- Sui partnered with WLFI, a DeFi protocol partially owned by Trump, aiming to boost financial transparency.

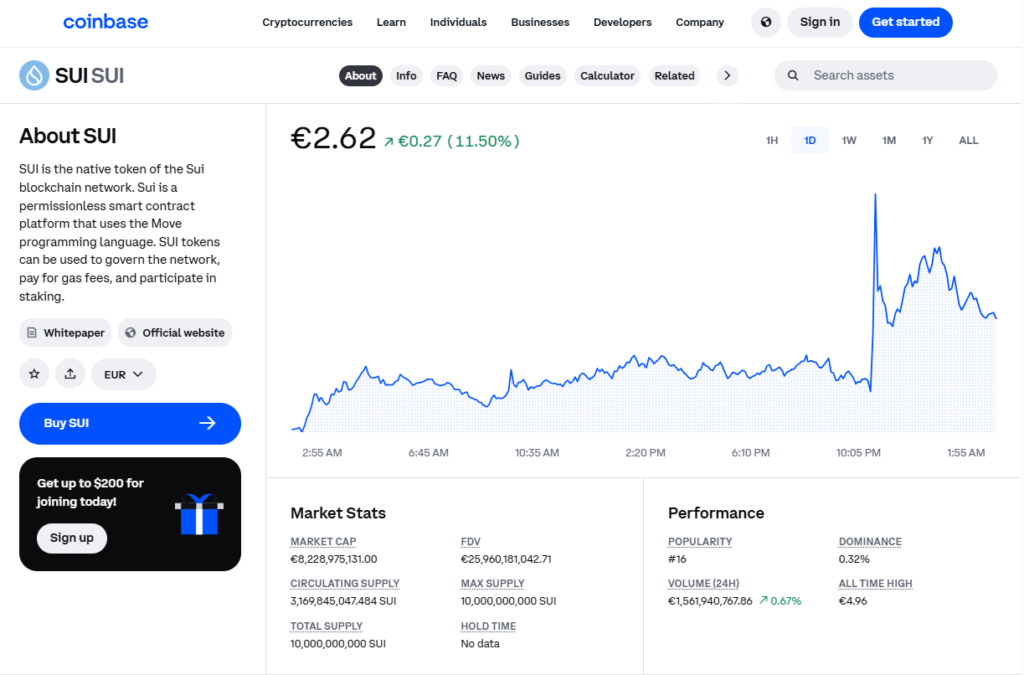

- The SUI token surged 14% following the announcement, signaling strong market interest.

- WLFI is stacking crypto holdings, promoting U.S.-pegged stablecoins, and strengthening the dollar’s role in DeFi.

Sui, a major Layer 1 blockchain, has just teamed up with World Liberty Financial (WLFI), a DeFi protocol partially owned by President Donald Trump. The goal? To push for a more open and transparent financial ecosystem.

SUI Token Surges

Following the announcement, the native SUI token jumped 14% on the day, as traders reacted to the news.

What’s the Deal?

WLFI plans to integrate Sui assets into its “Macro Strategy,” a token reserve aimed at backing top-tier blockchain projects. The move aligns with WLFI’s broader mission: strengthening the global position of the U.S. dollar within DeFi.

Eric Trump, acting as WLFI’s Web3 Ambassador, hyped up the partnership, calling Sui’s American innovation and scalability key reasons for joining forces.

“We are very excited to work with Sui and explore the innovative opportunities this collaboration presents,” said Eric Trump.

Zak Folkman, co-founder of WLFI, echoed the sentiment, emphasizing Sui’s rapid adoption and its potential to expand decentralized finance access.

“We chose Sui for its American-born innovation combined with impressive scale and adoption. It is a natural complement to our mission of bringing decentralized

finance to more Americans,” said Folkman.

What’s in it for Sui?

Evan Cheng, co-founder and CEO of Mysten Labs—the team behind Sui—sees this as a game-changer for asset storage and utilization. He stressed a shared vision of empowering individuals to control their financial assets and digital identities.

Sui has been on a rapid growth trajectory, recently crossing $70 billion in decentralized exchange (DEX) trading volume and amassing over 67 million accounts. Institutional adoption is rising, and this partnership could further boost its credibility.

WLFI’s Crypto Strategy

WLFI has been stacking crypto holdings since its launch, moving $307 million in digital assets to Coinbase Prime for treasury management. More recently, the firm added another $103 million after fresh investment rounds. The goal? To promote U.S.-pegged stablecoins and keep the dollar dominant in global finance through DeFi initiatives.

The Trump Factor

The Trump family’s deep involvement in WLFI has turned heads. Family members hold titles like “chief crypto advocate” and “Web3 ambassador.” Meanwhile, Justin Sun, a Chinese entrepreneur, has reportedly invested at least $75 million in WLFI and serves as an advisor.

Big Picture

This partnership is yet another example of a sitting U.S. president diving headfirst into blockchain. Trump’s companies have already dabbled in memecoins, NFTs, Ordinals, and DeFi platforms—and now, they’re extending their crypto influence to emerging blockchains like Sui.

As crypto and politics continue to intertwine, the bigger question remains: Will this move spark broader institutional adoption, or is it just another flash in the pan?