A study by crypto trading platform Bitfinex and the blockchain data firm Chainalysis has shown that crypto holders trust centralized exchanges more than decentralized finance (DeFi) protocols, given the growing threat of attacks on the latter.

Centralized Exchanges Platforms Double-Down On Security

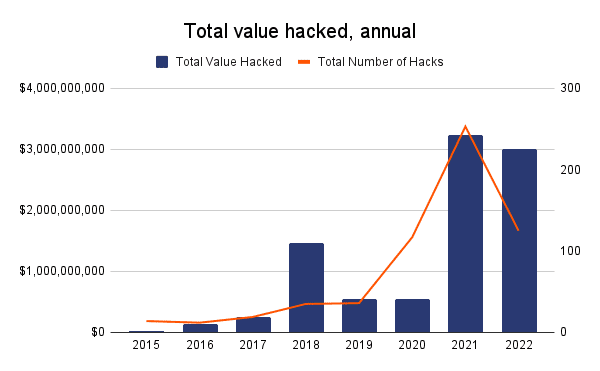

2022 is set to be the biggest year for hacking, given the spate of code exploits and security breaches that have been witnessed on DeFi protocols. The decentralized nature of DeFi networks provides hackers with open access to code that reveals the underlying vulnerabilities. In fact, over the last couple of months, the intensity has increased to a level where this year may record the highest losses.

October alone has become the biggest month ever concerning DeFi protocol exploits. According to a Chainalysis report, approximately $720 million have been lost in 11 different hacks over the last two weeks, with as many as four occurring on the same day, on October 13.

The blockchain data firm posted the following chart on Twitter, saying, “At this rate, 2022 will likely surpass 2021 as the biggest year for hacking on record.” According to the chart, hackers have made way with over $3 billion across 125 hacks in 2022, with about three months remaining.

A Bloomberg crypto market analyst Sunil Jagtiani reacted to the Chainalysis report saying that despite digital currencies crashing this year, they have remained a consistent cash machine for hackers. He added that DeFi protocols are mainly targeted as hackers exploit their security, coding, and structural weaknesses.

Within DeFi, a particular area is being targeted, explained Chainalysis:

“Cross-chain bridges remain a major target for hackers, with three bridges breached this month and nearly $600 million stolen, accounting for 82% of losses this month and 64% of losses all year.”

Contrastingly, centralized exchanges (CEX) have invested heavily in defenses to protect their users’ investments. According to a commentary by Bitfinex, most CEXs have put in place “stringent secure operating systems standards and audited third-party security system checks” such as Two Factor Authentication (2FA), distributed denial-of-service (DDoS) protection, and regular systems testing to guard against possible vulnerabilities. Additionally, exchanges have advanced their firewalls and intrusion detection systems to arm themselves against potential threats.

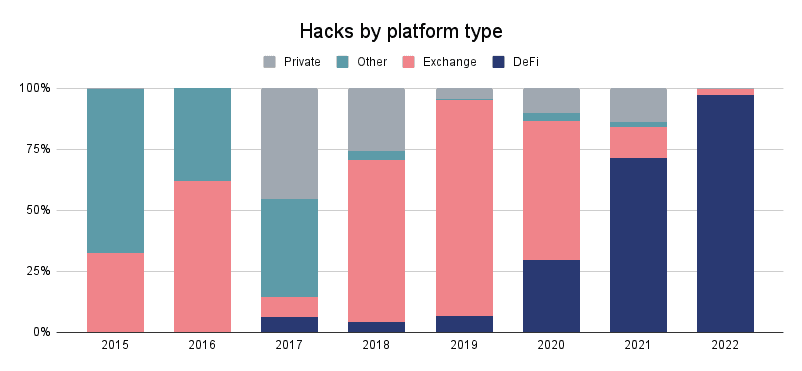

The Chainalysis report noted the significant reduction in the scale of exploits CEXs which mainly were targeted between 2018 and 2020, peaking at about 80% of all hacks in 2019. At the same time, the total value stolen from centralized exchanges has dropped by about 58%, from a record high of $952 million in 2018 to about $413 million in 2021.

Besides the recent incident where hackers took off with $100 million BNB from the Binance Smart Chain (BSC), 2022 has witnessed only about $80 being taken from CEXs. This differs from DeFi, which now accounts for more than 97% of losses.

Bitcoin Balances For CEXs Remain Near Record Highs

According to data from Chainalysis, year-end BTC balances for centralized exchanges are still close to all-time highs in 2022, despite the crypto winter. This indicates that users are comfortable storing their crypto on these platforms. YTD Bitcoin balances for CEXs stand at 6.9 million, an 11% increase from 6.2 million at the end of 2019.

“[This] point[s] to the increasing resilience of centralized exchanges against hackers. While we always advise cryptocurrency users to take security into their own hands by taking steps such as holding tokens in cold storage or using a hard wallet device, the custody solutions deployed by centralized exchanges have advanced considerably in recent years”, said Paolo Ardoino, CTO at Bitfinex.

Despite the bear market conditions, Chainalysis observed several days in June when more than 1 million unique wallets sent funds to exchanges. This number was hovering around 800,000 in the recent past.

Acknowledging these investor activities, Director of Research at Chainalysis Kim Grauer said:

“Specifically, HODLers are holding, and if anything, we saw an increase in the accumulation of crypto by longer-term holders. Much of this crypto is being held on centralized exchanges.”

The confidence the “hodlers” have in centralized exchanges has been driven by the performance of these platforms in times of extreme market conditions. CEXs have generally remained stable, although high liquidity remands seen some struggle.