- XRP surged nearly 18.7% intraday but gave back half the move, closing up about 9% and trading near $1.53.

- Exchange inflow data suggests holders are still selling into rallies, keeping upside momentum fragile.

- XRP needs to hold $1.51 as support and break $1.62 to target $1.76, while failure could pull price back toward $1.36.

XRP just delivered one of those classic “blink and you miss it” moves. The token ripped higher and nearly printed an 18.7% intraday gain, but it couldn’t hold the full push. By the time the session settled, XRP had given back about half of the rally and closed up roughly 9%, now trading around $1.53.

That kind of candle tells a story, and it’s not a simple one. On one hand, demand clearly showed up. On the other, a lot of holders were waiting with their finger on the sell button, and they didn’t hesitate.

XRP Selling Pressure Hasn’t Really Gone Away

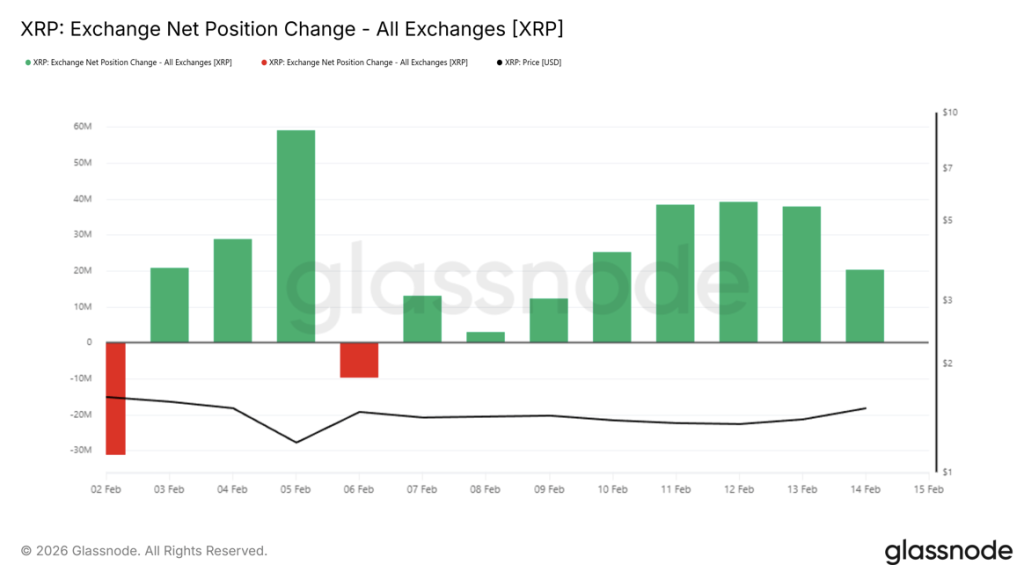

Despite the sharp move higher, exchange net position change data shows a familiar trend: XRP holders are still sending tokens to exchanges. On this metric, green bars represent inflows, which typically signal intent to sell. And right now, those inflows have stayed consistent, even during the rally.

That matters because it suggests this wasn’t a clean breakout fueled by strong conviction. Instead, it looks more like a spike that immediately triggered profit-taking. Outflows may dominate in some stretches, but the steady inflow behavior during rallies is a sign that investors are actively offloading XRP into strength.

When sellers keep showing up on every pump, it usually limits follow-through. It also tends to keep price trapped in a choppy range, where every upside move gets capped before it can turn into a real trend.

Short-Term Holders Are Controlling the Profit Pool

Another key signal comes from the MVRV Long/Short Difference metric, which tracks how unrealized gains are distributed between long-term holders and short-term holders. The current reading is low, meaning short-term holders are sitting on the larger share of profits right now.

And short-term holders don’t usually wait around.

They tend to sell quickly, especially after a sharp rally, because they’re not positioning for a long-term thesis. They’re positioning for the trade. That behavior likely played a big role in why XRP’s rally stalled so fast and why the candle ended with such a long wick.

As long as short-term profits dominate, XRP may keep running into repeated resistance. The market can push higher, sure, but it’s pushing into a crowd that’s eager to take gains the moment they appear.

XRP Price Faces a Tight Support-Resistance Battle

From a price action perspective, XRP’s latest session was strong, but also fragile. Nearly 18.7% up at the peak, then closing closer to +9% is basically the definition of early profit booking. The long wick is a visual reminder that bulls showed up, but they didn’t fully control the close.

Right now, the immediate goal is for XRP to hold $1.51 as support. Price is hovering just above that level at around $1.53, which puts it in a delicate spot. If $1.51 holds, the market has a foundation to build from. If it doesn’t, things can get sloppy quickly.

On the upside, resistance around $1.62 is the next major barrier. If short-term holders keep selling into rallies, that level could cap price again and trigger a pullback toward $1.36. That would keep XRP in a broader consolidation phase, even if the larger market remains supportive.

What Would Flip the Setup Bullish Again?

For XRP to regain real upside traction, the distribution needs to slow. If exchange inflows cool off and demand stays stable, the market could push higher without immediately getting smacked down by profit-takers.

A decisive break above $1.62 would strengthen the technical structure and signal that buyers are finally absorbing supply. If that breakout holds with follow-through, XRP could extend toward $1.76, which would invalidate the near-term bearish thesis and reinforce a recovery trend.

Until then, XRP is basically stuck in a tug-of-war. Bulls have momentum, but sellers still have the reflexes.