- Lummis introduced new legislation to update crypto tax policies, including a $300 exemption for small transactions and ending double taxation for miners and stakers.

- The bill invites public comments and aims to reduce burdens on everyday crypto users while maintaining compliance standards.

- This proposal revives ideas previously excluded from Trump’s broader “One Big Beautiful Bill,” signaling Lummis’ continued push for regulatory reform.

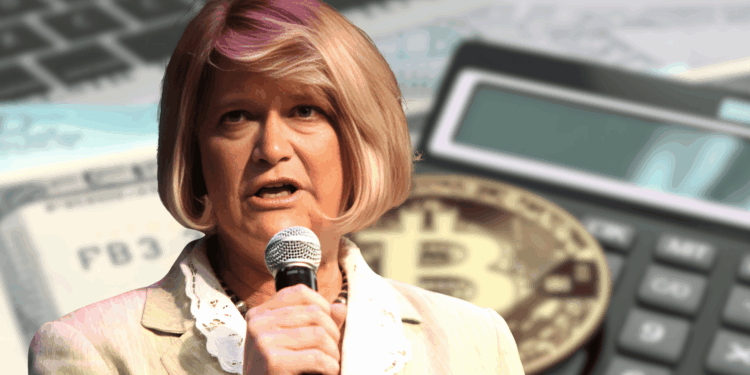

Senator Cynthia Lummis isn’t giving up on fixing what she sees as a broken system. On Thursday, the Wyoming lawmaker introduced a new crypto tax bill aimed at cleaning up outdated tax rules that, in her words, are straight-up blocking innovation. The move isn’t totally new though—it mirrors an earlier effort she made to squeeze these ideas into a broader bill that didn’t quite pan out.

Public Feedback Welcomed on Practical Tax Fixes

“We’ve got to stop letting these old-school tax codes trip up people who are just trying to be part of the digital economy,” Lummis said in a statement. She also threw open the door to public feedback, hoping to fine-tune the bill before pushing it toward the President’s desk. This latest version of her proposal includes some pretty practical stuff, like a $300 tax-free limit for small crypto transactions and ending the double-tax squeeze on miners and stakers. Simple, but big deal.

A $300 Threshold for Everyday Crypto Use

That $300 exemption is worth highlighting. It’s meant for everyday stuff—like grabbing a latte with Bitcoin—where tracking every little transaction becomes a nightmare. “The current rules just don’t make sense in the real world,” the statement noted. Lummis says the new limit makes things more usable without sacrificing IRS oversight, which honestly sounds like a win-win… at least on paper.

A Standalone Comeback After Failed Amendment

Earlier in the week, she tried bundling the same ideas into a broader piece of legislation—the so-called “One Big Beautiful Bill Act”—backed by Trump. It didn’t make it through the amendment gauntlet though. No vote. No inclusion. But with this new standalone push, she’s clearly not backing down. If anything, it looks like the fight for crypto tax clarity is just heating up.