- Retail is back, but smarter. Coinbase app rankings jumped 65% and crypto apps are seeing real user growth—but this feels more measured than the wild November 2024 rush.

- Institutions are still the heavy lifters. Bitcoin ETFs pulled in $14.8 billion in 2025 alone, and that institutional backbone is creating a steadier foundation for retail to build on.

- This rally has better bones. With easier access through ETFs, better apps, and actual regulatory progress, we’re seeing sustainable growth instead of boom-bust cycles.

It’s that familiar buzz again. We’re seeing evidence retail crypto interest is rekindling—echoing the energy we felt in November 2024 when Bitcoin soared into record territory. But this time around, things feel different—more thoughtful, less frenzy-driven.

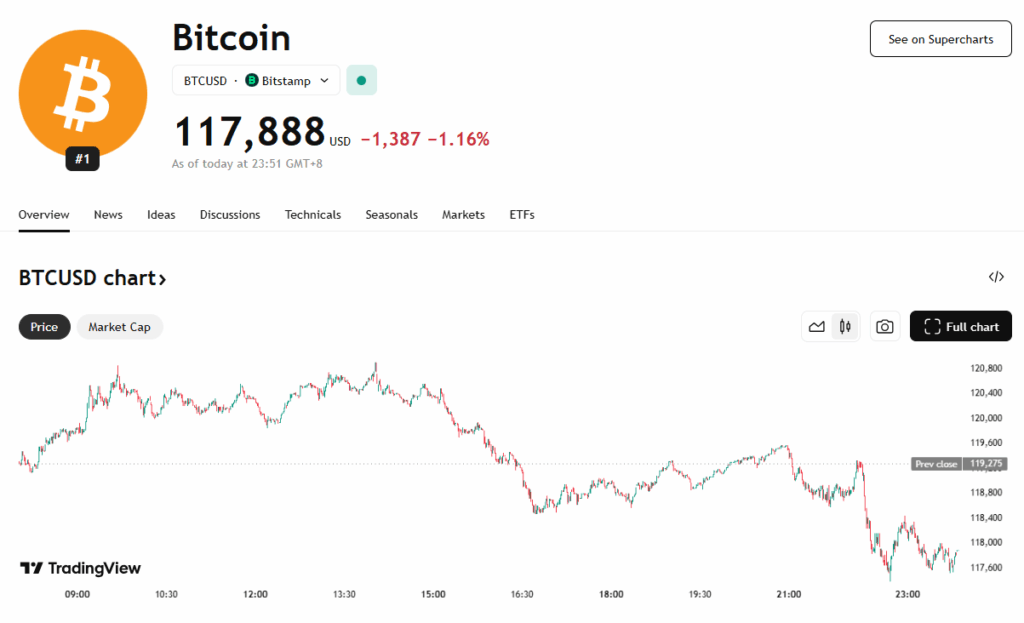

Take the Coinbase app, for example. It recently jumped from position 386 to 162 in Apple’s finance charts—a dramatic 65% surge in rankings that aligns closely with Bitcoin’s recent price gains. Historically, such leaps in app store popularity have been reliable signals of renewed retail activity, usually foreshadowing bullish phases. Yet, the tone is more measured now—early signals of life, not mass hysteria.

Institutions Are Still Driving the Bus

Under the surface, institutional players are still in full swing, carrying much of the burden. Bitcoin spot ETFs have absorbed roughly $14.8 billion in fresh capital in 2025—a level matching or exceeding last year’s totals. More importantly, these ETFs just broke last year’s pace, signaling that big money remains firmly committed.

Still, the retail return isn’t silent—though it’s arriving via more regulated, accessible channels. Apps, spot ETFs, and sleek wallet experiences are lowering friction, making it easier for everyday folks to step in. Add in the momentum from U.S. legislation—like the Genius Act and other crypto-forward bills—and there’s a regulatory tailwind that boosts both confidence and comfort.

A Different Kind of Rally

This environment feels bullish because it’s building a broader, deeper foundation under the market. When both institutions and casual investors are active, liquidity improves and volatility often smooths out. One-day price shocks lose some punch when there’s balanced engagement across segments. Plus, onramps through ETFs and retail apps are simplifying access—fractional purchases of BTC or ETH, instant app buys, no unfamiliar tech required.

We’re seeing this shift take root. App engagement spikes, ETF inflows continue, and corporations are starting to add crypto to their balance sheets in small but growing ways. That intersection of retail enthusiasm and institutional backbone marks a different kind of rally—less boom‑and‑bust, more compound-and-grow.

What to Watch Right Now

Which coins are worth watching right now? Bitcoin still leads—its ETF flows and mainstream adoption make it the anchor asset. Ethereum is gaining power too, with record inflows into ETH spot ETFs—$727 million in a single day recently, and $2 billion since early July—and rising utility from DeFi and staking. Beyond those, keep a close eye on Layer-1 alts like Solana, Cardano, and XRP—projects tying user-friendly tech to real-world use cases. Lastly, ecosystem enablers like social trading platforms, UX-first wallets, and DeFi tooling could benefit as more people enter the space.

What This Means for You

So what’s in it for you? If you’re thinking of getting started, now offers a decent mix of institutional backing and retail accessibility. A spot ETF or major coin exposure could be a lower-risk entry. Developers and builders—expect more retail-facing features and simplified on-ramps from apps and wallets. Institutions should take note that retail steadying alongside them creates a more robust market structure. Even casual observers: this isn’t just a quick spike in attention. It’s the start of deeper crypto engagement—and that could reshape the space for years to come.

In short: yes, retail interest is echoing November 2024’s energy—but this feels healthier. It’s slower, steadier, and anchored by real infrastructure and regulatory clarity. That’s what makes it genuinely bullish.