- Trump-linked American Bitcoin is eyeing acquisitions in Japan and Hong Kong to expand its BTC treasury, mirroring Michael Saylor’s playbook.

- The firm, founded by Donald Jr. and Eric Trump, already holds 215 BTC and recently raised $200M to scale its mining and accumulation efforts.

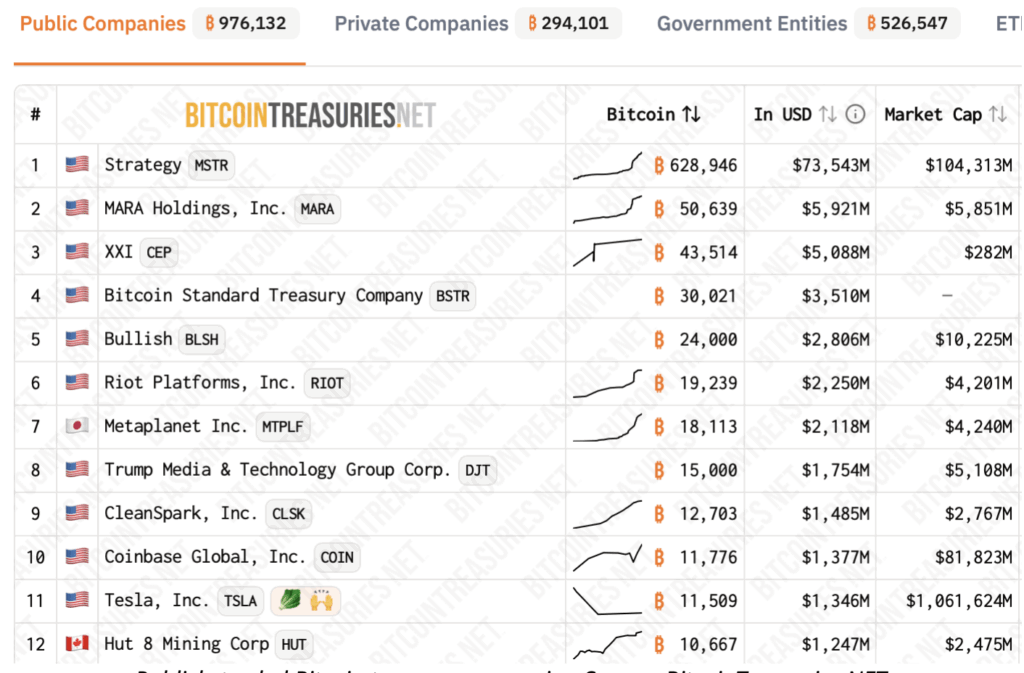

- Public companies now hold nearly 1M BTC (~$115B), tightening supply and reinforcing Bitcoin’s scarcity narrative in an inflationary environment.

American Bitcoin, the mining company tied to the Trump family, is making bold moves. Reports from the Financial Times suggest the firm is exploring acquisitions in Asia—specifically in Japan, and possibly Hong Kong—as it looks to supercharge its Bitcoin buying spree. The strategy seems to mirror Michael Saylor’s playbook, with Strategy now sitting on nearly 629,000 BTC worth close to $74 billion.

Building the “Strongest Bitcoin Platform”

The company has made its ambition clear: it wants to build “the strongest and most efficient Bitcoin accumulation platform in the world.” While no deals are locked in yet, the intent signals how aggressively American Bitcoin plans to scale. Founded by Donald Trump Jr. and Eric Trump, the firm already grabbed headlines earlier this year by merging with Gryphon Digital Mining to land a Nasdaq listing.

Treasury Stacking and $200M Raise

Since June, American Bitcoin has been stacking its treasury, holding 215 BTC as of June 10. Just weeks later, it raised $200 million to add even more Bitcoin and beef up its mining infrastructure. Clearly, the Trump-linked venture is moving fast to join the ranks of corporate giants piling into the asset.

Corporate Bitcoin Accumulation Heats Up

And they’re not alone. Strategy just added another 155 BTC to its pile this week, while Japanese firm Metaplanet scooped up 518 BTC, lifting its stash to more than 18,000 coins. According to BitcoinTreasuries.net, public companies now collectively hold nearly 1 million Bitcoin—worth about $115 billion. Private firms add another 294,000 BTC to that mountain.

Scarcity Narrative Grows Stronger

With only 21 million Bitcoin ever to exist, this relentless corporate accumulation keeps tightening supply. In a world where inflation and currency debasement keep making headlines, the scarcity narrative is only getting stronger. The bigger question now—how many of the remaining coins will end up locked inside corporate vaults?