- XRP is holding above $2 but remains stuck in consolidation after a volatile month.

- ETF inflows could fuel the next major rally, though macro conditions still restrict upside momentum.

- The broader market needs economic improvement before XRP can realistically re-enter a strong bullish trend.

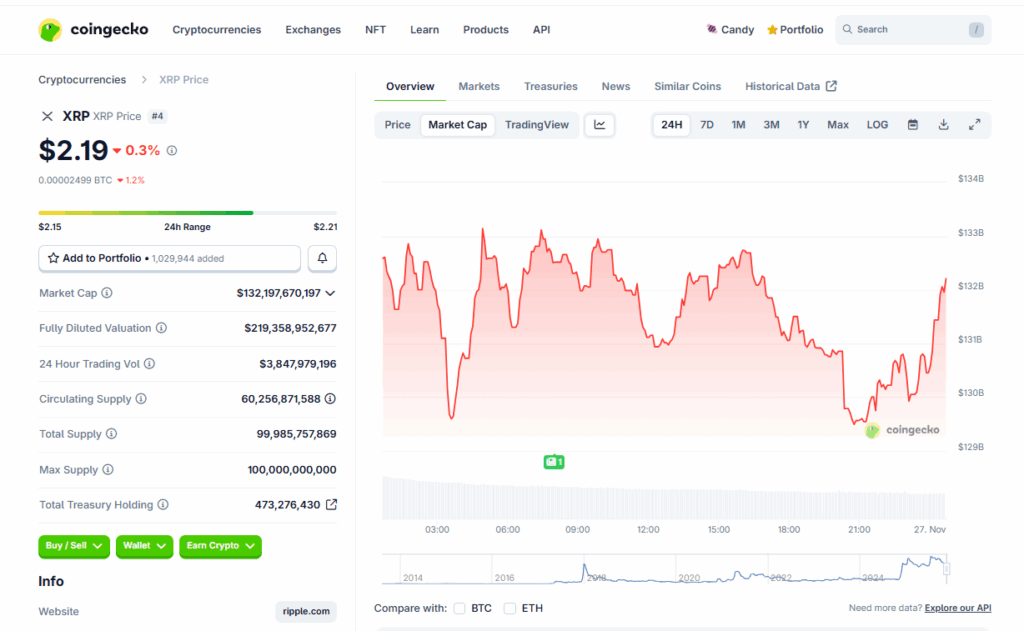

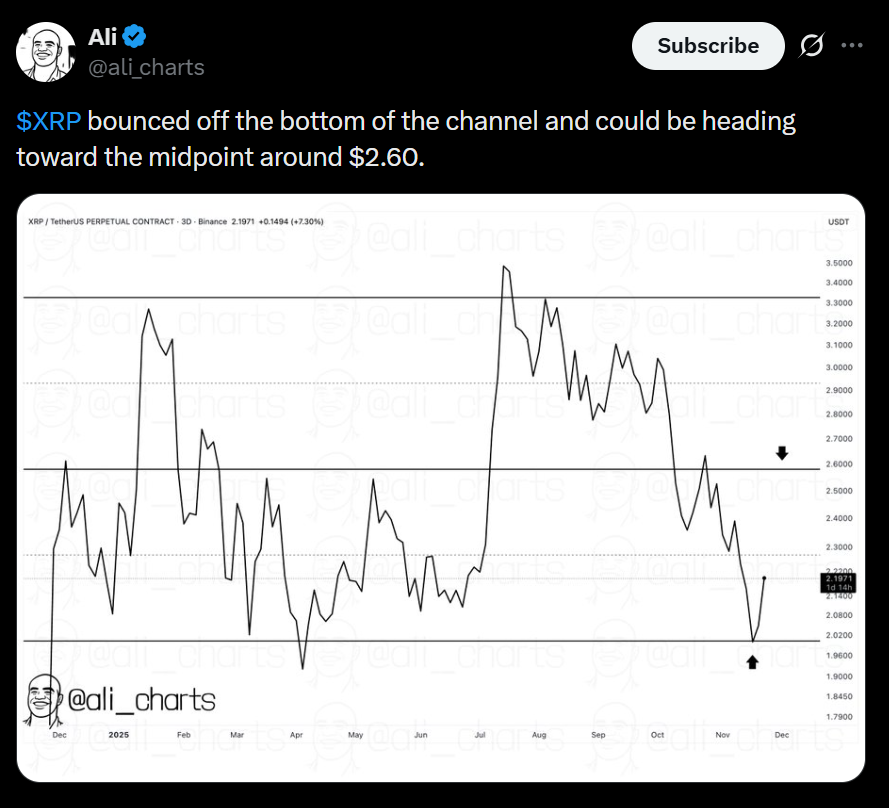

Ripple’s XRP token has managed to climb back over the $2 mark after sliding all the way down toward $1.80, giving holders at least a little breathing room. Even with that recovery, the chart still looks a bit mixed. XRP is up around 0.4 percent on the week, but the deeper time frames are still pretty red. Data shows the token dropping more than 2 percent in the last 24 hours, over 8 percent across two weeks, and more than 17 percent on the month. Even so, XRP is still up more than 51 percent since November 2024, which complicates the overall picture. The question now is simple: does XRP keep climbing, does it correct, or does the market just drift sideways for a bit?

Is XRP Ready for Another Leg Up?

Right now the broader crypto market looks like it’s drifting into a consolidation phase. Bitcoin, for example, has slowed down after reclaiming the $87K region, recovering from that quick dip toward $82K. XRP is showing something similar, hovering around that $2.20 to $2.25 band where buyers and sellers seem pretty balanced for the moment. Earlier this year, XRP was one of the standout performers across the entire market. It broke past the $3 level for the first time in about seven years and even managed to set a fresh all-time high. Most of that strength came after the long SEC lawsuit finally wrapped up, clearing a legal fog that weighed on the asset for years.

ETF Momentum Builds Behind the Scenes

One thing that could shift the tone again is ETF demand. XRP finally secured a spot ETF listing, something investors waited on for a long time. If those funds begin soaking up supply in any meaningful way, the price could respond fast. Still, macro conditions matter just as much. Economic growth looks sluggish, inflation is sticky again, and jobs data has been coming in higher than investors expected. All of that has pushed the odds of a 2025 rate cut way down, and without easier monetary conditions it’s harder for the entire crypto market to catch a real bid. In short, XRP has the ingredients for another strong move, but the wider economy may hold the final say.