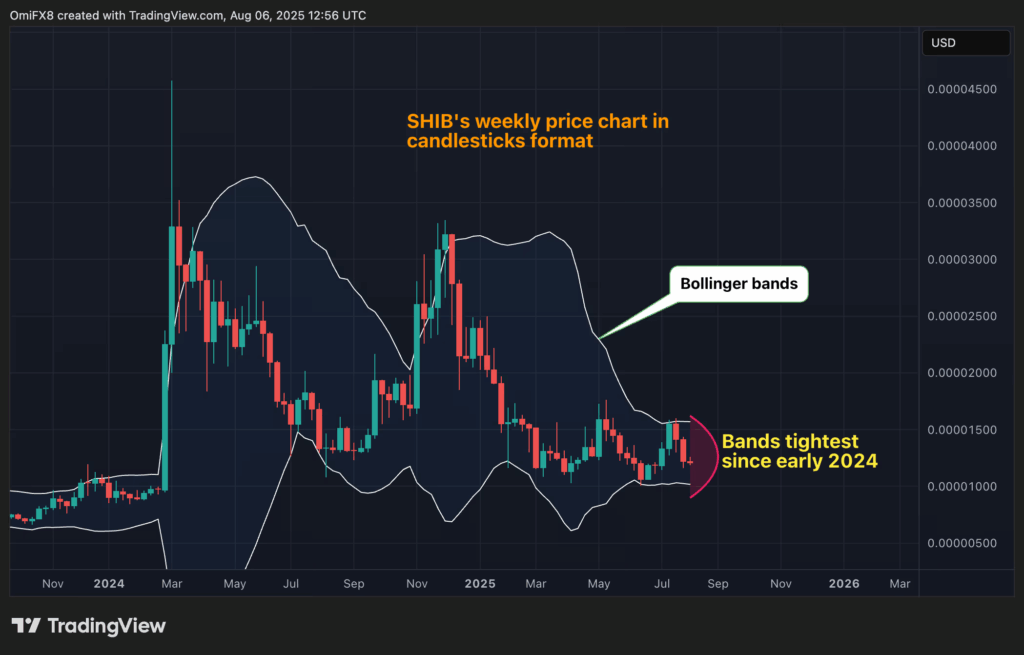

- SHIB’s weekly Bollinger bands are at their tightest since Feb 2024, signaling an imminent big price move.

- The token rebounded from last week’s 13.8% drop, defending $0.00001200 support with heavy buying.

- Over 19B tokens traded during breakout phases, hinting at strong institutional interest and accumulation.

Shiba Inu (SHIB) is entering a critical technical phase, with its weekly Bollinger bands narrowing to their tightest range since February 2024. This compression typically precedes a major price swing, as the market consolidates before a breakout in either direction.

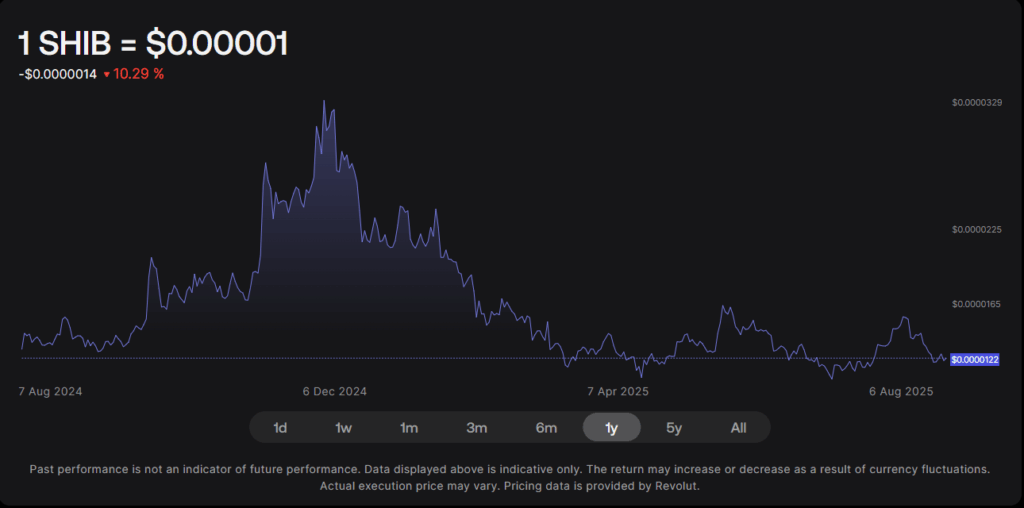

Last week, SHIB dropped 13.8% to $0.00001160, marking its steepest decline since March. However, the token has since stabilized and rebounded above $0.00001200, showing resilience and steady recovery momentum.

Price Action and Buying Activity

Over the past 24 hours, SHIB recorded notable volatility within a 25.4% peak-to-trough range, moving between $0.000012217 and $0.000011913. After an early sharp drop from $0.000012362 to $0.000011985, SHIB consolidated near the $0.000012000 support level before rebounding to $0.000012186 by session close.

A surge in buying activity was particularly evident in the final hour of trading, with prices climbing from $0.000012123 to $0.000012198. Transaction volumes exceeded 19 billion tokens during key breakout phases, including a crucial test of $0.000012125 support that was quickly defended, signaling institutional accumulation and strong bullish sentiment.

Technical Breakdown

- Bollinger Bands: Tightest weekly contraction since Feb 2024, hinting at a volatility spike ahead.

- Support: $0.000012000 remains a key defense level.

- Resistance: Current highs at $0.000012198 will be the first major barrier to break.

- Volume: Over 19B tokens traded during breakouts, indicating strong hands are stepping in.

Outlook

If SHIB can sustain its recovery and close decisively above $0.00001220 with increasing volume, it may confirm a bullish breakout from this compression pattern. However, failure to hold $0.00001200 support could trigger a swift retest of last week’s lows.