- XRP trades around $2.43, down 16% this week, stuck between historic resistance and support.

- Technicals turn bearish — RSI below 50, MACD crossover, and widening Bollinger Bands.

- Holding $2.30 could spark a rebound to $3.00, while losing it risks a slide toward $1.80.

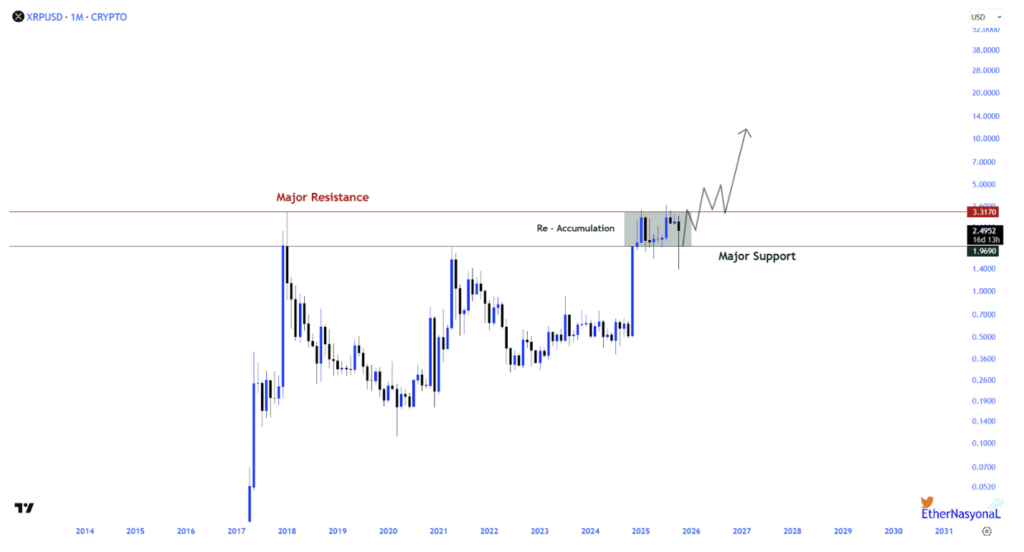

XRP seems stuck between two critical price zones — one that shaped its biggest rally back in 2017 and another that now decides whether history repeats or fades. Analyst EtherNasyonal pointed out that XRP’s current structure mirrors the 2017 setup, marking what could be the first real reaccumulation phase since that explosive run.

The 2017 peak at $3.30 now acts as the major ceiling, while the 2021 high near $1.96 forms a strong base of support. This area — often called the reversal zone — tends to attract long-term investors who bet on accumulation before a potential breakout.

At the moment, XRP trades around $2.43, down roughly 3% in 24 hours and 16% on the week. The bulls lost momentum at the $2.65–$2.70 resistance zone, and the bears are starting to take back control.

Technicals Show a Tired Market

Zooming into the weekly chart, XRP’s price action is tightening up — kind of like a spring waiting for either a pop or a breakdown. The Relative Strength Index (RSI) has slipped to 45.7, dropping below the neutral 50 mark — meaning sellers are clearly gaining traction.

The MACD paints the same picture: a fresh bearish crossover, the signal line now edging above the MACD line, and a red histogram that’s getting deeper. All of that points to fading buying pressure and mounting weakness.

Volatility’s creeping back too. The Bollinger Bands are stretching wider, with the upper band sitting near $3.55 and the lower one close to $1.96 — giving XRP plenty of room to swing either way. The 20-week EMA around $2.72 has flipped into resistance, while the 50-week EMA at $2.32 is the next defense line. If that breaks, eyes turn to the 100-week EMA near $1.80 for support.

Can XRP Hold the Line at $2.30?

Despite the short-term weakness, XRP’s midterm story still leans bullish — but only if it can defend that $2.30 support zone. A clean bounce here could easily push price back to $2.70, maybe even $3.00, if volume kicks in.

But a break below $2.30–$2.00 could send it sliding further, possibly down to $1.80 — where buyers will either step in or step away. Right now, the market feels quiet, almost too quiet, and that kind of stillness usually comes before a larger move.

The next few weeks might decide whether XRP keeps its uptrend alive or slips into a longer consolidation.