- Solana surged 15% to $115 after Trump pledged to roll back global tariffs, triggering a broad market rebound across stocks and crypto, with SOL outperforming major assets like Bitcoin and Ethereum.

- The SEC’s confirmation of crypto-friendly Paul Atkins sparked ETF optimism, raising Polymarket’s odds of a Solana ETF approval to 81%, potentially unlocking billions in institutional capital if approved.

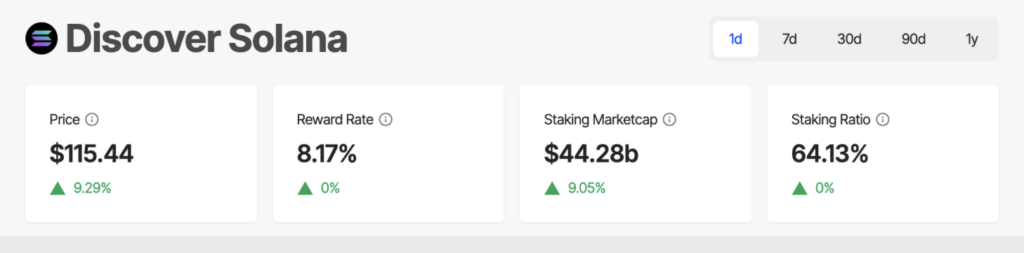

- Analysts suggest a $1,000 SOL isn’t out of reach, citing strong fundamentals—like high staking rates, growing on-chain activity, and limited token supply—as key drivers if macro and regulatory trends stay favorable.

Solana (SOL) popped off Thursday, rebounding over 15% from a session low of $100 to cross $115—this, right after former President Donald Trump threw a curveball and said he’d roll back global tariffs if he wins in November. The announcement sparked a wave of risk-on trading across the board: U.S. stocks jumped, crypto rallied, and altcoins, especially SOL, got a serious jolt.

But the real twist? What came later that day in D.C.

Trump Sparks Risk Rally, Altcoins Rejoice

SOL wasn’t just up—it was leading. Climbing into the top spot among large-cap gainers, it outperformed both Ethereum and Bitcoin on the day. According to CoinGecko, SOL hovered around $116 by press time, riding the wave of optimism after Trump’s trade policy U-turn. His administration would reverse tariffs for all partners—except China. That move alone sparked a massive rotation back into speculative assets.

Tech stocks boomed, altcoins followed, and Solana was front and center. Traders piled in.

The bounce also came with a technical twist: SOL reclaimed its 50-day moving average near $125. Some are now eyeing this as the foundation for a bigger breakout, especially if the macro picture stays supportive… and ETFs come into play.

SEC Shake-Up: Paul Atkins Reignites ETF Buzz

Later that same day, things got even spicier. The SEC confirmed crypto-friendly Republican Paul Atkins as a key figure in ETF framework evaluation. That little update sent Solana ETF speculation through the roof. Polymarket odds? Shot up to 81% for a Solana ETF verdict this year.

Atkins has a track record of pro-crypto takes—and now he might just be the guy helping push through altcoin ETFs. If that happens? Institutions might not need to buy SOL directly anymore. They’ll get exposure via ETFs.

And that, as we’ve seen with Bitcoin, could mean serious capital inflows.

How Would a Solana ETF Actually Impact Price?

If approved, a SOL ETF would open the floodgates. Institutions, retirement funds, wealth managers—they all get in, without needing to hold wallets or understand seed phrases. It also legitimizes Solana as an asset class.

After the Bitcoin ETF went live in early 2024, BTC went on a tear, eventually clearing $80,000. Analysts are suggesting SOL might follow a similar trajectory, especially with strong network usage backing it up.

Can SOL Hit $1,000? It’s Not That Crazy

Look—$1,000 sounds wild at first. But at a 7x from current levels, it’s not unheard of in crypto. The fundamentals are there:

- 1.3M+ daily active addresses

- $1B+ DEX volume per day

- New memecoins, NFT drops, enterprise partnerships… all piling on

Also worth noting: over 64% of SOL is staked, and token unlocks are slowing down. So even if demand explodes from ETF flows? There’s not a ton of supply floating around to absorb it.

If Bitcoin keeps up its strength and ETH ETFs roll out smoothly later this year, the market could build the conditions for SOL to run. The Q3 earnings season will be huge—especially if fintechs start hinting at ETF filings tied to altcoins.