- Trump reportedly feared his tariff plan could spark a depression, prompting a partial rollback to avoid economic collapse.

- Bond market turmoil and rising yields added pressure, pushing Trump to ease tariffs faster than planned.

- Treasury Secretary Scott Bessent and mounting global trade talks influenced Trump’s decision to shift course.

President Donald Trump, despite pushing a hardline tariff policy, was reportedly worried it might crash the U.S. economy — not just into a recession, but something worse. According to a Wednesday report from The Wall Street Journal, Trump privately told folks close to him that he didn’t want to trigger a full-blown depression.

That said, he was prepared for some “pain” to come from the policy. One person who spoke with him earlier this week told the Journal the president accepted that hardship would be part of the process. But not to the extent of a 1930s-style collapse.

Economists define a depression as a particularly nasty downturn — prolonged, deep, and usually paired with soaring unemployment. Thanks to modern monetary tools and policies (plus the safety net stuff like FDIC insurance), the U.S. hasn’t gone through one since the Great Depression. And while Trump’s tariff spree had some experts forecasting a recession, no one was really saying we’d hit depression levels… not yet, anyway.

Markets Panic, Then Rebound on Reversal

In the days leading up to Trump’s partial reversal, things got messy. Bond yields spiked, stocks nosedived. On Tuesday night, the 10-year Treasury yield blew past 4.5%, sparking rumors that a major holder — maybe China or Japan — was offloading U.S. bonds. Prices dropped, yields surged (yep, that’s how that works), and the alarm bells rang.

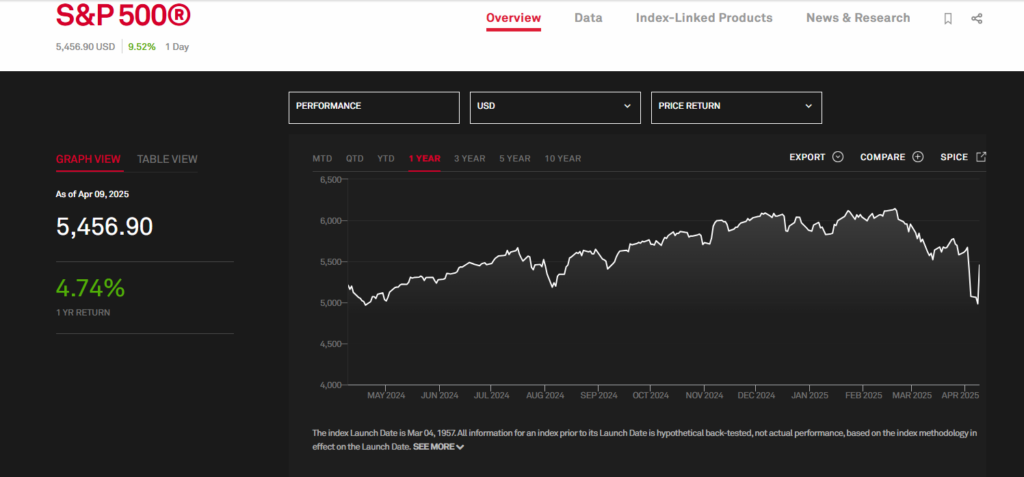

By Wednesday, Trump hit pause. His rollback of some country-specific tariffs breathed life back into the markets. The S&P 500 had its best day since 2008. Wild.

Kevin Hassett, who heads up the National Economic Council, told CNBC the bond market chaos was a big factor. “It made it… more urgent,” he said on Squawk Box. “But it was going to happen either way.”

“A Little Yippy”

Trump himself addressed the panic after the fact, suggesting people had overreacted. “They were getting a little yippy, a little bit afraid,” he said. Investors were spooked, but maybe too spooked for his liking.

According to sources cited by the Journal, a few things nudged Trump toward backing off: a growing list of countries willing to talk trade and the increased influence of Treasury Secretary Scott Bessent in shaping strategy.

The White House didn’t comment on the report, but at this point, it’s clear — Trump’s tariff crusade may have hit a wall. Whether it’s a tactical pause or a full pivot remains to be seen.