- Solana trades around $189, showing strength ahead of its October 20 reveal.

- Accumulation zone between $175–$200 hints at strong buying pressure.

- Rumors of a Solana payment card fuel speculation about its push into real-world finance.

Solana (SOL) is starting to heat up again. Traders are eyeing what could be a major breakout, just as the community buzzes over a cryptic teaser from the project’s official X account. The short clip showed glowing, stacked cards and played a sound like a payment confirmation—ending with the date October 20, 2025. Naturally, everyone’s guessing. Most think it hints at a Solana-branded debit or credit card, possibly signaling a big step into real-world payments.

SOL Finds Its Accumulation Zone

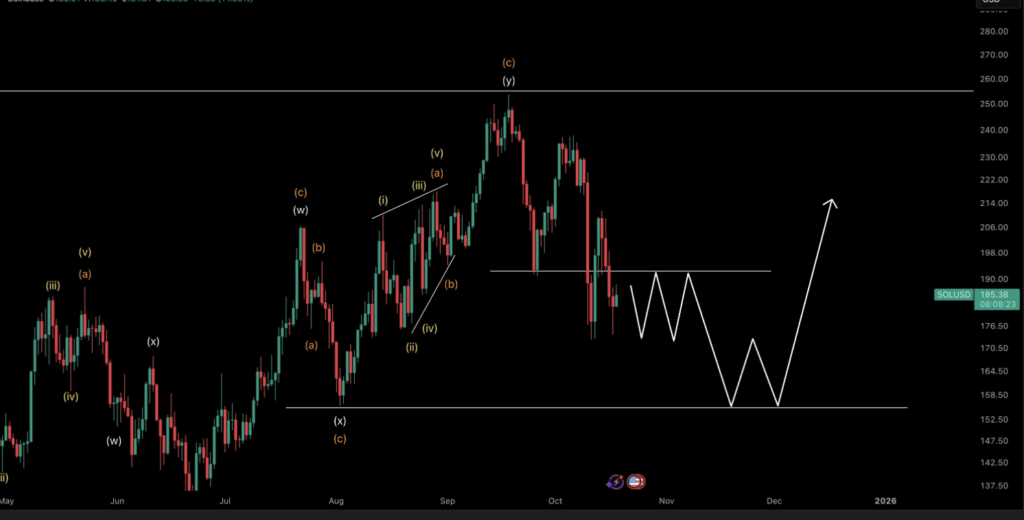

Market analysts at CryptoPulse note that Solana has carved out a clear accumulation zone between $175 and $200. The daily chart shows repeated rebounds near $182, where long lower wicks reveal that buyers keep stepping in whenever price dips too far.

This range has acted as solid ground for months, with traders treating it as a key area to build positions. A clean breakout above $200 could open the door to a run toward $270–$280, especially if institutional flows keep building. With recent ETF approvals and steady inflows from major funds, the broader market structure for Solana remains undeniably bullish.

Beyond the price chart, fundamentals continue to shine. Solana’s speed, low fees, and growing developer community make it one of the most competitive Layer-1s out there—often seen as Ethereum’s most serious rival. Many investors view this consolidation phase as a quiet build-up before the next wave of momentum kicks in.

Short-Term Volatility Still in Play

Despite the optimism, Crypto Tony warns that a short-term correction could still be on the table. According to his analysis, SOL might retest the $155–$160 region after facing resistance around $192.

That would line up neatly with previous accumulation zones, meaning any dip could just be another opportunity for long-term buyers to reload. It’s pretty normal in an uptrend—these small resets often help clear leverage and restore momentum before prices push higher again.

At the time of writing, Solana trades around $189.91, up 2.64% on the day and 4.58% for the week. With a market cap of over $103 billion, it continues to command attention across both retail and institutional circles.

What Comes Next

Between a strengthening chart and a mysterious October 20 teaser, Solana seems to be entering one of its most interesting phases in months. If the rumor of a Solana payment card proves true, it could mark a major leap toward mainstream crypto adoption—and perhaps ignite a new wave of enthusiasm around the project.

For now, traders are watching closely. A breakout above $200 might be the spark everyone’s been waiting for—but even a small dip could just be the calm before the next leg higher.