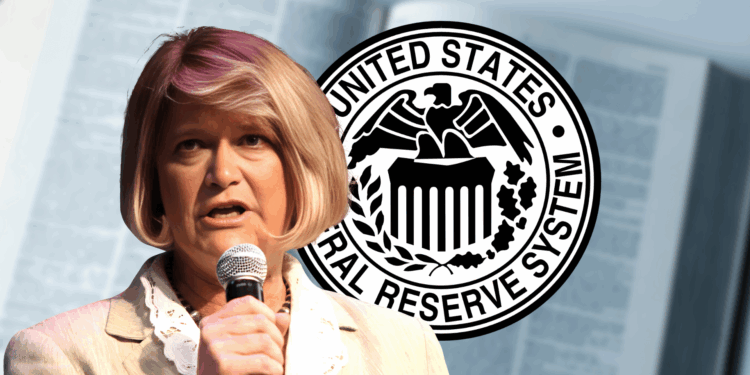

- Senator Cynthia Lummis slammed the Fed’s rollback of crypto rules as “just noise” and said real problems still remain.

- Lummis accused the Fed of blocking fair access to banking for crypto firms, even after withdrawing older supervisory policies.

- She vowed to keep pushing for reforms that would give digital asset companies a fair shot in the U.S. financial system.

Senator Cynthia Lummis isn’t impressed with the Federal Reserve’s latest move on crypto. In a post on April 25, she called the Fed’s decision to pull back a few crypto-related directives “just noise, not real progress,” blasting it as mostly for show.

According to Lummis, the real problem hasn’t changed: the same Fed staff who pushed what many call “Operation Chokepoint 2.0” — efforts to freeze crypto firms out of the banking world — are still in place, still pulling strings behind the scenes. She accused the Fed of straight-up “assassinating companies” in the industry and damaging America’s edge in the global race for innovation.

Just a day earlier, the Fed announced it was scrapping several older policies, including a 2022 rule that forced banks to notify regulators before doing anything crypto-related, and a 2023 rule that made them get a special “non-objection” before offering dollar-token services. Moving forward, banks will just be monitored under the Fed’s usual supervision — no special heads-up needed.

In their official explanation, the Fed said these changes are about “recalibrating” oversight while keeping the financial system stable. They even teamed up with the FDIC and OCC to withdraw a couple of joint statements that had warned banks about liquidity risks tied to crypto.

But Lummis isn’t buying it. She pointed out the Fed’s continued use of “reputation risk” assessments to block crypto activity — particularly through Section 9(13), which still basically labels anything involving Bitcoin and friends as “unsafe and unsound.” She says that despite the nice headlines, crypto firms are still being illegally shut out of fair access to key banking tools like master accounts.

Meanwhile, she gave a small nod to the FDIC and OCC for moving away from reputation-based rules, saying it’s the Fed that’s now out of step. Political winds in Washington are shifting too, with President Trump’s administration signaling a friendlier stance toward crypto — and early signs showing banks warming up to crypto firms once again.

Lummis made it clear she’s not backing down. She promised to keep fighting in Congress to make sure crypto companies get more than just “a life jacket” — they deserve a real shot to succeed inside the U.S. financial system.

A longtime crypto supporter, Lummis has been pushing for clear rules around crypto banking, master accounts, and digital asset regulations. Her latest comments show there’s still a lot of friction between lawmakers trying to push crypto forward and federal regulators dragging their heels.