- XLM retraced to the $0.42–$0.44 demand zone after a big run-up.

- Indicators still suggest bullish strength, but short-term charts show divergence.

- If Bitcoin stays stable, Stellar could bounce right back. If not… buckle up.

Stellar (XLM) has been showing serious strength lately. It just slid back into the $0.42–$0.44 zone—a level that’s drawn plenty of attention. This could be the end of the pullback… unless Bitcoin takes another tumble and drops under $116.8K. Then things might shift real fast.

After a wild 110% surge in just a week, it’s no surprise bulls are catching their breath. That kind of rally doesn’t go on forever without a breather. And as luck would have it, BTC dropped nearly 5% recently—from $123.2K down to $117.1K—pulling the whole market down with it, XLM included.

Bulls Still Hanging In, But Some Got Shaken Out

According to Coinalyze, sentiment is still pretty hot. Funding rates are positive, which usually means long traders are still confident. That said, XLM did drop around 10.6%, and about $20 million in open interest vanished. Sounds like a round of liquidations and maybe a bit of profit-taking up at that $0.51 resistance.

Spot CVD’s still climbing, though. That’s a good sign—it shows buyers haven’t thrown in the towel. This dip might not go very deep unless something bigger shakes up the market.

Daily Chart Still Leans Bullish

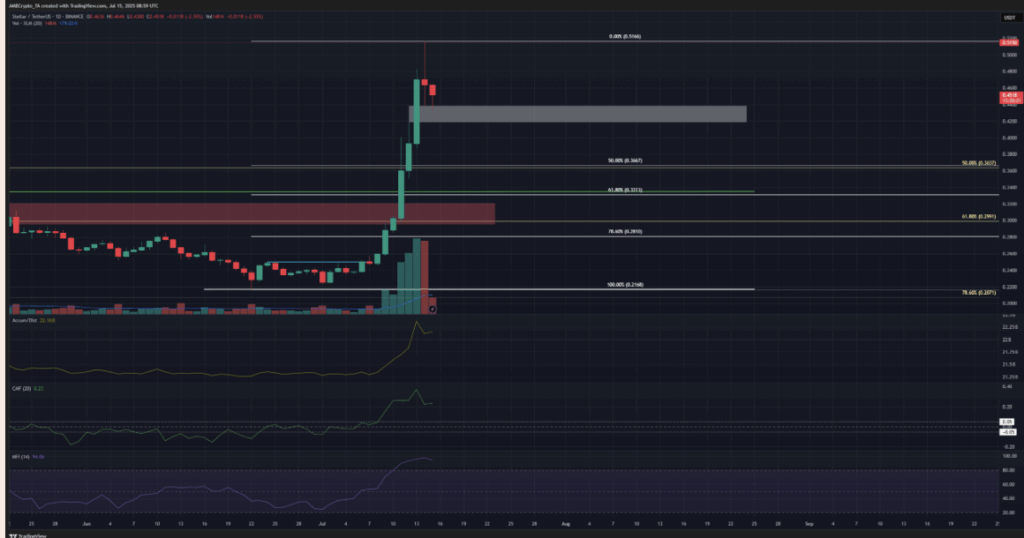

Zooming out to the 1-day chart, XLM’s setup looks solid. After breaking bullish on July 6th, the coin flew to $0.516 with heavy volume backing the move. Using Fib levels from the June 22nd low, we see that current price action is retesting a familiar support zone—the $0.42–$0.44 pocket that was left behind in the rush up.

Indicators are confirming strength too. The A/D line is still trending up, showing steady demand, and the CMF is sitting at +0.23, which is well above the line that usually flags real money flowing in. The Money Flow Index hit a crazy 97.7 recently—it’s cooled off a bit now, but still.

Short-Term Chart Flashes a Warning

Now, on the 4-hour chart, things look a bit shakier. There’s a bearish divergence between MFI and price—classic signal that a short-term pullback’s on deck. And sure enough, that’s what we got. XLM slipped to $0.43, and CMF cooled down to neutral too.

This little dip dragged prices back into a key demand area, and unless Bitcoin nosedives below $116K, bulls still have a shot to take back control. It’s not panic time—yet. But if BTC does break lower, all bets might be off.