- BitMine Immersion added 200,000 ETH ($800M) during last week’s crypto correction.

- The firm now holds 3.24M ETH worth over $13B — about 2.7% of total supply.

- Thomas Lee says the correction offers a “strong risk/reward” as others retreat.

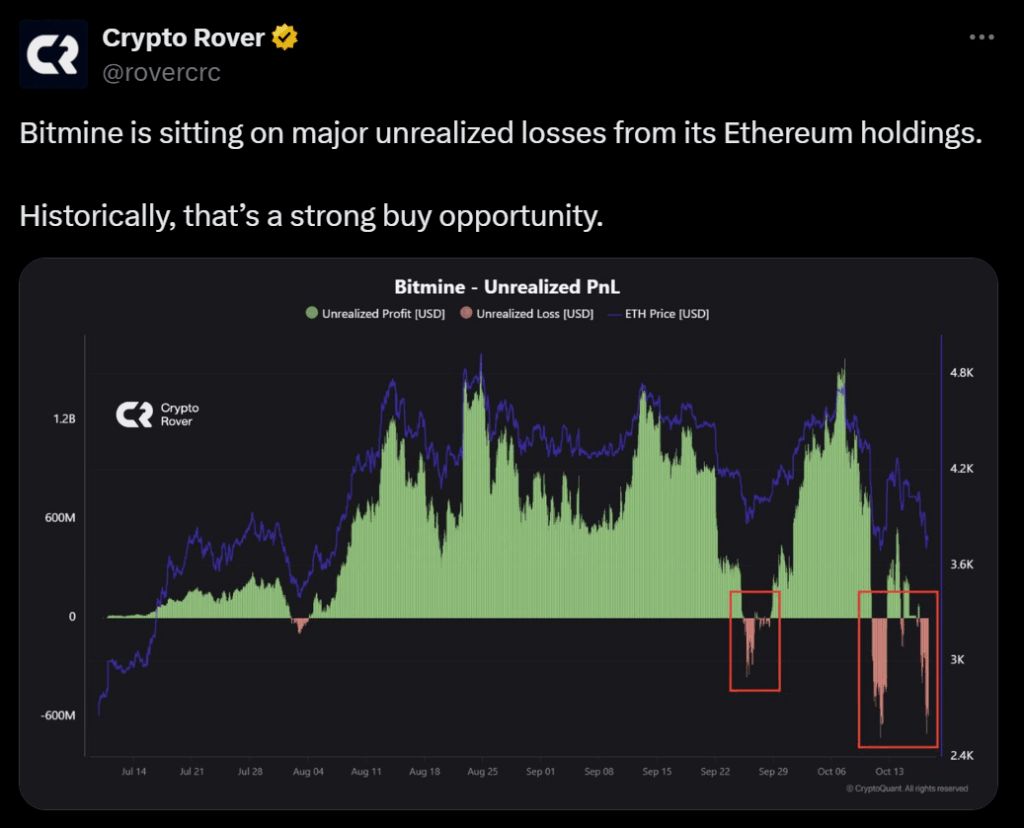

While most of the market was reeling from the recent crypto correction, BitMine Immersion Technologies saw an opportunity. The Ethereum-focused treasury firm, led by Fundstrat’s Thomas Lee, snapped up more than 200,000 ETH last week — about $800 million worth — continuing its aggressive accumulation strategy. The move brings BitMine’s total holdings to an impressive $13.4 billion across crypto, equities, and cash, with the bulk of that locked in ether.

Massive Ether Position Builds Momentum

After the latest purchase, BitMine’s ETH stash now stands at roughly 3.24 million tokens, valued at just over $13 billion. That represents about 2.7% of Ethereum’s total supply, with Lee noting the company’s long-term goal of reaching 5%. Beyond its massive ETH reserve, BitMine also holds $219 million in unencumbered cash, 192 BTC worth over $21 million, and $119 million in equity via Eightco Holdings (ORBS). As crypto prices bounced slightly over the weekend, BitMine’s stock climbed 8%, reflecting growing investor confidence in its accumulation play.

Buying the Dip With Conviction

Thomas Lee called the latest crypto pullback a “buying opportunity,” saying the recent “price dislocation represents an attractive risk/reward.” In just two weeks, BitMine added roughly $1.6 billion in ETH during the downturn that culminated in the sharp selloff on October 10. While other digital asset treasuries paused or even sold holdings, BitMine leaned in — effectively positioning itself as Ethereum’s largest institutional accumulator. The move signals that Lee’s team views short-term volatility as background noise in a long-term bullish thesis for ETH.

Digital Asset Treasury ‘Bubble’ May Have Burst

Interestingly, Lee also suggested that the “bubble” in digital asset treasury firms might have already popped. Many recently launched companies, he said, are now trading below the net asset value of their crypto holdings. BitMine, however, remains one of the few still trading at a slight premium according to Blockworks data — a sign that investors still see it as a trusted institutional proxy for Ethereum exposure. Whether the buying spree continues may depend on how ETH performs in the coming weeks, but BitMine’s conviction is clear: dips are for accumulating.