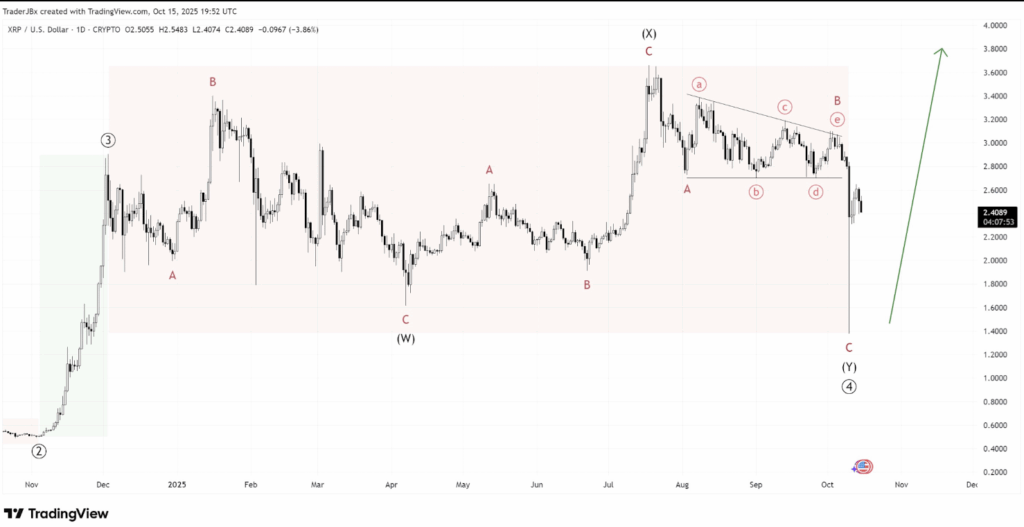

- XRP’s 10-month correction may be wrapping up, with signs of a potential shift toward bullish momentum.

- TraderJB sees two paths: a completed double-three correction or an extended triple-three that lasts into 2026.

- The key level to watch remains $2.80–$3.00 — a breakout there could confirm XRP’s next rally phase.

XRP’s been caught in a tug-of-war lately — bouncing back from early-October chaos but still struggling to reclaim that all-important $3.00 mark. Market strategist TraderJB thinks the token’s next big move is right around the corner, but which way it breaks will depend on how this long correction phase wraps up.

After plunging to around $1.50 during the October 10 selloff, XRP managed to claw back above $2.00. Since then, though, its momentum’s been muted. Every push higher gets swatted down near resistance, leaving traders wondering whether this is just a breather before liftoff — or the calm before another dip.

The W–X–Y Correction Nears Its End

According to TraderJB, XRP’s price action over the last ten months fits neatly into what’s known as a W–X–Y corrective structure — three distinct waves of decline, rebound, and consolidation. It’s been a long grind, each phase lasting roughly three to four months, as the asset worked off the excess from its earlier surge.

- Wave (W): From January to April, XRP tumbled from near $3.40 to $1.80.

- Wave (X): Between May and July, it bounced back sharply, reclaiming highs near $3.60.

- Wave (Y): Spanning August through October, the token mostly moved sideways before that brutal October crash.

That final selloff — the one that drove XRP to $1.50 — may have marked the end of the corrective pattern. TraderJB believes this low point likely completed the (4) wave within XRP’s larger market cycle. Interestingly, the drop flushed out a ton of leveraged long positions, potentially clearing the way for a healthier recovery.

Two Scenarios: Recovery or One More Dip

From here, TraderJB outlines two potential outcomes. The optimistic one says the correction is finished — a “double-three” pattern that paves the way for a fresh bullish leg. If that’s the case, XRP might finally be gearing up for its next upward impulse, especially if short positions start unwinding.

The more cautious scenario, though, is that the token still has a bit more work to do. In this version, XRP would carve out two smaller waves, (X) and (Z), forming what’s known as a “triple-three” correction. That would drag the consolidation out into mid-2026, delaying any meaningful rally until the pattern fully resolves.

For now, both paths are still in play. TraderJB leans slightly bullish, pointing out that structure and sentiment seem to favor an eventual upside breakout — but only if the token can clear key resistance near $2.80–$3.00.

What Comes Next for XRP?

At the moment, XRP trades around $2.38, stuck between heavy resistance overhead and solid support below. A strong move above $3.00 could signal that the market’s flipped in favor of buyers, kicking off a new rally cycle. But if it slips back under $1.50, that would confirm the correction isn’t quite done yet.

So far, XRP’s resilience has kept traders on their toes. Whether this is accumulation before the next breakout or just another leg in the correction — the next few weeks should make it clear. For now, all eyes remain glued to that $2.80–$3.00 zone, the level that could decide XRP’s fate heading into 2026.