- Spot Ether ETFs in the U.S. record highest inflows in six weeks post-election.

- Fidelity and Grayscale led Ether inflows with $26.9 million and $25.4 million, respectively.

- Spot crypto markets see a 4% rise, with Bitcoin reaching a new all-time high.

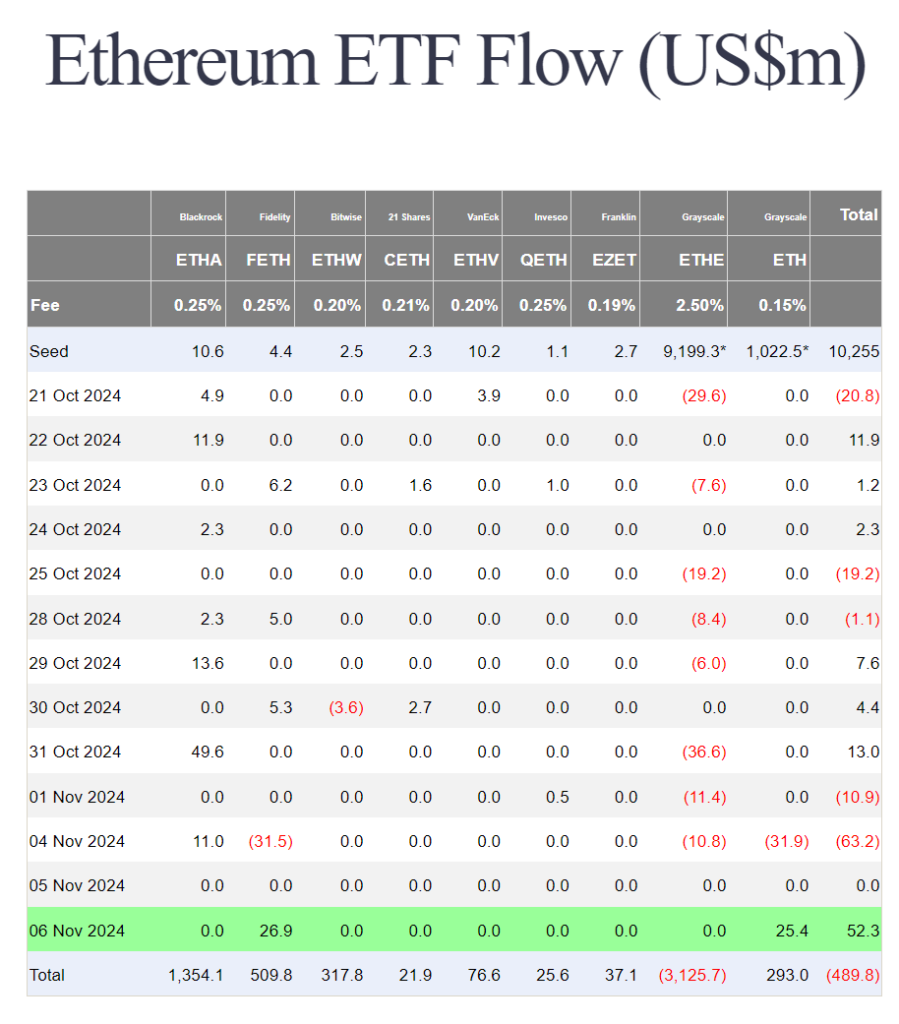

Spot Ether exchange-traded funds (ETFs) in the United States saw their highest inflows in six weeks following the recent U.S. presidential election. According to data from Farside Investors, nine recently launched spot Ether ETFs brought in a combined $52.3 million on November 6. While this represents a smaller total compared to spot Bitcoin ETFs, it marks a significant rise in interest for Ether ETFs, last seen on September 27.

Source: Farside

Fidelity and Grayscale Lead Inflows

The bulk of Ether ETF inflows went to two funds. Fidelity’s Ethereum Fund attracted $26.9 million, while Grayscale’s Ethereum Mini Trust added $25.4 million. However, other spot Ether ETFs recorded zero net flows, and BlackRock’s iShares Ethereum Trust, one of the leading funds, reported a net zero inflow. Despite this, the day’s activity highlighted growing interest in Ether ETFs, which aligns with the broader market’s rally.

Data shows that the total for all spot Ether ETFs remains in negative territory, at a net $490 million, driven largely by outflows from Grayscale’s high-fee ETHE fund. Since converting to a spot ETF in July, the Grayscale fund has seen a $3.1 billion decrease in assets under management.

Bitcoin ETFs See Stronger Inflows as Market Surges

While Ether ETFs saw notable inflows, spot Bitcoin ETFs fared even better, recording a combined $621.9 million in inflows on the same day. This marked a reversal after three days of outflows and included substantial activity from the Fidelity Wise Origin Bitcoin Fund, which led with a $308.8 million inflow—its largest since early June. Other products from Bitwise, Ark 21Shares, and Grayscale each saw more than $100 million in inflows.

Overall, crypto markets experienced a 4% increase in the past 24 hours, pushing the total market capitalization to $2.64 trillion. Bitcoin reached a new all-time high, exceeding $76,000 in late trading on November 6. Ether followed with a strong gain, climbing 10% to reach an intraday high of $2,872 in early trading on November 7, its highest price since August.