- XLM broke out of a 6-year triangle and rallied nearly 95% in three days.

- Volume, DeFi activity, and trading sentiment all surged alongside price.

- Pullback underway; key levels to watch are $0.40 (support) and $0.50 (breakout trigger). Targets above include $0.55 and $0.60.

XLM just pulled off a huge breakout, and honestly—it’s been a long time coming. After six years of grinding inside a symmetrical triangle, Stellar finally snapped free, gaining over 85% in just a few days. Momentum across the altcoin market helped, but this move felt personal. The breakout was clean, powerful, and left little doubt: something’s changed.

That triangle? It capped rally after rally for years. This time, XLM didn’t just tap the top—it exploded through it. In the last month alone, it’s up 75%, which signals short-term bulls have taken the wheel. And ever since that descending channel got broken earlier in July, the daily chart’s been stacking green candles like it’s trying to make up for lost time.

Volume Spikes, Sentiment Shifts

When price action looks this aggressive, volume matters—and it showed up. Trading volume jumped 55.27% in just 24 hours, hitting $3.31 billion. That kind of move doesn’t happen without people buying in hard. It’s one of those moments where momentum, sentiment, and structure line up almost perfectly.

That said, even after all that, XLM is still trading 51% below its all-time high of $0.9381 (from way back in January 2018). So while this rally is big, there’s still room. Analysts are starting to whisper about a 2x move if momentum sticks around into the coming weeks.

Classic Breakout Stuff—And Traders Took Notice

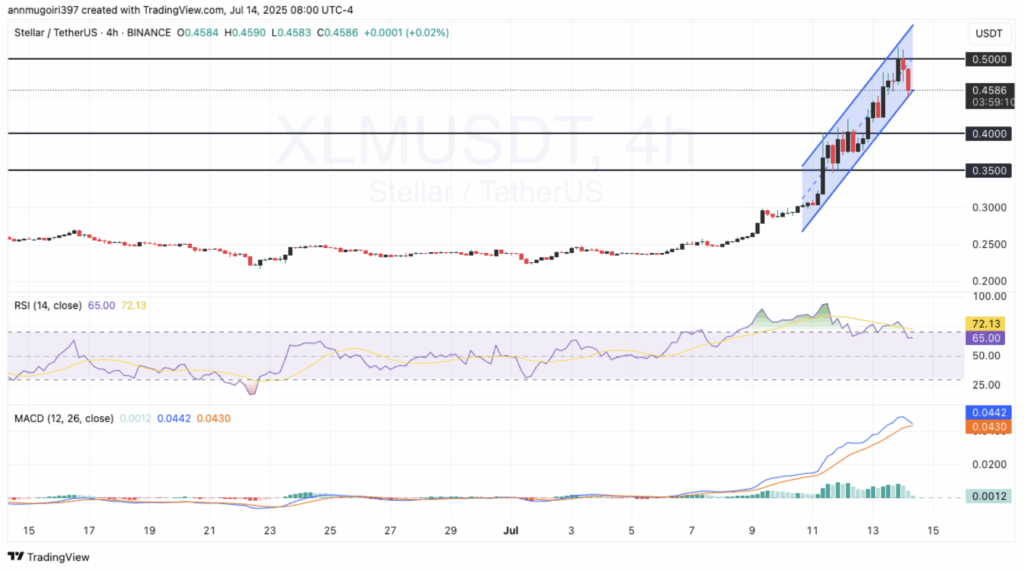

Crypto analysts have called it loud: XLM just followed a textbook breakout play. Prices doubled in a flash—nearly 95% in three days—and the charts look like something straight out of a technical analyst’s dreams. XLM/USDT went from $0.25 to just under $0.50, slicing through resistance that’s been pressuring it for what feels like forever.

According to World of Charts, it wasn’t just noise. The pressure built slowly, then boom—Stellar broke free. And with it, came the volume, the hype, and a flood of new buyers jumping in to ride the wave.

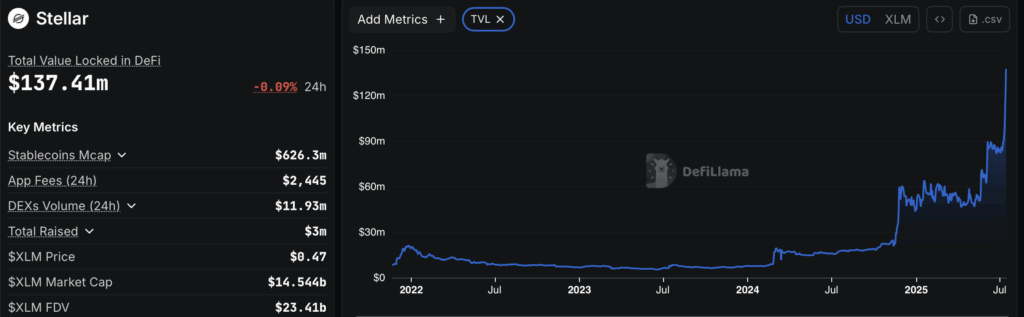

DeFi Activity on Stellar Picks Up Fast

It’s not just price action—Stellar’s DeFi ecosystem is starting to stir. Total value locked (TVL) jumped to $141.71 million, a 15.92% surge in a single day. That’s a serious injection of confidence.

The stablecoin market cap on Stellar is sitting at $627.11 million, giving the ecosystem a solid base to grow from. DEX trading volume over the last 24 hours hit $16.78 million, showing clear signs of rising activity and improving liquidity.

Oh, and application-generated fees? $2,445 in that same window—not crazy, but it shows users are active. The projects within the ecosystem have now pulled in around $3 million in total funding, which isn’t headline-grabbing, but steady growth matters here. It’s slow… but it’s building.

Price Pulls Back After Hitting Resistance—Now What?

After tagging $0.4567, XLM ran into some resistance and started to cool off—dipping more than 8% shortly after. The RSI backed off from 64, easing out of overbought territory, which could signal the rally needs a breather.

MACD still looks bullish—barely. The MACD line is still above the signal line, but they’re starting to converge. Momentum’s fading a bit, and that could mean more sideways action or even a sharper correction.

If that happens, watch the $0.40 and $0.35 zones—they’re the first solid support. But if bulls wake back up and reclaim $0.50 with conviction? That could open the door to a new wave. Fibonacci targets suggest $0.55 or $0.60 could be next.