- Vitalik Buterin cautioned the Zcash community that token-based voting could shift power to whales and slowly weaken core privacy values.

- Community members remain divided, arguing over committee rigidity versus market-driven governance risks like plutocracy.

- The debate intensifies as Zcash regains market attention, making upcoming governance decisions more impactful than usual.

Ethereum co-founder Vitalik Buterin is urging the Zcash community to rethink its direction on governance, warning that adopting token-based voting could undermine the very civil-liberty principles the project was built to defend.

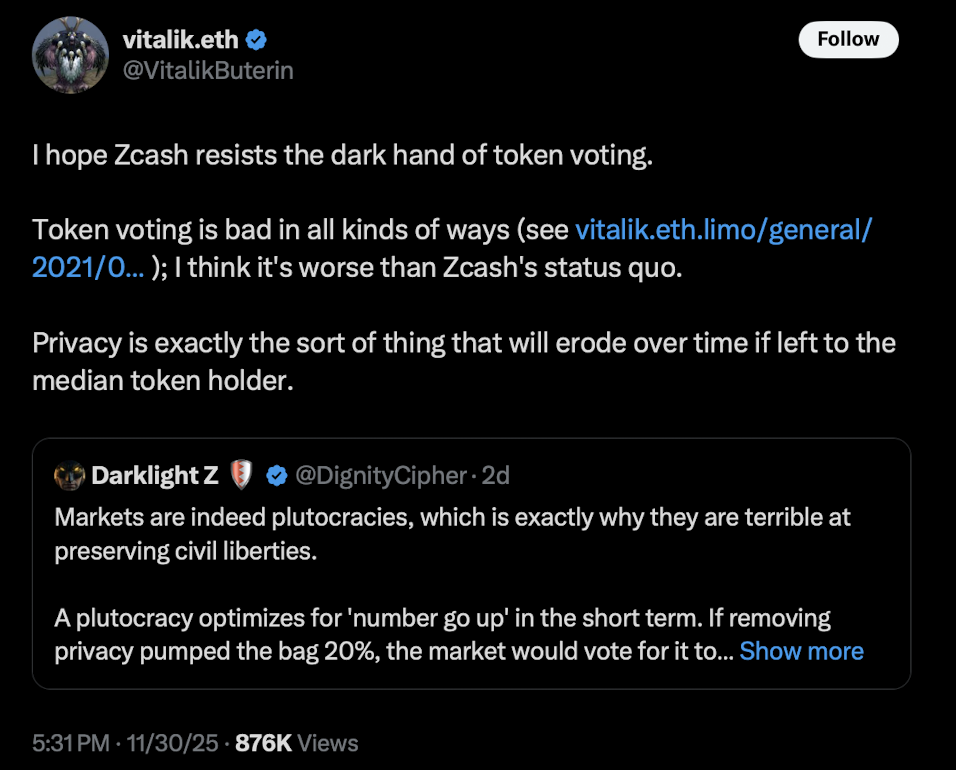

In a November 30 post on X, he argued that token voting naturally pushes any system toward short-term price incentives, not long-term values like privacy and censorship resistance.

Vitalik flags deep risks baked into token-weighted governance

Buterin tied his comments back to a 2021 essay where he explained the core vulnerabilities of token-weighted systems. One of the biggest issues, he said, comes from unbundled rights, which make covert vote-buying not only possible, but pretty easy to hide.

He also emphasized how these systems inevitably concentrate power in the hands of whales, leaving smaller token holders with almost no real accountability. Many smaller voters may simply “vote and forget,” especially if they feel their individual vote barely matters.

Vitalik didn’t soften his view: he called token voting “bad in all kinds of ways,” adding that it would likely be worse than Zcash’s current structure.

“Privacy is exactly the sort of thing that will erode over time if left to the median token holder,” he warned.

His remarks arrive as Zcash struggles with a bigger question — how to select its Zcash Community Grants Committee, a five-member body responsible for approving major ecosystem grants.

A community split on how decentralization should work

Many Zcash community members argue that the existing committee-based approach feels outdated.

Helius CEO and Zcash supporter Mert Mumtaz said the debate reflects a much broader governance issue. According to him, markets naturally punish bad decisions through falling token prices, shifting influence, and updating collective knowledge. Committees, he argued, don’t have that feedback loop and can remain completely disconnected from the consequences of their decisions.

He compared this disconnect to what Nassim Nicholas Taleb calls the “interventionista” — a bureaucrat making high-impact decisions without sharing any of the risks. In contrast, he noted that ancient Roman generals made decisions from the battlefield, not from behind a desk.

While Mumtaz is aware token voting has flaws, he believes static committees are even more problematic because they become “uncriticizable and account to no one.” Markets evolve, he said — committees rarely do. “Evolution wins long-term.”

Other community voices echoed related concerns.

- Naval, a user on X, warned that introducing overseers — even independent ones — creates systemic security vulnerabilities.

- Darklight argued that market-driven systems tend to drift into plutocracy, which can also fail to protect civil liberties over time.

A pivotal debate as Zcash regains market attention

This governance dispute is unfolding right as Zcash attracts renewed interest from traders and researchers. That timing raises the stakes even more — because whatever system the community settles on next could influence how Zcash evolves for years to come.

Here is where the community must choose between imperfect models, each with very different consequences for its future.