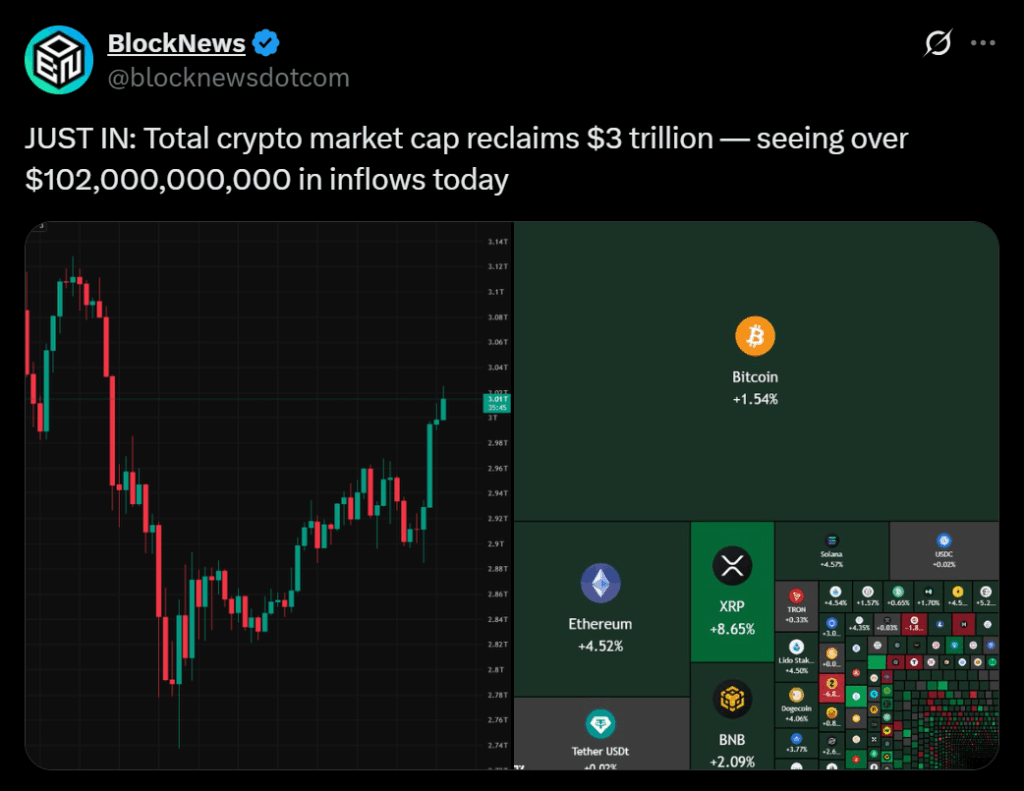

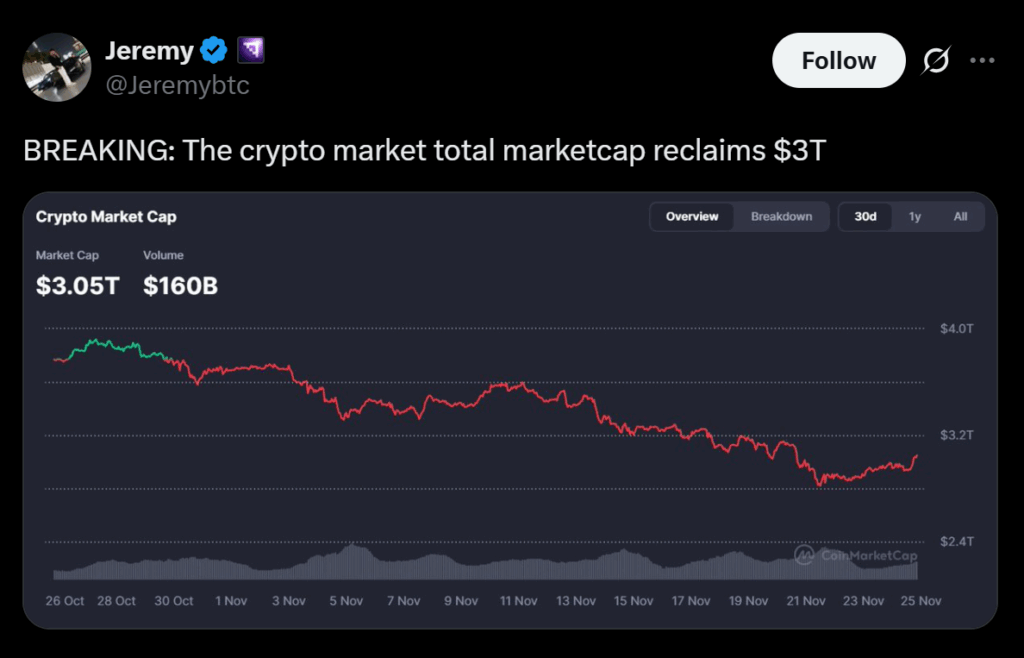

- Crypto market cap jumped back above $3T as $102B flowed in.

- BTC and ETH bounced as U.S. equities stabilized and ETF inflows returned.

- Sentiment is still in extreme fear, but fresh capital triggered a sharp relief rally.

Crypto markets finally caught a break today, with the total market cap reclaiming the $3 trillion mark after more than $102 billion poured back into the ecosystem in just a few hours. The sudden shift came after days of fear-driven selling, giving traders a much-needed reset as Bitcoin bounced toward the high-$88K range and Ethereum lifted off its lows.

Macro Stability Helps Bitcoin Catch a Bid

A big part of today’s bounce comes down to traditional markets calming down. Analysts pointed out that Bitcoin has been moving in lockstep with U.S. equity indices, and after a shaky week, those indices finally stabilized. That alone eased the pressure that’s been weighing on BTC since early November.

Even if the broader growth cycle still looks fatigued, the reduction in macro stress gave crypto enough space to rebound instead of spiraling into another leg lower.

ETF Demand Flips Positive Again

The real spark, though, came from renewed ETF inflows. U.S. spot Bitcoin ETFs brought in more than $238 million on Friday, reversing days of outflows. Ethereum ETFs also broke a brutal 10-day drought, pulling in $55 million.

That wave of institutional capital was enough to tilt sentiment away from despair and into cautious optimism. Fear remains extreme, but aggressive buyers clearly used the dip as an opportunity instead of a warning sign.

Why the Market Cap Reclaim Matters

Reclaiming the $3 trillion line isn’t just a round number—it’s a psychological shift. It signals that large players are still present, still accumulating, and still willing to buy when liquidity dries up. Today’s rally shows that despite the recent carnage, there’s real demand waiting just below the surface.