- TRUMP has fallen 90% since January, now down to single-digit price levels.

- A Fed rate cut could revive appetite for risk assets like TRUMP.

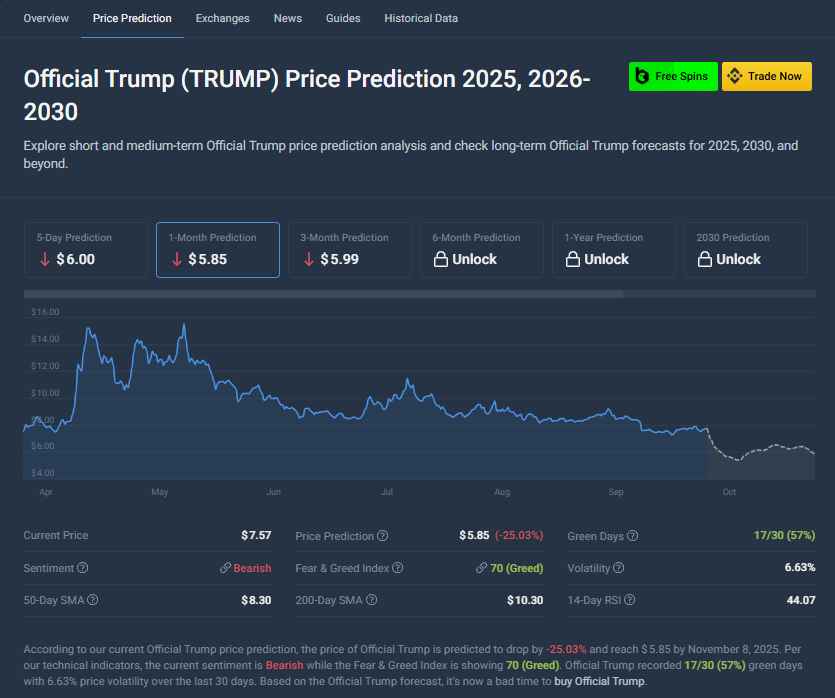

- Analysts remain cautious, with CoinCodex forecasting a further 28% decline.

Trump Coin (TRUMP), the Solana-based cryptocurrency launched just before Donald Trump’s inauguration as the 47th U.S. President, became one of the most talked-about meme tokens at the start of 2025. The token soared to an all-time high of $73.43 on January 19, the day Trump officially took office. However, what followed was a brutal correction.

Since that peak, TRUMP has fallen nearly 90%, with the token now trading deep in the red. According to CoinGecko, TRUMP is down 13% over the past month and 1.7% in the last week, though it managed slight rebounds of 0.8% daily and 0.7% biweekly. For many investors, the question now is whether this political token has any real comeback potential — or if the hype cycle has finally run its course.

Why TRUMP Is Struggling

The steep decline in TRUMP’s price is closely tied to fading enthusiasm around President Trump’s trade and economic policies, which many investors believe contributed to the weakening U.S. dollar. As the dollar slipped, investors began seeking safer havens like gold, pulling liquidity away from speculative markets such as cryptocurrencies.

Broader crypto market weakness has also amplified TRUMP’s decline. Profit-taking, global rate uncertainties, and low risk appetite have weighed heavily on meme tokens. In short, TRUMP’s struggles aren’t just about politics — they reflect a wider investor retreat from high-volatility assets.

The Case for a Possible Recovery

Despite the deep correction, some catalysts could help TRUMP find a floor. Analysts point to the Federal Reserve’s expected interest rate cut, which could drive risk-on sentiment across markets. A looser monetary policy often pushes capital back into crypto, and meme tokens like TRUMP could see renewed speculative inflows.

Moreover, the token continues to benefit from brand recognition and political association — two factors that tend to amplify volatility but also create room for fast rebounds when sentiment shifts. If market confidence returns in Q4, TRUMP could follow the broader altcoin recovery trend.

Analyst Outlook: More Pain Before a Bounce

Not everyone is optimistic. CoinCodex analysts predict further downside, expecting TRUMP to fall to $5.47 by October 19, representing another 28% drop from current levels. While this paints a short-term bearish picture, it also suggests that a retest of lower support zones could precede a potential relief rally heading into late 2025.

Final Thoughts

Trump Coin’s decline shows how hype-driven assets can swing dramatically in a short time. Still, with the Federal Reserve poised to stimulate markets and political tokens retaining cultural momentum, TRUMP may not be entirely out of the race. Whether it rebounds or fades into meme history will depend on timing, liquidity, and investor sentiment heading into the next wave of market volatility.