- The UK introduced draft legislation to regulate crypto firms under traditional finance rules.

- Talks with the U.S. are underway to create a shared regulatory framework for digital assets.

- A full Financial Services Growth Strategy will be unveiled in July to strengthen the UK’s fintech leadership.

The UK government just dropped a sweeping draft bill aimed at tightening up crypto regulations, pushing digital asset firms under the same heavy-duty standards as banks and other traditional finance players.

Announced on April 29 during London’s UK Fintech Week, the move is a big part of the country’s “Plan for Change” economic strategy, zeroing in on boosting financial stability, protecting investors, and making markets more transparent.

New rules for crypto companies

Under the new proposal, cryptocurrency exchanges, wallet providers, and other crypto service shops will fall under the same regulatory rules that apply to old-school finance. They’ll need to meet strict standards around transparency, operational strength, and — crucially — consumer protection. The idea is to clamp down on fraud, prevent shady market moves, and better protect retail investors, who’ve been flooding into the digital asset space lately.

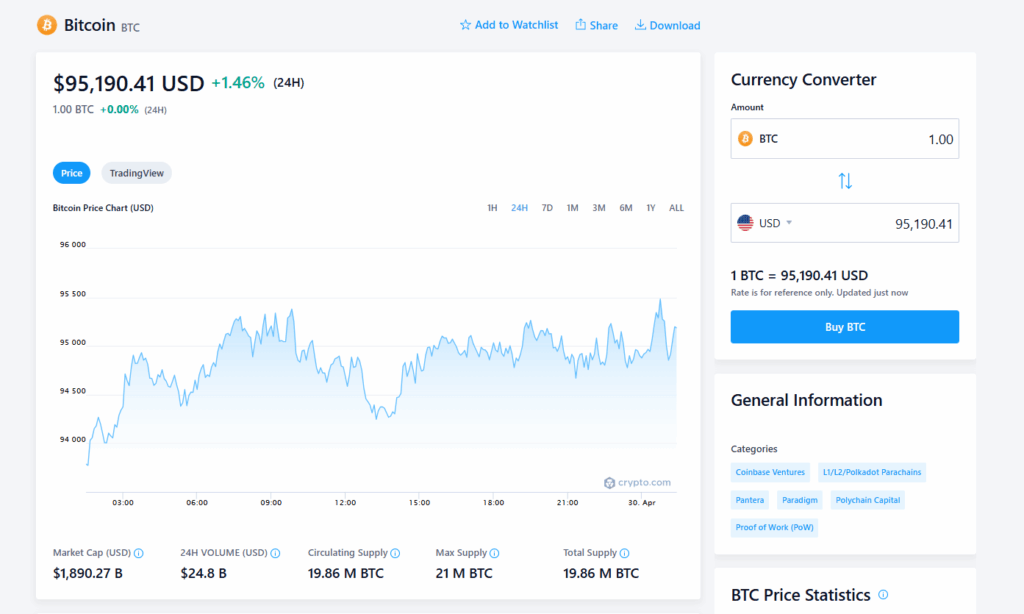

Quick stat: about 12% of UK adults now own crypto like Bitcoin or Ethereum — a number that shows just how mainstream this space has gotten.

The Financial Conduct Authority (FCA) had already started laying groundwork for crypto oversight, but this new draft ties it all into one big, unified framework. It’s clear the goal is to bring crypto companies into line, no more skating by under looser rules.

UK teams up with the US on shared standards

Chancellor Rachel Reeves also announced that the UK is teaming up with international partners, including the U.S., to hammer out shared standards for crypto regulation. Talks have kicked off with U.S. Treasury Secretary Scott Bessent about building a “transatlantic sandbox,” basically a safe testing ground where firms can innovate across borders under coordinated rules.

Reeves stressed that bad actors trying to dodge regulations will be dealt with firmly. The bigger picture? Make global investors more confident while keeping the crypto industry growing in a healthy, sustainable way.

What’s coming next for crypto regulation

Looking ahead, the UK plans to roll out a Financial Services Growth and Competitiveness Strategy on July 15. This blueprint will lay out long-term goals for fintech and other financial sectors, as the UK looks to lock in its spot as a world leader in financial innovation.

This new legislative push builds on years of groundwork too. Back in 2024, the UK proposed recognizing crypto and NFTs as legal property — a move aimed at helping courts handle asset recovery and boost digital asset protections. The FCA also outlined a phased plan to fully regulate stablecoins and crypto lending by 2026.

Bit by bit, the UK is making it crystal clear: crypto isn’t some wild frontier anymore — it’s being woven into the heart of the financial system.