- SkyBridge Capital will tokenize $300 million worth of funds on Avalanche, marking a major institutional push into blockchain.

- Tokenization could cut costs and remove middlemen, though regulatory challenges and adoption hurdles remain.

- The move signals growing confidence in tokenization, with heavyweights like BlackRock and Franklin Templeton also experimenting in this space.

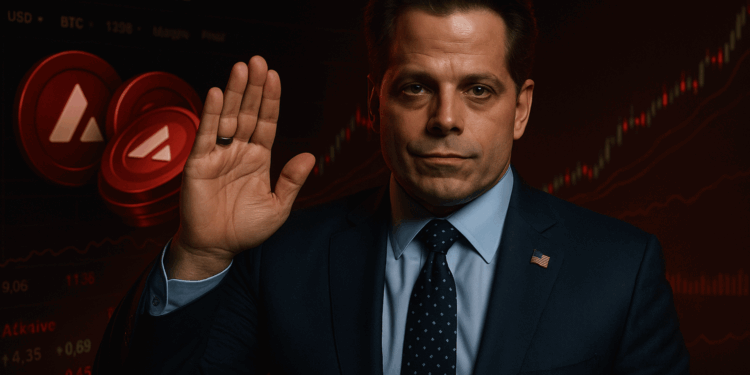

Anthony Scaramucci’s SkyBridge Capital is making a bold leap into tokenization, shifting about $300 million from two of its funds onto the blockchain. The announcement, made Tuesday, lands right in the middle of a growing wave of enthusiasm around what many are calling the future of finance: turning real-world assets into tradable digital tokens. Think U.S. Treasury bills, mutual funds, or even corporate debt—wrapped up and moved on-chain, where they can trade with the same fluidity as Bitcoin or stablecoins.

Scaramucci, who once worked at Goldman Sachs and briefly served in the Trump White House, sees this as more than just a side experiment. “I’m basically seeing 2026 into 2027 as the age of real-world tokenization,” he told Fortune, hinting that SkyBridge wants to be early to the party. About 10% of the firm’s total assets under management are going digital, with funds set to run on Avalanche—a blockchain that already hosts nearly $2 billion in assets, according to DefiLlama.

Breaking Down the Tokenized Funds

So, what’s going on under the hood here? One of SkyBridge’s tokenized funds invests directly in cryptocurrencies like Bitcoin—tokens that the SEC hasn’t flagged as securities. The second is a fund-of-funds, meaning it pulls together capital from SkyBridge’s various vehicles, including its crypto ventures and venture capital plays. By pushing these products on-chain, Scaramucci is betting that efficiency and transparency will outweigh the growing pains.

Supporters of tokenization argue that this model removes the drag of middlemen. Normally, when investors want to move money into or out of funds, they deal with layers of brokers, custodians, compliance officers, and banks—all of whom take fees and add friction. On a blockchain, the records are public, the transfers are nearly instant, and ownership is clear. In theory, that wipes out much of the cost and complexity.

Why Tokenization Is Picking Up Steam

The idea isn’t brand new, but momentum is clearly building. Financial giants like BlackRock, Franklin Templeton, and VanEck have already experimented with putting their money market funds on networks like Solana and Aptos. The appeal is obvious: an investor could buy or sell a slice of a fund as easily as sending crypto to a friend, with no endless paperwork or phone calls to banks.

Still, it’s early days. Tokenization is promising, but adoption has been slow, with plenty of regulatory gray zones still looming. That’s why partnerships matter—SkyBridge is teaming up with Tokeny, a firm that specializes in issuing tokenized securities, to help move its funds on Avalanche.

Avalanche’s Big Win

For Avalanche, this is a chance to prove itself as the go-to chain for institutional money. John Wu, president of Ava Labs, framed it bluntly: “We want to bring activity on-chain from traditional finance and show the world this tech can actually save them money.” If SkyBridge’s experiment works, it could nudge more Wall Street players to dip their toes into tokenization—and potentially reshape how the $100 trillion global securities market operates.