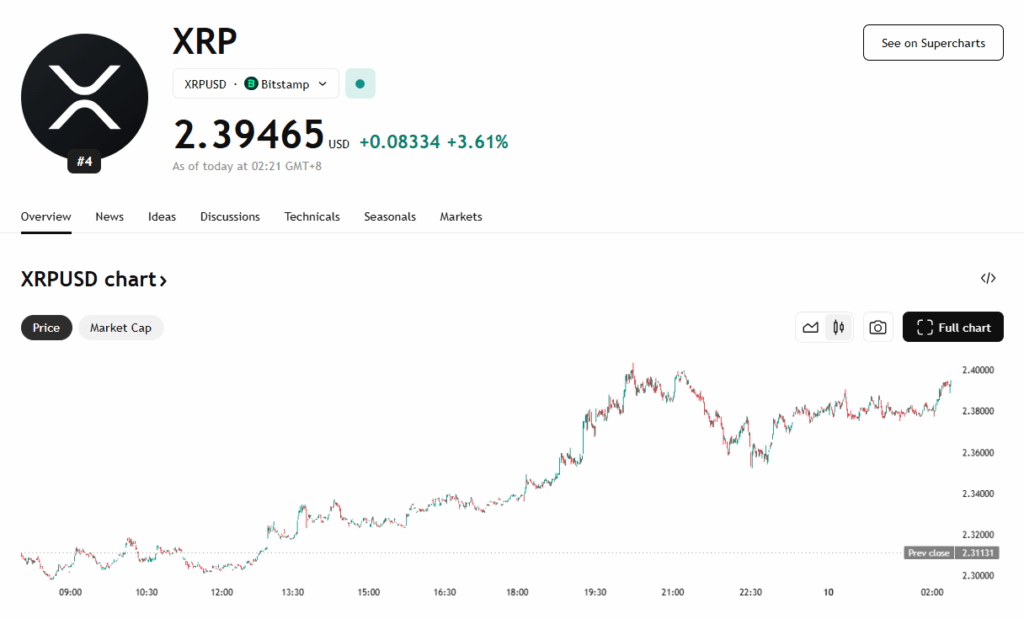

XRP has seen a notable resurgence, jumping over 11.75% in just a week as Ripple partners with BNY Mellon, America’s oldest bank. This collaboration marks a major moment for Ripple, as BNY Mellon becomes the primary custodian for Ripple’s RLUSD stablecoin, adding serious weight to XRP’s long-term utility and institutional credibility.

Ripple’s RLUSD stablecoin recently launched on both Ethereum and the XRP Ledger (XRPL), though 87% of its activity remains on Ethereum, according to DefiLlama. However, crypto analysts believe the real opportunity lies ahead. Ripple plans to integrate smart contracts on XRPL, positioning RLUSD to eventually compete directly with Ethereum-based stablecoins through faster and cheaper settlements.

This strategic move has renewed optimism around XRP’s utility, especially if Ripple’s ecosystem can claw market share from Ethereum’s stablecoin dominance. Analysts like Crypto Eri highlight that Ripple is playing the long game — urging patience from investors as its infrastructure and ecosystem evolve.

Technical Breakout Signals More Gains for XRP

From a charting perspective, XRP has broken above an inverse head-and-shoulders pattern on the daily timeframe — a classic bullish reversal signal. The $2.30 resistance level has flipped to support, with upside targets near $2.87, a potential 20% gain from the breakout zone. On the longer-term 3-day chart, XRP is also breaking out of a descending triangle, which may target $3.72 by August, a projected 55% rise.

This bullish price action aligns with a broader shift in market sentiment toward XRP, especially as institutional adoption picks up and Ripple’s long-promised innovations begin to materialize.