- Solana dipped below $100, hitting a 14-month low and triggering $71 million in liquidations.

- On-chain activity and memecoin volume are down sharply, dragging DEX usage with them.

- Institutional interest is rising, with CME launching SOL futures and PayPal adding support.

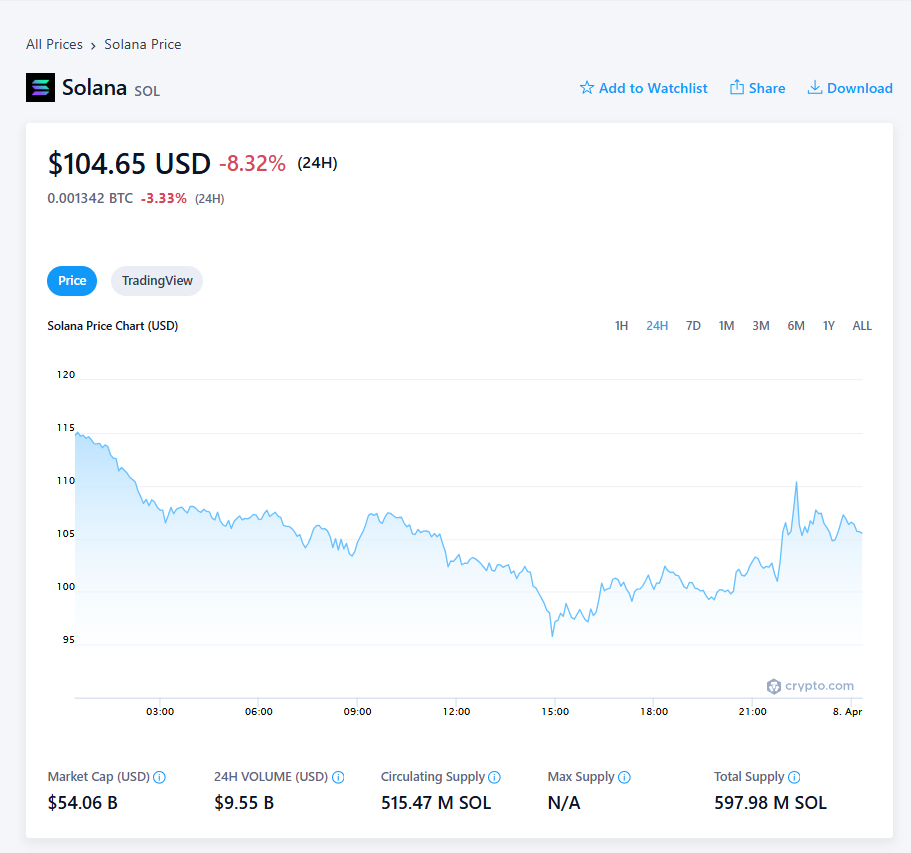

Solana (SOL) took a steep dive in the last 24 hours, tumbling under the $100 mark as a wave of uncertainty rippled through the broader crypto market. The sudden drop sparked concern among investors, with prices briefly touching $96 before clawing back to around $101 at the time of writing, per CryptoSlate data.

Leveraged Positions Liquidated

The slide marked Solana’s lowest point in 14 months and triggered liquidations totaling roughly $71 million, based on figures from CoinGlass. A good chunk of these losses came from traders holding leveraged long positions, caught off guard by the steep plunge.

Global Trade Woes Fuel Panic

Market watchers are pointing fingers at macro factors—specifically the rising tensions from global tariff disputes. President Donald Trump’s sweeping trade policies and the retaliatory moves from other nations have stoked fears of a slowdown, pushing risk-on assets like crypto into the red.

On-Chain Activity Sputters

Solana’s woes don’t stop at price action. On-chain metrics have also been sliding. VanEck, a major asset manager, noted a significant decline across Solana’s key indicators in March: average transaction fees dropped 66%, stablecoin transfer volumes slid 34%, and DEX activity collapsed by 53%.

The firm said Solana’s share of DEX market activity hit its lowest since October 2024, down from a brief moment in January where it even outpaced Ethereum.

Memecoin Hype Fizzles

One major culprit behind the slowdown? The fading memecoin mania. VanEck reported that daily memecoin volume peaked near $12 billion earlier this year but nosedived to around $720 million by March.

Despite the dip, memecoins still dominate Solana’s ecosystem. Excluding SOL and stables, these tokens made up 92% of DEX volume in March—a sign that speculation is still alive, if a bit subdued.

Institutions Show Glimmers of Interest

Still, it’s not all doom and gloom. Institutional players are starting to sniff around. CME, the Chicago Mercantile Exchange, recently launched SOL futures, and Volatility Shares followed up with the first SOL futures ETF.

These products could pave the way for a potential spot ETF, opening the door for broader exposure.

PayPal Expands Solana Support

Adding to the mix, PayPal has rolled out Solana support for its U.S. users. Now, folks can buy, sell, or transfer SOL on both the PayPal app and Venmo, thanks to what the company described as “rising demand” from users hungry for more token variety.

While the short-term may look rocky, long-term interest in Solana remains alive—though maybe not as euphoric as it was just a few months ago.