- Trump–Xi meeting signals potential trade de-escalation and market relief.

- Jim Cramer warns of crypto’s rising influence on traditional equities.

- Binance’s $400M initiative aims to restore user confidence and liquidity.

Crypto markets remained tense but active over the past 24 hours as traders navigated a mix of geopolitical developments, institutional moves, and shifting sentiment. With global leaders hinting at de-escalation and major exchanges stepping in to restore confidence, the day delivered equal doses of caution and optimism. So, let us take a closer look at what shaped the market action.

Trade Truce Hopes Lift Market Mood

The long-awaited meeting between Donald Trump and Xi Jinping in South Korea remains on schedule, calming fears of a full-blown trade rupture. Both Washington and Beijing signaled a softer stance, with Treasury Secretary Bessent hinting that the 100 percent tariff threat could be avoided. The diplomatic tone helped steady risk sentiment after weeks of turbulence driven by tariff threats and capital outflows.

Markets responded with cautious relief, though volatility lingered as new sanctions and cross-border policy uncertainty weighed on traders. Crypto assets mirrored traditional markets, with Bitcoin hovering near support and altcoins seeing selective recoveries.

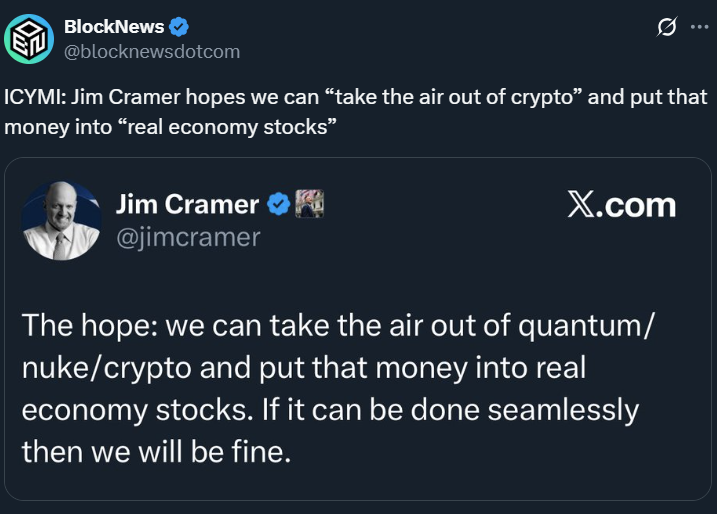

Cramer Calls Out Crypto’s Growing Grip on Wall Street

Market commentator Jim Cramer raised alarms about the increasing influence of crypto speculation over U.S. equities. His remarks followed a session where Bitcoin and the S&P 500 both slipped, underscoring how intertwined digital and traditional markets have become. Cramer’s warning highlighted what many analysts have been noting quietly — crypto sentiment is now a driver of stock market volatility, not a bystander.

While his caution drew attention, traders quickly revived the “Inverse Cramer” meme, suggesting his bearish tone might actually mark a local market bottom. Regardless of the jokes, the overlap between crypto and equities is deepening as more institutions hold digital assets on their balance sheets.

Binance Steps In to Rebuild Confidence

Binance rolled out a $400 million “Together Initiative” aimed at stabilizing post-crash conditions and restoring user trust. The plan allocates $300 million in token vouchers and $100 million in institutional loans to bolster liquidity and support ecosystem partners. The move signals a coordinated push by the world’s largest exchange to strengthen the market’s foundation during a period of lingering uncertainty.

Industry analysts view this as a significant step toward rebuilding confidence after recent volatility. By focusing on both retail and institutional recovery, Binance positions itself as a stabilizing force at a time when sentiment remains fragile. The initiative could mark an important turning point for liquidity and participation as the industry looks to recover lost ground.

Final Thoughts

To conclude, the past 24 hours showed a market still on edge but increasingly resilient. Between geopolitical progress, shifting investor psychology, and major players taking initiative, crypto continues to mirror global finance more closely than ever. Overall, the next moves by policymakers and exchanges could define whether this rebound becomes sustainable or fades into another relief rally.