- TRX is holding above former resistance near $0.300, signaling strength

- Price structure favors continuation with $0.32 as the key level to flip

- Long positioning and rising active addresses support a bullish short-term outlook

TRON is showing a bit more backbone than most right now. After pushing higher earlier this week, TRX didn’t fade or rush to give back its gains. Instead, price settled into a higher range, with buyers quietly stepping in and absorbing supply. That kind of behavior usually hints at growing confidence, at least in the short term.

TRX Holds Its Ground as Buyers Stay Active

While momentum across the broader market remains selective, TRX continues to attract capital that appears willing to stick around. This isn’t the usual hit-and-run flow. The token has managed to hold above the former resistance zone near $0.300, a level that capped price action for months. Now, it’s acting more like a base, which points to rising demand rather than short-lived positioning.

To see whether this shift has legs, it helps to look beneath the surface. Both the technical structure and on-chain signals are starting to line up in TRON’s favor.

Price Structure Signals a Continuation, Not a Bounce

TRX’s recent move suggests it has transitioned out of consolidation and into a recovery-driven expansion phase. After spending months trapped below a descending trendline, price finally pushed through multiple resistance layers. That kind of breakout usually carries more weight than a simple relief rally.

The $0.32 area is now the key zone to watch. It previously acted as resistance, and TRX is currently testing whether it can flip that level into support. A clean hold above it would open the door to a move toward $0.3680, roughly a 20% upside from current levels. As long as price stays above the breakout base, the structure favors continuation over exhaustion. Still, a drop back below $0.30 could invite profit-taking and pull TRX toward the $0.2900 region.

On-Chain Metrics Point to Growing Participation

On-chain data adds another layer of support to the bullish case. According to Coinglass, positioning is leaning heavily long. Around 63% of accounts are currently holding long positions, compared to just 37% on the short side. That creates a long-to-short ratio near 1.76, a clear sign that traders are leaning optimistic.

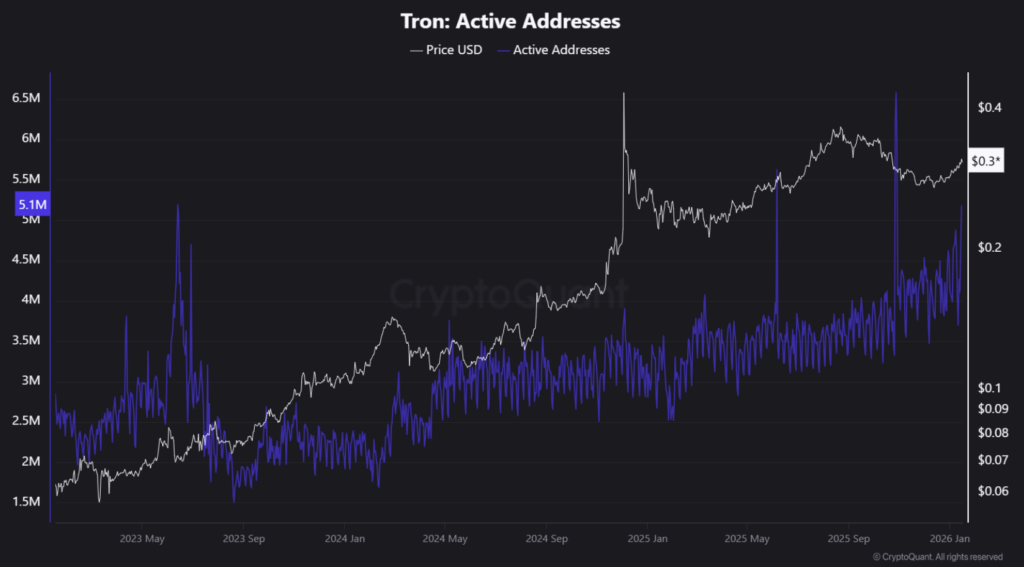

Beyond derivatives, network activity is picking up as well. The number of active addresses is climbing, and more importantly, many of those addresses are holding balances. That suggests real participation is increasing, not just speculative churn. As network engagement expands, it tends to reinforce demand, giving TRX’s price action a stronger foundation.

If this trend holds, TRON could be setting up for further gains, though short-term pullbacks are always part of the process.